Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 3 November 2025 05:55 - - {{hitsCtrl.values.hits}}

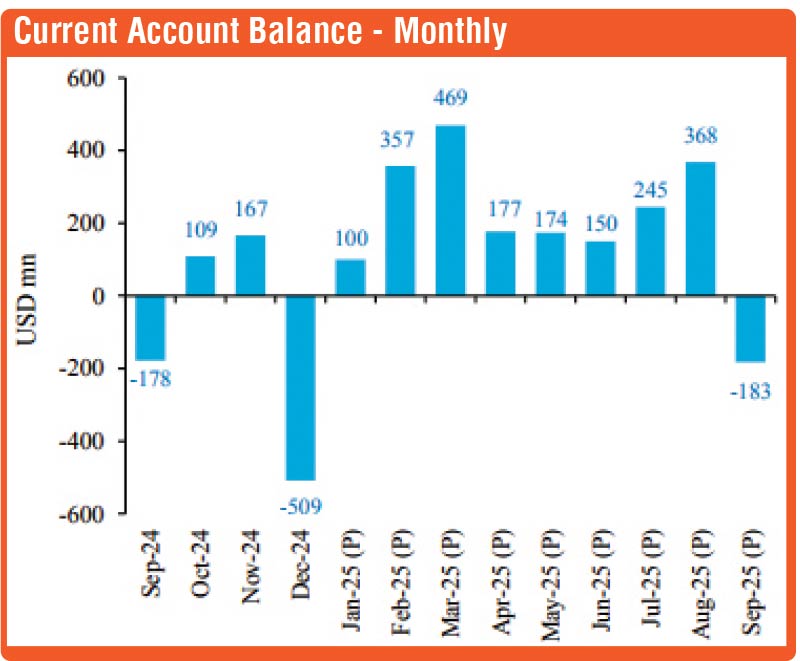

Sri Lanka’s external sector remained robust in the first nine months of 2025, despite the current account registering a deficit of $ 183 million in September 2025 for the first time this year on surging vehicle imports.

However, the cumulative current account remained in surplus year-to-date (YTD) end-September $ 1.9 billion, up 29% from $ 1.43 billion a year ago, on moderate growth in merchandise and services exports and tourism earnings and higher worker remittances, according to the Central Bank of Sri Lanka (CBSL).

Merchandise trade dynamics continue to shift, with the trade deficit increasing in September 2025 to $ 910 million, up from $ 634 million a year ago, as imports growth out-paced exports. Imports in September rose by 24.5% year-on-year (YoY) to $ 2.05 billion, whilst in the first nine months, the growth was 12.2% to $ 15.4 billion. Exports grew 12.5% YoY to $ 1.13 billion in September, and by 7.3% in first nine months to $ 10.2 billion.

Resultantly, the trade deficit in September rose to $ 910 million, up from $ 634 m a year ago. The merchandise trade deficit in September was largely driven by the surge in vehicle imports, the CBSL said.

The CBSL said that vehicle imports, comprising both personal and commercial vehicles, totalled $ 286 million in September, leading to total vehicle imports of $ 1.2 billion in the first nine months of the year.

The terms of trade improved in September 2025 YoY, driven by higher growth in export prices relative to import prices, while the Sri Lankan rupee depreciated by 3.9% against the US dollar YTD end-October 2025.

The services sector net inflows reported a 6.3% decline from a year ago to $ 181 million in September 2025, but was up a moderate 1.7% YoY to $ 2.85 billion in the first nine months of the year.

Earnings from tourism showed a moderate 1.1% YoY increase to $ 1803 million in September 2025, while cumulative tourism earnings for the first nine months of the year was $ 2.47 billion, up 5.3% from a year ago.

Workers’ remittances amounted to $ 696 million in September 2025, up 25.2% from a year ago, while cumulative inflows for the January-September 2025 period was $ 5.8 billion, a robust 20% growth from a year ago.

The CBSL said foreign investments in the Government securities market continued to record a net inflow in September 2025, while the foreign investments in the Colombo Stock Exchange (CSE), covering both primary and secondary markets, recorded a net outflow.

Gross official reserves, including the swap facility with the People’s Bank of China (PBOC), remained steady at around $ 6.2 billion by end-September 2025, despite meeting external debt servicing commitments, the CBSL said.