Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 1 October 2025 00:00 - - {{hitsCtrl.values.hits}}

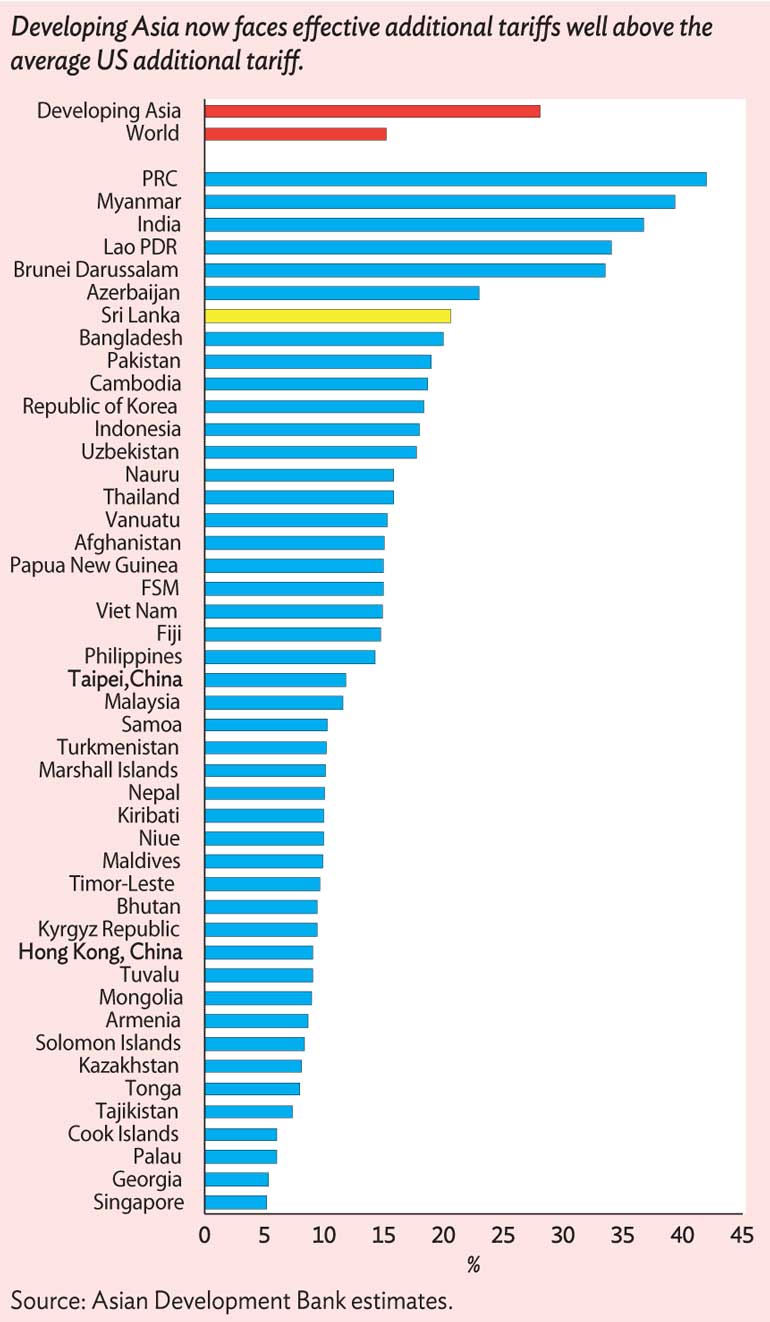

The Asian Development Bank (ADB) said yesterday that growth in Sri Lanka will be held back in 2026 by new US tariffs on key exports, even as momentum remains intact this year.

“These developments will likely tamp down the impact on the economy this year from a 20% tariff imposed on Sri Lankan exports to the US, mostly garments and rubber. But the tariffs will be more of a headwind, holding back external sector performance and consumption in 2026 because of possible job losses, both directly and indirectly,” the ADB said in its latest report released yesterday titled ‘Asian Development Outlook: Growth Slows as New Global Trade Environment Takes Shape’.

It said that US tariffs have soared to historic heights amid continued elevated trade policy uncertainty. Though generally lower than announced on 2 April, the additional tariffs that took effect in August are historically high. From 2.4% in 2024, the average effective US tariff rate has surged to 17.4%, the highest since the Great Depression of the 1930s.

