Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 1 June 2022 00:00 - - {{hitsCtrl.values.hits}}

Amidst rising inflation, cost and a contracting economy the Government yesterday announced new tax

|

| President Gotabaya Rajapaksa |

|

| Prime Minister Ranil Wickremesinghe |

measures including reintroduction of previous rules to recoup at least half of the revenue lost due to relief given in November 2019.

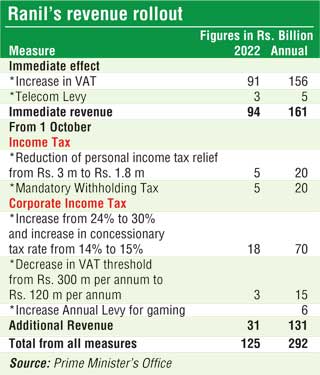

Following approval by the Cabinet of Ministers on Monday, Prime Minister and Finance Minister Ranil Wickremesinghe yesterday unveiled the new tax regime with two measures with immediate effect and others from 1 October and next year.

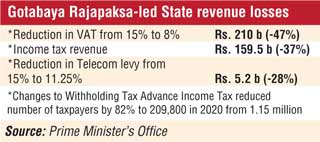

In a statement, the Prime Minister’s Office said the low tax regime introduced in late 2019 by President Gotabaya Rajapaksa caused an annual loss of around Rs. 600 billion – 800 billion in tax revenue to state coffers. Estimated revenue envisaged from new measures is nearly Rs. 300 billion next year.

Immediate measures are VAT rate at 12% and decreasing VAT threshold from Rs. 300 million per annum to Rs. 120 million per annum effective from October 1, 2022. Additionally VAT exemption schedule will be reviewed aimed at removing unproductive exemptions based on the economic benefits; removal of the VAT exemption on Condominium Residential Apartments effective from 1 October and removal of zero% VAT rate granted on the supply of services by a hotel, guest house, restaurant or other similar businesses providing similar services, registered with the Sri Lanka Tourism Development Authority, if 60% of the total value of the inputs are sourced from local supplies/sources and imposition of 12% tax rate on the same effective from 1 October.

The other immediate move is restoration of Telecommunication Levy at 15% as opposed to 11.25% at present.

Personal and corporate income tax

Revisions to personal and corporate income tax were also announced. Among them were reduction of the personal relief from Rs. 3 million to Rs. 1.8 million effective from 1 October and revision of Personal Income Tax Rates effective from 1 October ranging from a low rate of 4% for first Rs. 1.2 million and a high of 32% for over Rs. 8.2 million.

Withholding Tax (WHT) has also been brought back. Measures include making APIT/ Withholding Tax on Employment Income (PAYE) mandatory for all taxpayers exceeding the personal relief of Rs. 1.8 million per year of assessment effective from 1 October.

Making AIT/ Withholding Tax mandatory for all taxpayers and consider AIT on interest of individual taxpayers and dividends as final payments effective from 1 October. Deduction of AIT will be at the following rates. Interest -5%; Dividend – 14%; Rent – 10% on rent exceeding Rs. 100,000 per month and in all other cases – 14%.

following rates. Interest -5%; Dividend – 14%; Rent – 10% on rent exceeding Rs. 100,000 per month and in all other cases – 14%.

Changes to Withholding Tax

Additionally Withholding Tax on service payments exceeding Rs. 100,000 per month made to individuals such as professionals will be at the rate of 5% effective from 1 October. Re-introduction of relief on interest income of Rs. 1.5 million for senior citizens effective from 1 October was also announced.

In terms of corporate tax, among measures announced are increasing the standard CIT rate from 24% to 30% and increasing the concessionary CIT rate from 14% to 15% effective from 1 October. This would make Sri Lanka’s CIT rate in conformity with the Inclusive Framework led by the Organisation for Economic Cooperation and Development (OECD) which includes a global minimum CIT rate of 15%, applicable to the global profits of large multinational corporations. However, the rates applied to manufacturing (18%) and liquor and tobacco, and betting and gaming (40%) remain unchanged.

Making dividends paid by a resident company to non-resident persons liable to income tax effective from 1 April 2023. Removing the following income tax holidays granted under the previous amendment. This will not apply to projects or undertakings commenced prior to 31 March 2023.

Ten-year tax exemption period for an undertaking that sells construction materials recycled in a selected separate site established in Sri Lanka to recycle the materials which were already used in the construction industry.

Five-year tax exemption period for any business commenced on or after 1 April 2021 by an individual after successful completion of vocational education from any institution which is standardised under TVET concept and regulated by the Tertiary and Vocational Education Commission.

Seven-year tax exemption period for an undertaking commenced by a resident person in the manufacturing of boats or ships in Sri Lanka and received or derived any gains and profits from the supply of such boats or ships.

Five-year tax exemption period for any undertaking commenced on or after 1 January 2021 by any resident person who constructs and installs the communication towers and related appliances using local labour and local raw materials in Sri Lanka or provides required technical services for such construction or installation.

Any undertaking for letting bonded warehouses or warehouses related to the offshore business, in Colombo and Hambantota ports, if such person has invested in such warehouses effective from 1 April 2021.

Removal of additional deduction granted for expenses related to Marketing and Communication effective from 1 April 2023.

The Prime Minister also announced plans to revisit the definition given for “multi-national companies” under the Inland Revenue Act, No. 24 of 2017 effective from 1 April 2023 to improve the clarity of the definition.

Noting that the tax rates pertaining to Betting and Gaming Levy have unchanged since 2015 onwards, the following has been proposed including increasing the Annual Levy for carrying on the business of gaming from Rs. 200 million to Rs. 500 million.

An increase of the Annual Levy for betting has been proposed on the basis: From Rs. 4 million to Rs. 5 million when it is carried on through agents; From Rs. 0.6 million to Rs. 1 million when it is carried on using live telecast facilities and From Rs. 50,000 to Rs. 75,000 when it is carried on without the use of live telecast facilities. Additionally, the rate of the levy on Gross Collection has been increased from 10% to 15%.

The Prime Minister’s office said in addition to the above tax policy reforms, steps will be taken to strengthen revenue administration at revenue collecting agencies such as Sri Lanka Customs, Inland Revenue Department and Excise Department with the infusion of technology and rigorous tax audits.