Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Tuesday, 21 October 2025 04:55 - - {{hitsCtrl.values.hits}}

The main reason for the decline in the status of USD as a reserve currency has been the acceleration of US inflation rate reducing its real value within the domestic economy

The real threat to the prominence of USD as a reserve currency had been posed not by these emerging alternative currencies. It has been made by gold which is a close substitute for USD as a store of value and Bitcoin, a cryptocurrency that has offered enormous speculative profits to its holders. Except the possibility of making capital gains out of any increase in the market prices, gold does not earn any revenue for the holder. In fact, gold makes a negative annual earning since the holders must pay a commission or a service charge to the depository which provides safekeeping services to investors

The real threat to the prominence of USD as a reserve currency had been posed not by these emerging alternative currencies. It has been made by gold which is a close substitute for USD as a store of value and Bitcoin, a cryptocurrency that has offered enormous speculative profits to its holders. Except the possibility of making capital gains out of any increase in the market prices, gold does not earn any revenue for the holder. In fact, gold makes a negative annual earning since the holders must pay a commission or a service charge to the depository which provides safekeeping services to investors

Dollar becoming informal reserve asset

Dollar becoming informal reserve asset

The US dollar is a real currency which is backed by an economy that produces the largest quantum of real goods and services as a single economy. In 2010, that amounted to $ 15 trillion. In 2024, it has nearly doubled to $ 29 trillion marking an annual average growth rate of about 2%. Its share in global GDP has risen from 22% in 2010 to 26% in 2024. In addition, world nations use USD as their main reserve currency amounting to about 58% according to the data for 2024. That is based on trust since it is not a formal arrangement like the one that existed from 1945 to 1971 under the gold exchange standard to which the US government had agreed when the World Bank and IMF were formed.

Unlike the gold standard where countries had to maintain a 100% backing of their currencies with a gold stock, in the gold exchange standard, the US government agreed to exchange dollars for gold at a fixed rate of $ 35 per fine ounce of gold. Thus, countries did not have to maintain a gold reserve of 100% to make their currencies acceptable for global transactions. If they hold USD, they could convert them to gold at any time at this fixed rate. But when the open market prices of gold rose to about $ 70 per fine ounce, instead of resetting the dollar rate, the US government unilaterally abandoned the gold exchange system in August 1971. But USD continued to serve as the leading reserve currency in the world because the other nations had trust in the US economy and its policies.

Rise of alternative currencies

But this is changing fast. According to a study by IMF, USD is ceding its dominant position to rising alternative currencies.1 Accordingly, USD had an enviable share of about 75% in global reserves in early 2000s. This share has fallen to 58% in 2024. In an opposite development, nontraditional currencies, namely, Australian dollar, Canadian dollar, and Chinese Renminbi together with a few other newcomers have increased their share from 2% in early 2000s to close to 12% by 2024. They do not still offer a formidable challenge to USD but their phenomenal rise is a deadly warning to US authorities. The other currencies which had been a threat to USD, namely, Sterling Pound, Euro, and Japanese Yen, have remained at the same position as they had been three decades ago.

The main reason for the decline in the status of USD as a reserve currency has been the acceleration of US inflation rate reducing its real value within the domestic economy. The US Consumer Price Index for all urban consumers amounted to 100 in 1982-4. It had accelerated to 323 by August 2025 implying the fall of the value of a dollar in 1982-4 to 30 US cents.2 Therefore, it is natural for the holders of USD to lose their confidence in the currency.

Gold as a substitute asset

The real threat to the prominence of USD as a reserve currency had been posed not by these emerging alternative currencies. It has been made by gold which is a close substitute for USD as a store of value and Bitcoin, a cryptocurrency that has offered enormous speculative profits to its holders. Except the possibility of making capital gains out of any increase in the market prices, gold does not earn any revenue for the holder. In fact, gold makes a negative annual earning since the holders must pay a commission or a service charge to the depository which provides safekeeping services to investors. Gold which is refined as 1 kg bars are accepted for safekeeping by these depositories and a gold certificate is issued to investors. It is these certificates which are traded in the market and not the actual gold. If trading takes place between two parties who keep their gold with the same depository, a book entry is made by debiting the seller’s account with the depository and crediting the buyer’s account with the amount. Gold is physically shifted from one depository to another if the trading takes place between two parties who keep their gold in two different depositories. Despite these negative annual earnings, central banks which keep gold as a part of reserves prefer to acquire it if they lose trust and confidence about the US government or its policies. The continued rise in the market price of gold during the last few decades has been prompted by the possibility for using gold as a store of value when the market price of USD is subject to wide fluctuation, on one side, and the price of gold is on a continuous ascending trend, on the other.

