Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 1 June 2022 00:00 - - {{hitsCtrl.values.hits}}

Prime Minister and Finance Minister Ranil Wickremesinghe

Inland Revenue Head Office

The Treasury

Sri Lanka introduced a low tax regime in late 2019. The reforms included the reduction of tax rates of Value Added Tax (VAT), Personal Income Tax (PIT) and Corporate Income Tax (CIT), and narrowing tax bases of VAT and PIT, while introducing a plethora of tax incentives, such as tax exemptions for agriculture and Information Technology (IT) and enabled services, tax deductions and tax holidays. This caused an annual loss of around Rs. 600 billion – 800 billion in tax revenue to state coffers.

Therefore, these reforms are now being looked at as policies that led to a significant loss of Government revenue, partly due to the spread of COVID-19 pandemic in 2020/2021 and related developments, which affected the revenue generation process, ultimately resulting in the lowest revenue to GDP ratio in the region. The revenue to GDP ratio has declined to 9.1% in 2020 from 12.7% in 2019 and further deteriorated to 8.7% in 2021. This is significantly lower than the average revenue ratio of around 25% of GDP in emerging markets and developing economies.

The low tax regime, the impact of the COVID-19 pandemic on revenue mobilisation, together with the pandemic relief measures, widened the budget deficit significantly to 11.1% of GDP in 2020 and 12.2% of GDP in 2021 from 9.6% of GDP in 2019. This has led to an increase in the Government debt to GDP ratio to 100.6% in 2020 and 104.6% in 2021 from 86.9% in 2019.

This fiscal imbalance has significant adverse spill over effects over the economy. Sri Lanka’s economic outlook remains vulnerable with the unprecedented inflationary pressures, persistently large fiscal and balance of payment financing needs, large debt overhang and critically low level of reserves and pressures on the exchange rate. Economic growth will be adversely affected by the foreign currency shortage and ensuing economic conditions prevailing in the country as well as loss of business and investor confidence due to credit rating downgrades.

The loss of access to international markets and the relatively low amount of other foreign exchange inflows to the Government have created substantial issues in financing the Government budget deficit. In 2020 and 2021, the entire budget deficit was financed through domestic sources as there were net repayments to the foreign sources.

Of the domestic sources to finance the budget deficit, the majority was obtained from the banking sources, particularly from the Central Bank of Sri Lanka, given the unavailability of sufficient amounts of net financing in the domestic non-bank sources. Continuous significant amounts of Central Bank monetary financing have adversely affected the economy, particularly with the significant pressure on the inflation and the exchange rate.

At present, the situation has aggravated to a very critical level where the General Treasury has to increasingly obtain Central Bank financing to make the Government expenditures, including a substantial part of interest, salaries and wages, pensions and Samurdhi payments etc. This is clearly unsustainable and hence the implementation of a strong fiscal consolidation plan is imperative through revenue enhancement as well as expenditure rationalisation measures in 2022 and beyond to ensure macroeconomic stability to support the medium to long-term economic growth objectives of the country.

In the above background, the following tax reforms are proposed to be implemented over the immediate and near term.

Proposed Tax Reforms

2. Proposals

2.1 Income Tax

Income Tax revenue, in nominal terms, declined significantly by 37.3% or Rs. 159.5 billion to Rs. 268.2 billion in 2020 from Rs. 427.7 billion in 2019 owing to the revision of tax rates, thresholds and slabs and the impact of the pandemic. This marked a decline in income tax revenue to GDP ratio to 1.8% in 2020 from 3.0% in 2019. Revenue from income tax increased by 12.6% to Rs. 302.1 billion in 2021 from Rs. 268.2 billion in 2020. However, income tax revenue to GDP ratio remains low at 1.8% in 2021.

a) Personal Income Tax (PIT)

Under the tax reforms implemented, personal relief of Rs. 500,000 and employment relief of Rs. 700,000 (totalling to a relief of Rs. 1.2 million) was increased to Rs. 3 million effective from 1 January, 2020. An expenditure relief up to a total sum of Rs. 1.2 million was introduced and expenses incurred during a year of assessment could be deducted as relief in arriving at the taxable income.