Trade policy uncertainty remains at very high levels, despite easing from April’s peak, the ADB said.

“Uncertainty is fuelled by announcements of several bilateral US trade agreements without finalised terms, the prospect of new US sectoral tariffs on pharmaceuticals and semiconductors, and possible revisions to tariffs already in place”.

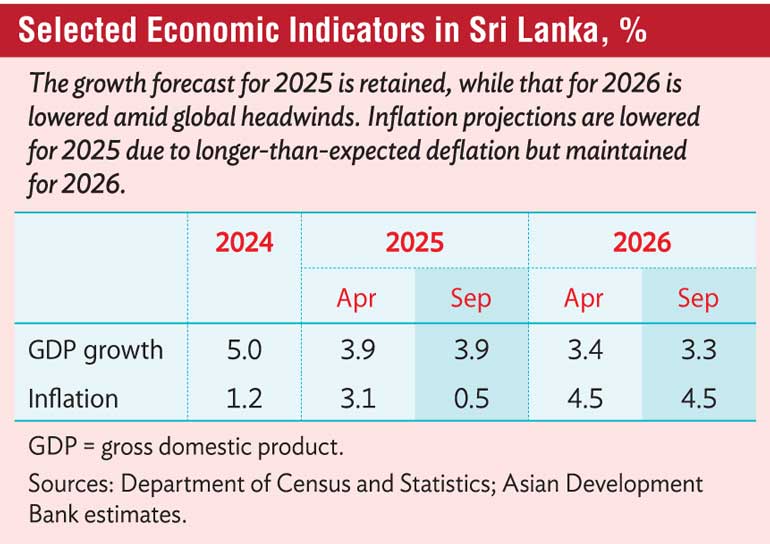

For Sri Lanka, ADB said growth in 2025 is forecast to remain unchanged at 3.9%, supported by manufacturing, construction and services, after the economy expanded by 4.8% year on year in the first quarter. It forecasts growth to slow down to about 3.3% in 2026.

Industrial production rose 5.1% in the first half, approaching pre-crisis levels, while private credit grew 19.6% in July, driven by vehicle imports, low interest rates and a favourable business outlook.

Inflation returned in August after months of deflation, though price pressures remain subdued. Headline inflation fell 1.7% year on year in the first eight months of 2025, compared with a 0.5% increase a year earlier, as transport and energy costs declined.

The Central Bank cut its policy rate by 25 basis points in May and held it at 7.75% in July. Average inflation for 2025 has been revised down significantly to O.5% while the 2026 forecast is unchanged at 4.5% on expectations of gradually rising food and energy prices.

The current account surplus grew by 30.2% in the first half of 2025 on the back of strong remittances and steady tourism earnings. Imports rose 12.4% during the period, reflecting a surge in vehicle imports, while exports grew 5.7%.

Workers’ remittances rose 19.3% and tourism earnings increased 8.4%. Gross official reserves stood at $ 6.2 billion at end-August, covering 3.7 months of imports, only slightly higher than December 2024, as debt service payments resumed.

The IMF completed Sri Lanka’s fourth Extended Fund Facility review in July, with disbursements totalling $ 1.74 billion so far. Debt restructuring moved forward with agreements reached with France, India, Hungary, Japan, Saudi Arabia and the United Kingdom in 2025.

The ADB said risks remain elevated. These include a stronger-than-expected impact from the US tariffs, volatility in the Middle East affecting remittances, swings in energy prices, and a potential global slowdown that could weaken tourism and external demand. Domestically, weather-related disruptions could weigh on agriculture and food prices.

In August, economic think tank Institute of Policy (IPS) warned that the 20% reciprocal tariff unilaterally imposed by the Trump administration could lead to export losses of $ 634 million and put nearly 16,000 jobs at risk, mostly female workers in the apparel industry.

With a quarter of Sri Lanka’s total exports facing at least a 20-percentage-point increase in tariffs, the trade-weighted effective tariff rate will be 29.9%, compared to 10.20% in April 2025. Sri Lanka’s main exports to the US, apparel and rubber products, will face effective tariff rates of 36.8% and 20.2%, respectively, it said.