Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 15 August 2025 06:08 - - {{hitsCtrl.values.hits}}

|

IPS Research Fellow Dr. Asanka Wijesinghe presenting his study yesterday – Pic by Upul Abayasekara

|

Economic think tank Institute of Policy (IPS) yesterday warned that the 20% reciprocal tariff unilaterally imposed by the Trump administration could lead to export losses of $ 634 million and put nearly 16,000 jobs at risk, mostly female workers in the apparel industry.

When the US announced the new tariff rate on 31 July, most business chambers in Sri Lanka welcomed the move because it meant a further reduction from an earlier 44% rate. However, even at 20%, the adverse impact is significant.

A new study by the IPS released yesterday pointed out that although the 20% tariff rate offers Sri Lanka some relief compared to previous reciprocal rates, the US effective tariff rate for Sri Lanka remains high.

The latest US tariff announcement raises the effective rate to 29.9%, the highest since 1935.

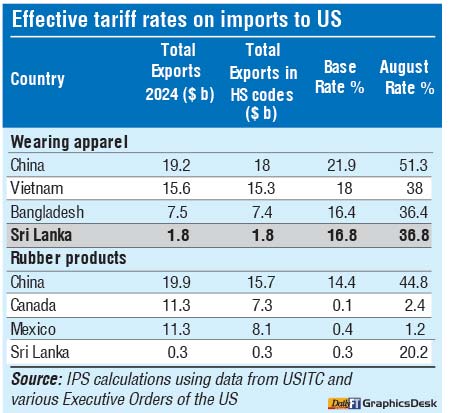

“With a quarter of Sri Lanka’s total exports facing at least a 20-percentage-point increase in tariffs, the trade-weighted effective tariff rate will be 29.9%, compared to 10.20% in April 2025. Sri Lanka’s main exports to the US, apparel and rubber products, will face tariffs of 36.8% and 20.2%, respectively,” IPS Research Fellow Dr. Asanka Wijesinghe said.

It finds that additional tariffs affect US imports both by raising general price levels, which reduces overall demand, and by changing relative prices between competing suppliers. While Sri Lankan stakeholders welcomed the 20% tariff compared with the rates for Vietnam and Bangladesh, the broader price increases could depress US consumer demand, with retailers potentially passing on costs.

“The general equilibrium estimates show that, under a 20% tariff scenario, Sri Lanka’s wearing apparel exports to the US could decrease by 12.1%, amounting to $ 221 million in value, compared to the baseline projected for 2024. The negative impact on the rubber sector could be even greater, leading to a 42% decline. The overall negative impact across all industries could be $ 634 million,” Dr. Wijesinghe said.

He points out that due to input-output linkages, export shocks are transmitted to labour and capital markets, affecting labour and competitiveness.

“Sri Lanka may offset some of the export losses by redirecting exports to other markets such as the EU. For example, apparel and rubber exports to the EU and UK could slightly increase, reducing the adverse output effect,” Dr. Wijesinghe said.

However, job losses in the apparel industry could be substantial. “The impact on labour demand disproportionately affects unskilled workers in the readymade garment industry, who are mainly women. The total reduction in labour demand in the ready-made garment industry could be 15,908 workers, based on model estimates applied to data from the 2023 Labour Force Survey,” he noted.

However, job losses in the apparel industry could be substantial. “The impact on labour demand disproportionately affects unskilled workers in the readymade garment industry, who are mainly women. The total reduction in labour demand in the ready-made garment industry could be 15,908 workers, based on model estimates applied to data from the 2023 Labour Force Survey,” he noted.

Dr. Wijesinghe said the incentive to negotiate a further reduction of US reciprocal tariffs was significant. A policy simulation shows that reducing the reciprocal tariff rate to 15% could eliminate net losses to real GDP. Under this scenario, assuming other countries face announced rates while Sri Lanka’s rate falls to 15%, the economy could expand by 0.038% due to apparel growth and reduced losses in rubber.

The analysis also examines removing para-tariffs, such as the CESS and PAL, for US imports under a reciprocal arrangement. While this could boost US imports of soybean residuals by 39.8%, meat products by 61.8%, and dairy products by 37.9%, it may have mixed effects. Low-cost soybean residual imports could benefit animal feed producers and improve household nutrition, but increased meat and dairy imports could hurt domestic producers, eroding value addition.

Dr. Wijesinghe notes that removing para-tariffs may produce a net positive effect only at a reciprocal tariff rate of 10-15%. At a 20% US tariff, the removal could lead to a negative GDP impact, despite gains in some sectors.