Such expenses include health expenditure and educational expenditure incurred locally, interest paid on housing loans, contributions made to a pension scheme (other than under employer or on behalf of employer) and expenditure incurred for the purchase of equity or security (includes treasury securities, listed shares and listed financial instruments). In addition, tax slabs on taxable income were increased from Rs. 600,000 to Rs. 3 million and the maximum personal income tax rate was reduced from 24% to 18%.

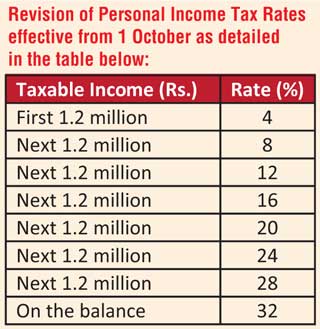

The high tax exemption threshold and the expenditure relief together with the low tax rates have impacted the revenue performance in 2020 and 2021. Hence, revising PIT rates progressively would raise PIT revenue considerably. In consideration of the above, the following proposals are made.

impacted the revenue performance in 2020 and 2021. Hence, revising PIT rates progressively would raise PIT revenue considerably. In consideration of the above, the following proposals are made.

Reduction of the personal relief from Rs. 3 million to Rs. 1.8 million effective from 1 October.

b) Withholding Tax (WHT)

Withholding tax on employment income, on investment receipts other than amounts received as winning from lotteries, rewards, betting or gambling, on share of partnership income, on service fees and contract payments was removed effective from 1 January 2020.

Effective from 1 April 2020, Advance Personal Income Tax (APIT) was introduced for employment income and it is a compulsory deduction on the relevant payments made by an employer to non-residents and non-citizens but optional for residents and citizens. Advance Income Tax (AIT) was introduced on the payments of dividend, interest, discount, charge, natural resource payment, rent, royalty, premium or any similar periodic payments made to a resident. AIT is optional for them and will be deducted only at their request.

Owing to above reforms and increase of thresholds, the number of taxpayers registered to pay income tax under the Pay-As-You-Earn (PAYE)/ APIT has declined by 81.8% to 209,800 taxpayers at end 2020 from 1,149,883 taxpayers end 2019. Withholding/AIT agents registered for Withholding Tax/ AIT on Interest have declined to 615 at end 2020 from 1,627 at end 2019.

Considering the revenue impact of the above proposals, opportunities of tax evasion and the complexities added to the tax administration process as well as to the taxpaying system, the following proposals are made:

Making APIT/ Withholding Tax on Employment Income (PAYE) mandatory for all taxpayers exceeding the personal relief of Rs. 1.8 million per year of assessment effective from 1 October.

Making AIT/ Withholding Tax mandatory for all taxpayers and considering AIT on interest of individual taxpayers and dividends as final payments effective from 1 October. Deduction of AIT will be at the following rates.

Interest -5%

Dividend – 14%

Rent – 10% on rent exceeding Rs. 100,000 per month

In all other cases – 14%

Imposing Withholding Tax on service payments exceeding Rs. 100,000 per month made to individuals such as professionals at the rate of 5% effective from 1 October.

Re-introduction of relief on interest income of Rs. 1.5 million for senior citizens effective from 1 October.

c) Corporate Income Tax (CIT)

Standard CIT rate was reduced from 28% to 24% effective from 1 January 2020. Gains and profits from Information Technology and enabled services were exempted from income tax, while a concessionary tax rate of 14% was granted to construction, healthcare, and concessionary tax rate of 18% was granted to manufacturing.

