Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 19 June 2019 01:47 - - {{hitsCtrl.values.hits}}

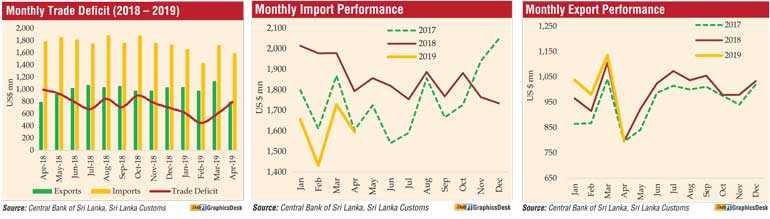

The country’s trade deficit narrowed significantly in April and in the first four months of this year thanks to dwindling imports and satisfactory export performance.

Central Bank yesterday revealed that in April, the deficit in the trade account narrowed to $ 797 million from $ 999 million in April 2018. On a cumulative basis, the deficit in the trade account contracted noticeably to $ 2.45 billion during the first four months of 2019 in comparison to $ 3.98 billion a year earlier.

“The external sector remained relatively stable in April 2019 supported by a contracting trade deficit,” the Central Bank added.

The considerable reduction in the trade deficit in April was due to the decline in import expenditure by 11% (year-on-year) $ 1.59 billion and a marginal increase of export earnings by 0.4% (year-on-year) to $ 798 million. The dip in imports in April was for the sixth consecutive month.

This decline was mainly due to lower imports of consumer goods and intermediate goods, particularly gold and fuel, despite an increase recorded in investment goods imports.

Imports in the first four months were down by 17.4% to $ 6.4 billion and exports in the first four months were up 4.5% to $ 3.95 billion.

Earnings from industrial exports increased in April mainly due to the improved performance in textiles and garments, petroleum products and gems, diamonds and jewellery exports. Earnings from textiles and garment exports increased in April benefiting from higher demand for garment exports from the USA and non-traditional markets such as Canada, China, Australia and Brazil.

However, earnings from garments exports to the EU market declined in April due to lower demand from the UK, Italy, Germany and France.

Further, export earnings from petroleum products increased during the month due to the combined impact of higher export volumes and prices of bunker and aviation fuel. Earnings from gems, diamonds and jewellery exports increased significantly due to the higher performance in gem exports.

In addition, export earnings from chemical products, base metals and articles, transport equipment and printing industry products contributed towards the increase in industrial exports in April. However, reflecting the moderate performance in all sub categories, export earnings from rubber products declined in April.

Further, export earnings from food, beverages and tobacco and machinery and mechanical appliances declined significantly during the month due to poor performance in most of the subcategories. In addition, leather, travel goods and footwear, animal fodder, wood and paper products and plastics and articles dropped in April.

Earnings from agricultural exports declined, on a year-on-year basis, in April due to poor performance in earnings from tea, spices and minor agricultural product exports. Export earnings from tea declined during the month due to the combined impact of lower average export prices and volumes of tea.

Further, export earnings from spices decreased owing the lower export earnings from all categories except cloves. In addition, earnings from minor agricultural products declined in April led by the reduction in export earnings from most of the subcategories particularly fruits, betel leaves and areca nuts.

However, export earnings from coconut rose during the month due to high export volumes of coconut kernel products led by desiccated coconut and non-kernel coconut products led by fibre. Meanwhile, export earnings from vegetables, unmanufactured tobacco and rubber also increased in April.

Export earnings from mineral exports increased in April due to improved performance in all subcategories except precious metals.

The export volume index in April increased by 9.5% while the export unit value index decreased by 8.3%, indicating that the growth in exports was entirely driven by the increased volume compared to April 2018.

Import expenditure on consumer goods declined significantly in April, mainly due to lower imports of non-food consumer goods, particularly personal motor vehicles. Import expenditure on personal motor vehicles continued to decrease significantly since December 2018, owing to the reduction reported in importation of motor cars with less than 1000 cc engine capacity, hybrid and electric motor vehicles reflecting the lag effect of policy measures introduced on importation of vehicles during the second half of 2018.

Further, import expenditure on rice fell during the month due to a considerable decline in imported volumes of rice with the increase in rice availability in the domestic market. In addition, import expenditure on seafood, sugar, beverages, rubber products and telecommunication devices declined in April. However, import expenditure on dairy products, home appliances, medical and pharmaceuticals and fruits increased during the month.

Imports of intermediate goods decreased in April from most of the subcategories, particularly gold and fuel. Expenditure on gold imports, which started to decline since May 2018 following the imposition of customs duty on gold in April 2018, stagnated at a negligible level in April as well.

Further, despite an increase registered in crude oil imports led by higher imported volumes and prices, expenditure on fuel imports declined during the month owing to lower imported volumes of refined products and coal in spite of the higher average import prices of those categories. In addition, import expenditure on base metals, plastic and articles thereof, food preparation and chemical products decreased in April.

However, import expenditure on textiles and textile articles increased during the month led by fabrics imports while expenditure on mineral products imports increased led by cement clinker imports. Further, expenditure on wheat and maize, fertiliser and agricultural inputs increased in April.

Import expenditure on investment goods increased in April, mainly due to higher imports of transport equipment which grew significantly in April owing to higher imports of railway related equipment, trishaws, lorries and commercial cabs.

However, import expenditure on machinery and equipment decreased during the month driven by lower imports of most of the categories particularly, electronic equipment, machinery and equipment parts and office machines. Reflecting lower imports of iron and steel, and cement, import expenditure on building material declined in April.

Import volume and unit value indices decreased by 8.3% and 3.0%, respectively, in April. This indicates that the decline in imports during the month was driven by the combined impact of both volumes and prices of imported goods.

Meanwhile, the terms of trade, which represents the relative price of imports in terms of exports, deteriorated by 5.4% (year-on-year) to 108.3 index points in April due to the higher rate of decline in export prices in comparison to the decline in import prices. On a cumulative basis, the terms of trade deteriorated by 1.9% (year-on-year) during the first four months of 2019 in comparison to the corresponding period of 2018.