Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 13 April 2022 00:00 - - {{hitsCtrl.values.hits}}

By Nisthar Cassim

|

| President Gotabaya Rajapaksa |

|

| Prime Minister Mahinda Rajapaksa |

|

| Central Bank Governor Dr. P. Nandalal Weerasinghe |

|

| Finance Ministry Secretary K.M. Mahinda Siriwardana |

|

The Government yesterday signaled Sri Lanka was bankrupt, announcing a temporary suspension of repayment of all external debt as of yesterday, saying the country can no longer honour its commitment owing to poorer financial position caused by external and internal shocks.

The move puts an end to Sri Lanka’s outstanding track record of servicing its external debt obligations since the independence but a “negotiated or soft default” is viewed as more respectable as opposed to a disastrous “hard default”.

Treasury Secretary Mahinda Siriwardena told journalists yesterday that the “orderly and consensual” restructuring of external debt obligations will be buttressed by an economic assistance program supported by the International Monetary Fund (IMF).

He recalled that Sri Lanka has had an unblemished record of external debt servicing since independence in 1948.

“However recent events including the COVID-19 pandemic and fallout from the hostilities in Ukraine, eroded Sri Lanka’s fiscal position,” he said.

“Late last month the IMF assessed that Sri Lanka’s debt stock is unsustainable. This is although the Government had taken extraordinary steps in an effort to remain current on all its external indebtedness it is now clear that this is no longer a tenable policy and a comprehensive restructuring of these obligations will be required,” Finance Ministry Secretary admitted.

Confronted by this hard reality, Siriwardena said the Government has approached the IMF for assistance in designing an economic recovery program and for emergency financial assistance.

The Government is also seeking financial help from its other multilateral and bilateral partners to alleviate the sufferings that the extraordinary situation has caused on the people.

“We have lost the ability to repay foreign debt. It has come to a point that making debt payments are challenging and impossible,” Central Bank Governor Dr. Nandalal Weerasinghe said at the media briefing adding: “We need to focus on essential imports and not have to worry about servicing external debt.”

“This is a pre-emptive negotiated default. We have announced it to the creditors,” the new CBSL Chief added.

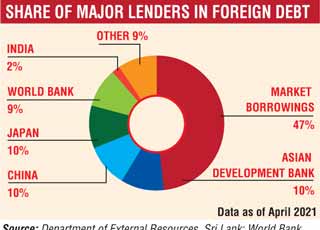

Sri Lanka has around $ 6 billion of external debt servicing for the rest of 2022 whilst usable reserves had plunged to a historic low of a mere $ 150 million. Between next year and 2026 Sri Lanka’s external debt servicing is estimated at $ 25 billion.

Sources said yesterday’s announcement is expected to force rating agencies to downgrade Sri Lanka to Restrictive or Selective default (RD/SD).

The Government’s move comes after two years of denial by President Gotabaya Rajapaksa’s regime and successive Central Bank Governors that Sri Lanka’s external debt is sustainable and will not default by relying on “homegrown” measures.

This was after the country was shunned from international capital markets following the downgrade of its sovereign credit rating.

Following is the full text of the Finance Ministry announcement on the ‘Interim Policy Regarding the Servicing of Sri Lanka's External Public Debt’.

This memorandum summarises the policy of the Government of Sri Lanka (Government) concerning the servicing of Sri Lanka's external public debt pending the completion of the Government's discussions with the IMF and the preparation of a comprehensive debt restructuring program covering these obligations.

For purposes of this policy, “external debt” means obligations for borrowed money, or the deferred purchase price of goods or services (i) denominated in a currency other than rupees and (ii) governed by a law other than the law of Sri Lanka.

Sri Lanka has had an unblemished record of external debt service since independence in 1948. Recent events, however, including the effects of the COVID-19 pandemic and the fallout from the hostilities in Ukraine, have so eroded Sri Lanka's fiscal position that continued normal servicing of external public debt obligations has become impossible.

Late last month, the IMF assessed Sri Lanka's debt stock as unsustainable. Although the Government has taken extraordinary steps in an effort to remain current on all of its external indebtedness, it is now clear that this is no longer a tenable policy and that a comprehensive restructuring of these obligations will be required.

Confronted by this hard reality, the Government has approached the IMF for assistance in designing an economic recovery program and for emergency financial assistance. The Government is also seeking financial help from its other multilateral and bilateral partners in order to alleviate the suffering that this extraordinary situation has imposed on the citizens of Sri Lanka.