Considering the revenue impact of the above reforms, the following proposals are made:

Increasing the standard CIT rate from 24% to 30% and increasing the concessionary CIT rate from 14% to 15% effective from 1 October. This would make Sri Lanka’s CIT rate in conformity with the Inclusive Framework led by the Organisation for Economic Cooperation and Development (OECD) which includes a global minimum CIT rate of 15%, applicable to the global profits of large multinational corporations. However, the rates applied to manufacturing (18%) and liquor and tobacco, and betting and gaming (40%) remain unchanged.

Making dividends paid by a resident company to non-resident persons liable to income tax effective from 1 April 2023.

Removing the following income tax holidays granted under the previous amendment. This will not apply to projects or undertakings commenced prior to 31 March 2023.

Ten-year tax exemption period for an undertaking that sells construction materials recycled in a selected separate site established in Sri Lanka to recycle the materials which were already used in the construction industry.

Five-year tax exemption period for any business commenced on or after 1 April 2021 by an individual after successful completion of vocational education from any institution which is standardised under TVET concept and regulated by the Tertiary and Vocational Education Commission.

Seven-year tax exemption period for an undertaking commenced by a resident person in the manufacturing of boats or ships in Sri Lanka and received or derived any gains and profits from the supply of such boats or ships.

Five-year tax exemption period for any undertaking commenced on or after 1 January 2021 by any resident person who constructs and installs the communication towers and related appliances using local labour and local raw materials in Sri Lanka or provides required technical services for such construction or installation.

Any undertaking for letting bonded warehouses or warehouses related to the offshore business, in Colombo and Hambantota ports, if such person has invested in such warehouses effective from 1 April 2021.

Removal of additional deduction granted for expenses related to Marketing and Communication effective from 1 April 2023.

Revisiting the definition given for “multi-national companies” under the Inland Revenue Act, No. 24 of 2017 effective from 1 April 2023 to improve the clarity of the definition.

Making any other consequential amendments due to the above proposals.

2.2 Value Added Tax (VAT)

The VAT rate was reduced from 15% to 8% with effect from 1 December 2019 and the threshold for registration of VAT was increased from Rs. 3 million per quarter or Rs. 12 million per annum to Rs. 75 million per quarter or Rs. 300 million per annum effective from 1 January 2020. Due to the above reforms coupled with the impact of COVID-19, VAT revenue declined by 47% to Rs. 233.8 billion in 2020 from Rs. 443.9 billion in 2019.

In light of the above, the following proposals are made.

Increasing VAT rate from 8% to 12% with immediate effect.

Decreasing VAT threshold from Rs. 300 million per annum to Rs. 120 million per annum effective from 1 October.

iii. Reviewing VAT exemption schedule and removal of unproductive exemptions based on the economic benefits.

iv. Removal of the VAT exemption on Condominium Residential Apartments effective from 1 October 2022.

v. Removal of 0% VAT rate granted on the supply of services by a hotel, guest house, restaurant or other similar businesses providing similar services, registered with the Sri Lanka Tourism Development Authority, if sixty per centum of the total value of the inputs are sourced from local supplies/sources and imposition of 12% tax rate on the same effective from 1 October.

vi. Making any other consequential amendments due to the above proposals.

2.3 Telecommunication Levy

Telecommunication Levy was reduced from 15% to 11.25% effective from 1 December 2019 which led to a decrease in revenue by 28% to Rs. 13.1 billion in 2020 from Rs. 18.3 billion in 2019. Hence, it is proposed to increase the Telecommunication Levy from 11.25% to 15% with immediate effect.

2.4 Betting and Gaming Levy

The tax rates pertaining to Betting and Gaming Levy have not been revised from 2015 onwards. Hence, following amendments are proposed with regard to Betting and Gaming Levy effective from 1 January2023.

Increasing Annual Levy for carrying on the business of gaming from Rs. 200 million to Rs. 500 million.

Increasing Annual Levy for betting

From Rs. 4 million to Rs. 5 million when it is carried on through agents

From Rs. 0.6 million to Rs. 1 million when it is carried on using live telecast facilities

From Rs. 50,000 to Rs. 75,000 when it is carried on without the use of live telecast facilities

Increasing the rate of the levy on Gross Collection from 10% to 15%.