Dollar’s fall in terms of gold

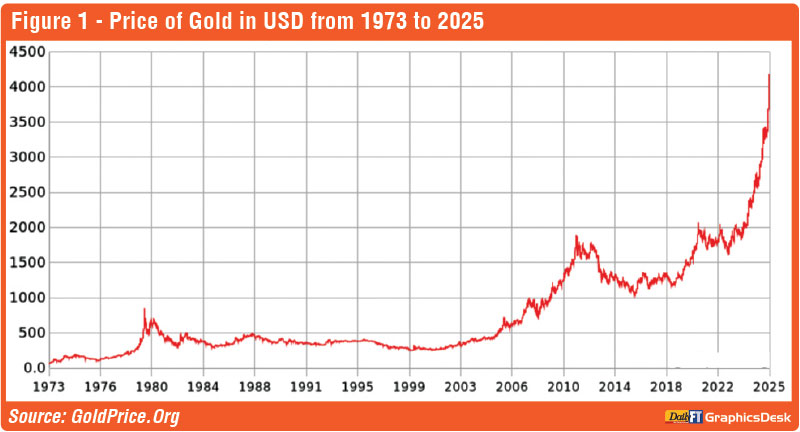

Figure 1 shows the price of a fine ounce of gold from 1973 to October 2025. The price of gold had been at about $ 500 per fine ounce in 1980. This has risen progressively to $ 4,231 per fine ounce by mid-October 2025. In terms of the value of gold, USD has fallen from 62 mg in 1980 to 7 mg in October 2025. This is equal to an 88% decline in the value of gold. Gold prices have started to steep up sharply after Donald Trump was elected to US presidency in January 2025; at that time a troy ounce of gold amounted to $ 2,624.

Because of his unilateral and imprudent tariff policy, the trust which the world nations had placed with USD began to get eroded compelling them to use gold as a safety haven amidst the fear of declining US economy coupled with an explosion of the price levels. He had started his second term when a dollar was worth 12 mg of gold. During the first 10 months of his presidency, value of a dollar fell to 7 mg of fine gold. Markets do not follow the whims and fancies of political leaders. They vehemently oppose them and follow a path directed to them by a collective choice made by millions of individual decision makers.

US economy continues to suffer from Trump’s unsound tariff policy met by retaliatory measures taken by countries which have been hit by him. Though most of the mainstream economists, among them, mostly, Nobel laureates, have pointed this out to Trump, his policy advisors do not seem to take note of this warning. His beautiful budget bill for 2025 has also been the target of attack by Nobel laureates in economics speaking openly that they have grave concerns about it

US economy continues to suffer from Trump’s unsound tariff policy met by retaliatory measures taken by countries which have been hit by him. Though most of the mainstream economists, among them, mostly, Nobel laureates, have pointed this out to Trump, his policy advisors do not seem to take note of this warning. His beautiful budget bill for 2025 has also been the target of attack by Nobel laureates in economics speaking openly that they have grave concerns about it

Trump driven crypto rally

Even before Donald Trump was elected to presidency, the leading cryptocurrency, Bitcoin or BTC, had an independent rally in the markets. At the time of the first creation of BTC in 2009, its value had been fixed at 10 US cents per BTC. But by early November 2024, its value had shot up to $ 69,000. BTC had been created to serve as a peer to peer medium of payment bypassing the costly intermediaries like the established banking systems. It was not to serve the other purposes of money, namely, a store of value, a unit of account or a method of making deferred payments. However, since its issue through the system had been restricted, every four years, the new issues are halved and the total is capped at 21 million BTC, there was a shortage of BTC relative to the demand. It pushed up the prices. When prices went up in the market, speculators stepped in and started to use the crypto as a speculating financial asset: an artificial demand was created by speculators who expected to profit from the future increases in the prices. This was the reason for the continued rise in the value of BTC in the market. These speculative sentiments were boosted by Donald Trump when he announced before the presidential election in 2024 that he was the only pro-crypto candidate in the election trail.3 He promised to launch a national crypto stockpile if elected to a second term. Trump did not realise that his move will kill the USD when the public preferences would shift from it to cryptos. But it caused crypto markets to surge higher and BTC hit a new all-time high above $ 75,000 overnight. This rally continued even after his election on the expectation of the creation of a crypto stockpile by the new administration.

A stockpile at the expense of gold reserves?