The Government intends to pursue its discussions with the IMF as expeditiously as possible with a view to formulating and presenting to the country's creditors a comprehensive plan for restoring Sri Lanka's external public debt to a fully sustainable position.

Interim External Public Debt Servicing Policy

It shall therefore be the policy of the Sri Lankan Government to suspend normal debt servicing of all Affected Debts (as defined below), for an interim period pending an orderly and consensual restructuring of those obligations in a manner consistent with an economic adjustment program supported by the IMF.

The policy of the Government as discussed in this memorandum shall apply to amounts of Affected Debts outstanding on 12 April. New credit facilities, and any amounts disbursed under existing credit facilities, after that date are not subject to this policy and shall be serviced normally.

The holders of all Affected Debts are being requested to capitalise any amounts of principal or interest falling due during this interim period, at an interest rate not higher than the normal contractual rate applicable to that credit, until a restructuring proposal can be presented to the creditors for their consideration.

For record-keeping purposes (and for purposes of determining the outstanding principal amount of Affected Debts in the eventual restructuring), all principal and interest payments falling due after 5 p.m. (Sri Lanka time) on 12 April under Affected Debts shall be deemed to have been capitalised (that is, added to the outstanding principal of the relevant debt) and such amounts shall bear interest during the interim period at the normal contractual rate applicable to that credit.

Promptly after the scheduled due date for each amount of principal or interest affected by this policy, the Ministry of Finance (Ministry) shall send to the creditor (or to the relevant trustee or fiscal agent) written confirmation of the new principal amount of the Affected Debt as shown on the Ministry records.

The Ministry shall stand ready to execute a short-form instrument confirming the capitalisation of maturing amounts as described above for creditors that may require such documentation for regulatory or accounting purposes.

The holder of an Affected Debt that wishes to receive the rupee equivalent of an amount falling due during the interim period in lieu of the capitalisation of that amount as described above, should contact the Ministry as soon as practicable, but no later than one month from the day on which such amount fell due.

The Ministry shall attempt to accommodate such requests provided that doing so (i) is consistent with the Central Bank's monetary policy and (ii) is feasible under the relevant credit documentation.

Affected debts

This policy shall apply to the following categories of external public debts of the Democratic Socialist Republic of Sri Lanka (Republic) and its public sector borrowers:

I.All outstanding series of bonds issued in the international capital markets

II.All bilateral (Government-to-Government) credits, excluding swap lines between the Central Bank of Sri Lanka and a foreign central bank

III.All foreign currency-denominated loan agreements or credit facilities with commercial banks or institutional lenders (including such institutions owned/controlled by foreign governments) for which the republic or a public sector entity is the obligor or guarantor

IV.All amounts payable by the Republic or a public sector entity following a call during the interim period upon a guarantee (or equivalent financial undertaking) issued in respect of the debt of a third party

Government undertakings

The Government is taking the emergency measures described in this memorandum only as a last resort in order to prevent further deterioration of the Republic's financial position and to ensure fair and equitable treatment of all creditors- commercial and bilateral, in the comprehensive debt restructuring that now seems inescapable.

The Government has taken extraordinary steps in an effort to avoid a resort to these measures, but it is now apparent that any further delay risks inflicting permanent damage on Sri Lanka's economy and causing potentially irreversible prejudice to the holders of the country's external public debts.

The Government intends these emergency measures as temporary expedients designed to preserve the financial status quo until, with the assistance of the IMF and Sri Lanka's other official sector partners, a full economic recovery program can be prepared.

To this end, the Government expects and intends:

1.To advance its discussions with the IMF on an economic adjustment program as expeditiously as possible

2.To post on the Ministry’s website all Debt Sustainability Analyses and similar assessments prepared by the staff of the IMF or by Sri Lanka’s own financial advisors in connection with the economic adjustment program

3.To engage in good faith discussions with representatives of both bilateral and commercial creditors regarding the features of a comprehensive external debt restructuring program consistent with the parameters of the IMF-endorsed economic adjustment program and to invite the views of those parties on the elements of such an external debt restructuring program

4.To be guided in the design and implementation of that external debt restructuring program by the principles of inter-creditor equity (both between different creditor groups and among individual members of each creditor group) and full transparency

Pix by Lasantha Kumara