In addition to the above tax policy reforms, steps will be taken to strengthen revenue administration at revenue collecting agencies such as Sri Lanka Customs, Inland Revenue Department and Excise Department with the infusion of technology and rigorous tax audits.

The revenue impact of the above tax policy reforms is given as Annexure.

2.5 Amendments to the Fiscal Management (Responsibility) Act, No. 3 of 2003

Under the Fiscal Management (Responsibility) Act, No. 3 of 2003, as amended by the Fiscal Management (Responsibility) (Amendment) Act, No. 12 of 2021, the Treasury Guarantee limit is set for 15% of the GDP for the current financial year along with the two preceding financial years. Since about 70% of the guarantees have been issued in foreign currencies, the Rupee value of guarantees issued has increased significantly over and above the set limit of 15% due to the high depreciation of the Sri Lankan Rupee.

Considering the above, the following amendments are proposed.

Inclusion of a provision where exceeding the Treasury Guarantee limit is permitted in the case where there is an exceptional depreciation or other unforeseen circumstances.

Inclusion of an escape clause to ensure flexibility that the Government may deviate from the operational target(s) or fiscal rule(s) due to unforeseen circumstances. This would eliminate the need to continually amend the Act each time when a target is breached.

3. Approval

Accordingly, the approval was given by the Cabinet of Ministers to:

3.1 with respect to income tax reforms

to direct the Legal Draftsman to draft the Inland Revenue (Amendment) Bill incorporating the proposals referred in sub-paragraph 2.1 above;

to submit the draft Bill referred in (i) above to Hon. Attorney General for legal clearance; and

to publish the draft Bill in the Government Gazette and submit the same for the approval of the Parliament; and

3.2 with respect to Value Added Tax (VAT) reforms

to issue a Gazette Notification to increase the VAT rate;

to direct the Legal Draftsman to draft the Value Added Tax (Amendment) Bill incorporating the proposals referred in sub-paragraph 2.2 above;

to submit the draft Bill referred in (ii) above to Hon. Attorney General for legal clearance; and

to publish the draft Bill in the Government Gazette and submit the same for the approval of the Parliament; and

3.3 with respect to the Telecommunication Levy

to direct Secretary to the line Ministry in charge of Telecommunications Regulatory Commission of Sri Lanka (TRCSL) to implement the proposal referred in sub-paragraph 2.3 above immediately;

to direct the Legal Draftsman to draft the Telecommunication Levy (Amendment) Bill incorporating the proposal referred in sub-paragraph 2.3 above;

to submit the draft Bill referred in (ii) above to Hon. Attorney General for legal clearance; and

to publish the draft Bill in the Government Gazette and submit the same for the approval of the Parliament; and

3.4 with regard to Betting and Gaming Levy Act, No. 40 of 1988

to direct the Legal Draftsman to draft the Betting and Gaming Levy (Amendment) Bill incorporating the proposals referred in sub-paragraph 2.4 above;

to submit the draft Bill referred in (i) above to Hon. Attorney General for legal clearance; and

to publish the draft Bill in the Government Gazette and submit the same for the approval of the Parliament; and

3.5 with regard to the Fiscal Management (Responsibility) Act, No. 3 of 2003

to direct the Legal Draftsman to draft the Fiscal Management (Responsibility) (Amendment) Act incorporating the necessary legal provisions for the implementation of proposals mentioned under 2.5 above;

to submit the draft Bill referred in (i) above to Attorney General for legal clearance; and to publish the draft Bill in the Government Gazette and submit the same for the approval of the Parliament; and

3.6 to direct the Legal Draftsman to prepare all relevant draft legislations in order to give effect to the proposals mentioned under Paragraph 2 above, in consultation with the Ministry of Finance, Economic Stabilisation and National Policies for the consideration of the Cabinet of Ministers and implement an appropriate programme to prepare relevant amending legislation expeditiously to be submitted in Parliament.