Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 20 March 2024 02:02 - - {{hitsCtrl.values.hits}}

Hoteliers particularly those in the city have hailed the robust earnings thus far by the rebounding tourism sector and expressed optimism of continued momentum if pricing is not tampered with.

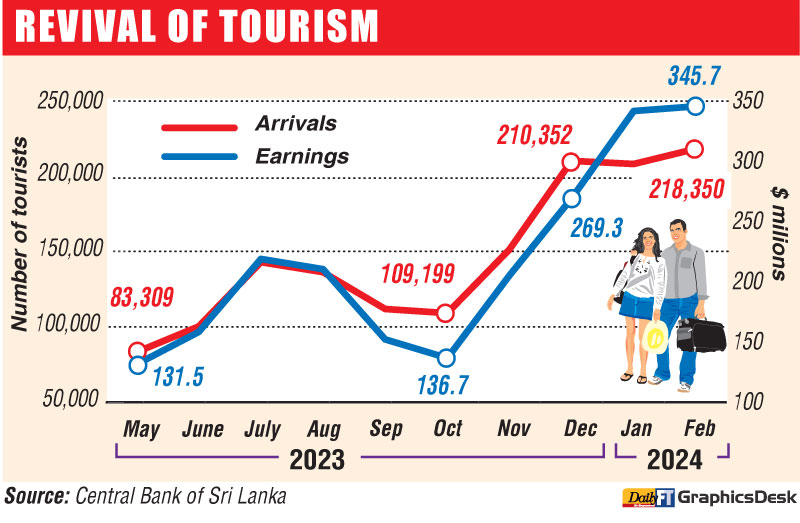

Sri Lanka earned $ 687.5 million in the first two months of 2024 from tourism against $ 118 million a year ago according to the Central Bank.

The massive nearly 500% increase in earnings from the corresponding period of last year is on the back of a sharp rise in tourist arrivals. Arrivals amounted to 426,603 in January to February whilst year to date (17 March), arrivals had increased to 537,887. First 17 days of March saw around 111,284 visitors.

In the first two months of the year, earnings is 35% of 2023’s full year income of $ 2 billion from 1.5 million

tourists.

City hoteliers attributed the sharp rise partly to the introduction of Minimum Room Rate (MRR) since October last year by the Government. From a low of $ 137 million in October, earnings have soared to $ 346 million by February. Sri Lanka has succeeded to draw over 200,000 tourists per month since December and the industry is hopeful of a similar feat in March as well. Sri Lanka surpassing half a million mark in tourist arrivals within the first three months was regarded as significant since they achieved a similar feat only in May last year and in September in 2022.

A Sri Lankan travel and tourism delegation of over 30 led by Tourism Minister Harin Fernando and Sri Lanka Tourism Promotion Board (SLTPB) is currently on a multi-city tourism promotion in Australia.

The move is part of overall efforts to tap into the potential of non-traditional markets.

In March arrivals were largely influenced by the Indian tourists, closely followed by Russia. Other markets include; Germany, the UK and France. Daily arrivals have also improved from 6,515 during the first two weeks to 6,546.

Year to date India (81,256) and Russia (79,737) remain top tourist source markets reflecting 15% of total arrivals, followed by the UK (46,205), Germany (40,398) and China (33,239) respectively.

Tourism Minister Harin Fernando has set a target of $ 4 billion in earnings in 2024 on a base of 2.3 million tourists.

Industry analysts noted that to reach the $ 4 billion target for 2024 would require continuity of the momentum seen thus far. City hoteliers opined that continuity of the MRR will be critical in this trajectory.

The MRR excluding breakfast is $ 100 for 5-star hotels, $ 75 for 4-stars, $ 60 for 3-stars and $ 50 for others. In recent months, the Bread and Breakfast (B&B) rate in hotels and resorts in tourist areas outside Colombo was averaging $ 200 or more per night.

However the MRR remains a contentious issue especially from inbound tour operators and MICE industry leaders who complain that city hotels are not price competitive in comparison to other destinations such as Malaysia and Bangkok for meetings, incentives, conventions and exhibition travel segments.

This is despite the Sri Lanka Tourism Development Authority (SLTDA) making special provisions for attractive rates for MICE travellers.

One of the concerns was that MRR will have an impact on the price-sensitive Indian market. However, statistics thus far proves otherwise with arrivals from the giant neighbour on top at 81,256 year to date. In January arrivals from India amounted to 34,399 (averaging 1,109 per day) and in February it was 30,027 (averaging 1,035 per day). In March up to last week there were 16,830 arrivals from India averaging around 100 per day. In the full year of 2023, there were 302,844 Indian tourists (with a peak of 43,973 in December) as against 123,004 in 2022.

Though some top tier five stars are wary, others admitted that the present MRR has certainly helped 3 star and 4 star hotels whilst overall staff service charge have risen as well benefitting the employees.

As reported in the Daily FT on 28 February the city hotels enjoyed a good December quarter aided by tourist influx and minimum room rate. (See https://www.ft.lk/top-story/City-hotels-enjoy-good-Dec-quarter-aided-by-tourist-influx-minimum-room-rate/26-758919).

A review of interim results released by listed city hotel companies reveal not only healthy top line growth but improvement in operating profit and to some better bottom line. Several also reported reduced losses due to the improved operating environment though cost escalation (except interest cost) remains a common concern, according to tourism industry and stock market analysts.

Beneficiaries included JKH subsidiary Asian Hotels and Properties PLC flagship of which is the bustling Cinnamon Grand, JKH subsidiary Trans Asia Hotels Plc, Hayleys PLC subsidiary, the Kingsbury PLC, Taj Lanka Hotels PLC, Galadari Hotels, Renuka Hotels PLC and Renuka City Hotels PLC and Jetwing Symphony PLC which owns Jetwing Colombo 7.

The MRR system was in place from 2010 to 2019 but was discontinued following the Easter Sunday attacks. In 2018 when MRR was in force Sri Lanka was successful in attracting 2.3 million tourist arrivals in 2018 and $ 4.4 billion in earnings, making it the industry’s best year so far.