This stockpile is equal to a foreign exchange reserve being maintained by national governments. Since USA was a foreign exchange issuer and it could issue that foreign exchange at its will, unlike other national governments, it did not have to maintain a forex reserve. Instead, it maintained a gold stock which was the informal backup for USD. In 1971 when USA unilaterally abandoned the gold exchange standard, its gold stock had been depleted to about 8000 metric tons, down from high 20,000 metric tons in 1957. Since then, it had maintained its gold reserves around this level without any upscaling though there had been a rapid growth in GDP and international transactions. This gold is priced at a historically low level of $ 42.22 per troy ounce or $ 1.4 million per metric ton. So, the total book value of the gold stock of USA is about $ 11 billion.

Unless USA prints new money, it is this stock which should be sold in the market at the prevailing market prices to build the promised crypto stockpile. Speculators, smelling early blood have pushed up the price to profit from Trump’s planned move from gold to cryptos as the main reserve held by USA. But this is a risky affair since, while gold has a global demand from other central banks, there is no such demand for cryptos or BTC from them. This makes Trump’s planned crypto stockpile a worthless asset which has been highly inflated by recent market BTC runs.

However, in anticipation of the delivery of the crypto promise by Trump administration, the price of BTC rose sharply from $ 95,000 at end 2024 to $ 124,000 by early October 2025. The bubble started to burst and now its price has fallen to about $ 113,000 by mid-October. As a result, over a single night, assets worth of $ 19 billion got wiped out making the dream of realising super profits out of Trump’s currency policy a non-event for most of the investors. Imagine the predicament which central banks would suffer from had they added such a volatile imaginary currency to their forex reserves.

Gold prices have started to steep up sharply after Donald Trump was elected to US presidency in January 2025; at that time a troy ounce of gold amounted to $ 2,624. Because of his unilateral and imprudent tariff policy, the trust which the world nations had placed with USD began to get eroded compelling them to use gold as a safety haven amidst the fear of declining US economy coupled with an explosion of the price levels. He had started his second term when a dollar was worth 12 mg of gold. During the first 10 months of his presidency, value of a dollar fell to 7 mg of fine gold

Gold prices have started to steep up sharply after Donald Trump was elected to US presidency in January 2025; at that time a troy ounce of gold amounted to $ 2,624. Because of his unilateral and imprudent tariff policy, the trust which the world nations had placed with USD began to get eroded compelling them to use gold as a safety haven amidst the fear of declining US economy coupled with an explosion of the price levels. He had started his second term when a dollar was worth 12 mg of gold. During the first 10 months of his presidency, value of a dollar fell to 7 mg of fine gold

Gold: preferred asset of central bank

The preference of central banks has always been to gold as a valuable asset. As political uncertainty and geopolitical risks have fuelled their safe-haven demand, the market price of gold has now surpassed the magic price of $ 4,000 per troy ounce. Accordingly, as the latest data show, they hold more gold in their forex portfolios than the US treasuries: 24% of gold holdings as against 23% of US treasuries in forex reserves.4 Seen as a viable alternative to heavily indebted US dollar, the share of gold in central bank reserves has increased most among emerging market economies. Among them, China, Russia, and Türkiye have been the largest buyers of gold in recent times.

Trump at receiving end

US economy continues to suffer from Trump’s unsound tariff policy met by retaliatory measures taken by countries which have been hit by him. Though most of the mainstream economists, among them, mostly, Nobel laureates, have pointed this out to Trump, his policy advisors do not seem to take note of this warning.5 His beautiful budget bill for 2025 has also been the target of attack by Nobel laureates in economics speaking openly that they have grave concerns about it.6 Even the Nobel prize winners in 2025 have been critics of Trump’s trade policies and his administration’s higher education reforms which they say an attack of academic freedom.7 Given this Trump made economic crisis in USA, it is inevitable that USD will fall in the market, while gold will surge. However, cryptos will burst their bubble with no backed-up economy behind them.

Footnotes:

1https://www.imf.org/en/Blogs/Articles/2024/06/11/dollar-dominance-in-the-international-reserve-system-an-update

2https://fred.stlouisfed.org/series/CPIAUCSL

3https://www.cnbc.com/2024/11/06/trump-claims-presidential-win-here-is-what-he-promised-the-crypto-industry-ahead-of-the-election.html

4https://www.visualcapitalist.com/central-banks-now-hold-more-gold-than-u-s-treasuries/

5https://www.reuters.com/world/us/16-nobel-prize-winning-economists-say-trump-policies-will-fuel-inflation-2024-06-25/

6https://www.cnbc.com/2025/06/03/why-nobel-prize-winning-economists-oppose-trumps-budget-bill.html

7https://www.reuters.com/world/mokyr-aghion-howitt-win-2025-nobel-economics-prize-2025-10-13/

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected].)