Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 19 February 2026 03:00 - - {{hitsCtrl.values.hits}}

Up from 10-decade high in Dec. 2025, according to JB Securities

Up from 10-decade high in Dec. 2025, according to JB Securities

Tipper and heavy truck registrations point to revival in construction activity

Tipper and heavy truck registrations point to revival in construction activity

Luxury vehicle volumes low, generate close to 200% in cumulative taxes

Luxury vehicle volumes low, generate close to 200% in cumulative taxes

External sector remains resilient

External sector remains resilient

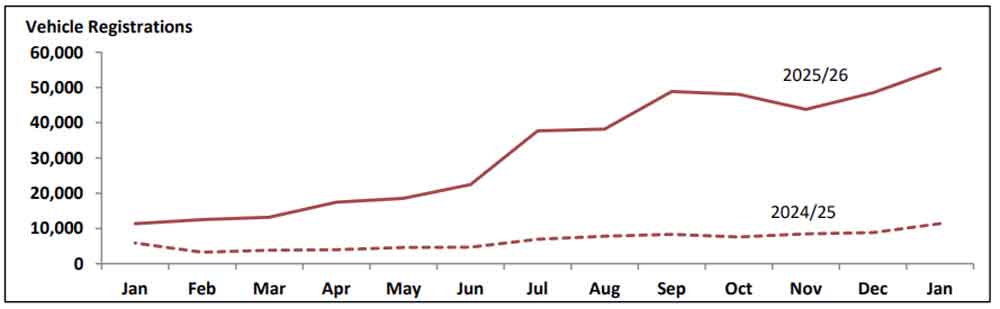

Vehicle registrations peaked in January 2026, reaching an all-time high of 55,365 units following the lifting of restrictions early last year, up from 48,525 units in December 2025, which was then a near-decade high.

According to a JB Securities report analysing vehicle registration data, transport-related imports accounted for 70.6% of total imports, amid firmer construction activity and steady credit flows. Two-wheelers dominated the market, representing 64.17% of total registrations.

Indian-origin imports increased to 30,766 units in January from 26,631 in December 2025, led by two-wheelers at 24,163 units and three-wheelers at 3,441 units. Japanese-origin imports rose to 9,603 units, while Chinese-origin imports climbed to 4,959 units.

Locally assembled vehicle registrations reached 8,239 units in January, up from 7,105 in December 2025, with two-wheelers accounting for 7,425 units.

Heavy and medium commercial vehicle registrations strengthened. Large tractor registrations rose to 244 units from 225 in December, with financing penetration at 78.7%. Hand tractor registrations declined to 71 units from 145 units a month earlier.

JB Securities CEO Murtaza Jafferjee said the increase in tipper registrations reflected a recovery in construction activity.

“The sharp increase in tipper registrations across both medium and heavy truck segments points to a clear recovery in construction activity,” he said.

Referring to construction-sector GDP indexed to 2015, he said: “The headline peak in 2017 was inflated by the inclusion of Port City construction within GDP coverage. Excluding Port City, the adjusted peak of the index was around 125. By 2023, at the height of the economic crisis, the index had fallen to 66.9, representing a 46.5% contraction from the adjusted peak. The 2025 estimate is approximately 88.3, still 29.5% below the adjusted peak levels, but about 32% above the 2023 trough.”

On cement volumes, he said: “Consumption declined sharply from 7.1 million MT in 2021 to 3.6 million MT in 2023, before recovering to 4.5 million MT in 2024 and an estimated 5.3 million MT in 2025. Volumes remain well below peak.”

He added: “The pickup in registrations of construction-linked vehicles, including tippers, loaders and trucks, suggests the sector has moved beyond survival mode. What is emerging now is gradual re-fleeting and selective capacity expansion, not a boom.”

On the external sector, Jafferjee said: “The external sector in December remained resilient and managed to post a current account surplus in spite of very high imports in December.”

Monthly vehicle imports peaked at $ 311.1 million in December 2025, comprising personal vehicles of $ 240.9 million, commercial vehicles of $ 60.2 million, and other categories of $ 10 million. Total vehicle imports for 2025 amounted to $ 2.162 billion.

“In spite of record level of vehicle imports, the external sector posted a current account surplus of $ 45.2 million in December aided by a record net secondary income of $ 870.9 million aided by remittances for end of year and Cyclone Ditwah contributions,” he said.

Goods imports in December 2025 amounted to $ 2.155 billion, marginally below the 2025 monthly peak of $ 2.157 billion in September and below the all-time high of $ 2.241 billion recorded in December 2021.

Jafferjee noted that the 2021 record was achieved despite a vehicle import ban, driven by excessive monetary expansion by the Central Bank and attempts to manage the exchange rate through moral suasion.

He added that despite elevated imports, the Central Bank continued to accumulate foreign exchange in the domestic market, purchasing over $ 200 million in December 2025, with net absorption continuing into January.

Premium brand registrations totalled 206 units in January, of which 38 were brand new and 168 pre-owned, underscoring the dominance of the grey market in the luxury segment.

In the brand-new premium category, Mercedes-Benz led with 33 units, driven by the C-Class (17) and E-Class (8). In the pre-owned segment, Audi topped the market with 65 units, largely from the A3 (50). Mercedes-Benz followed with 48 units, comprising C-Class (13), E-Class (9) and S-Class (1). BMW recorded 25 units, led by the X1 (8) and 5-Series (5), while Lexus posted 19 units, primarily the LX (10) and LBX (5).

High-end registrations during the month included one Maybach GLS, one Porsche Macan, one Porsche Panamera, one Bentley Bentayga, three Bentley Flying Spur sedans, one Rolls-Royce Phantom EWB, two Ferrari 296 GTBs, one Lamborghini Urus and one Lamborghini Huracán.

Despite low volumes, this ultra-luxury segment carries a significant fiscal contribution, with cumulative taxes on such imports approaching 200%, supporting Government revenue.

SUVs and crossovers recorded 7,664 units in January, up from 7,043 units in December. Brand-new vehicles accounted for 3,522 units, while pre-owned vehicles totalled 4,142 units.

Toyota led the segment with 2,633 units, driven by the Raize (1,954), followed by the Yaris Cross (217), Urban Cruiser (162) and Land Cruiser variants totalling 226 units — Prado 150 (67), LC 250 (103) and LC 300 (56). Honda ranked second with 1,400 units, almost entirely from the Vezel (1,355). Nissan placed third with 967 units, dominated by the Magnite (959). Suzuki followed with 755 units, largely from the Fronx (736), while BYD recorded 688 units, led by Sealion variants (668) and the Atto (20). Kia posted 220 units, mainly the Sorento (150) and Sonet (36).

Crossovers accounted for 94% of total SUV and crossover registrations. Financing penetration stood at 49%, broadly in line with the wider market.

Hybrid registrations rose to 3,465 units in January from 3,142 units in December 2025. SUVs and crossovers accounted for 3,320 units, while motor cars contributed 88 units. Of the hybrid SUVs and crossovers, 2,462 units were pre-owned. The segment remained concentrated among Japanese manufacturers.

EV registrations increased to 3,763 units in January from 3,220 in December 2025. Two-wheelers led with 2,976 units, followed by motor cars at 329 units, SUVs and crossovers at 169 units, and three-wheelers at 29 units.