Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 18 July 2022 00:00 - - {{hitsCtrl.values.hits}}

The Government yesterday reduced the price of fuel by Rs. 10 and Rs. 20 per litre as a relief measure but the move prompted the Public Utilities Commission (PUCSL) Chairman to question credibility, timing and the quantum.

The Government yesterday reduced the price of fuel by Rs. 10 and Rs. 20 per litre as a relief measure but the move prompted the Public Utilities Commission (PUCSL) Chairman to question credibility, timing and the quantum.

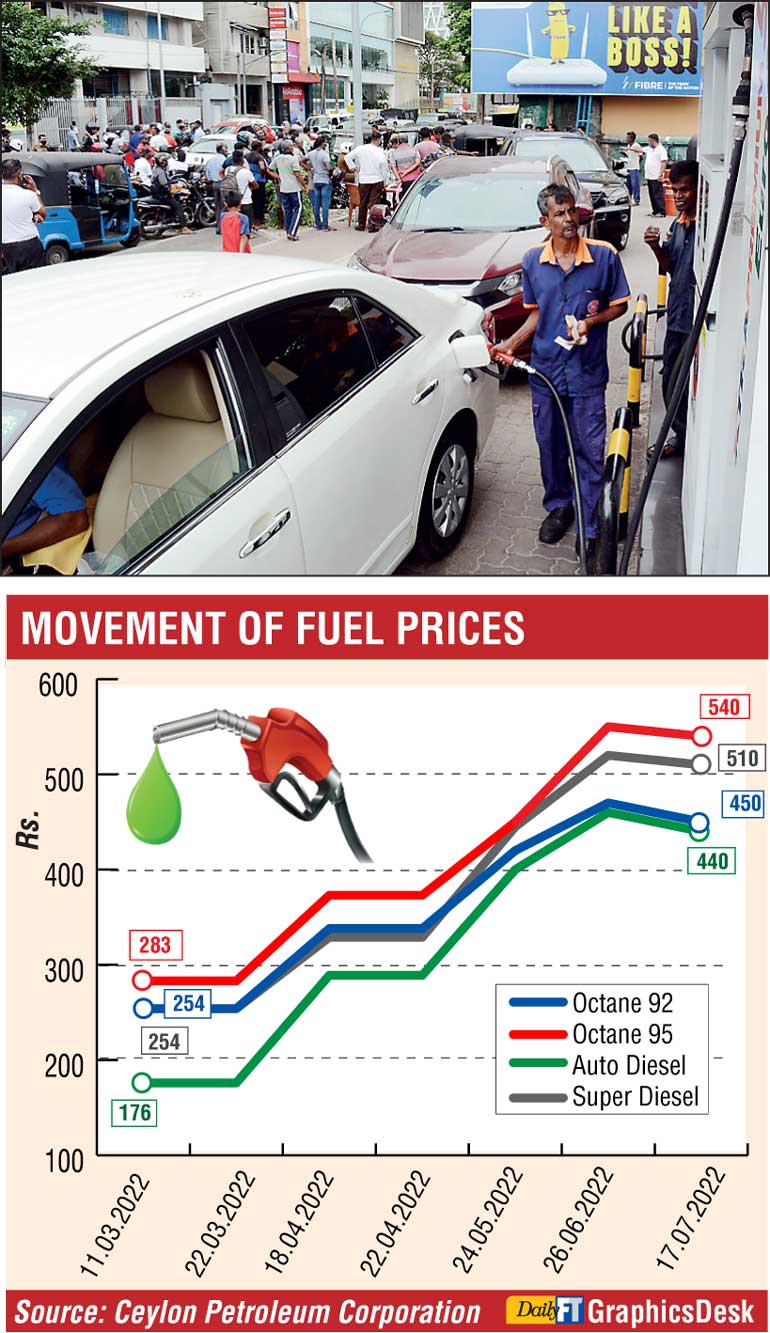

State-owned Ceylon Petroleum Corporation (CPC) first announced the reduction after which Lanka IOC PLC decided the same. The price of standard diesel and petrol was reduced by Rs. 20 per litre and the reduction of premium variant price was Rs. 10 per litre.

The reduction was unexpected and the quantum was insignificant for millions who have been queuing up for multiple days for fuel.

As per the previously announced decision in May by Power and Energy Minister Kanchana Wijesekara was that price will be revised fortnightly or monthly. Accordingly, the last upward revision ranging from Rs. 60 and Rs. 100 per litre was on 26 June. The next automatic revision was expected by 10 July (if fortnight) or next week (monthly).

The surprise cut was viewed by political analysts as a move by the current administration eyeing the Parliamentary vote on Wednesday for a permanent President to serve the remainder of the term of Gotabaya Rajapaksa. In the six months ended June, CPC had revised prices upward six times and LIOC by seven times.

PUCSL Chairman Janaka Ratnayake, who created a storm when he told a COPE hearing that fuel prices could be sold at Rs. 100-200 per litre cheaper, said yesterday that the administration was making a mockery and treating the public as fools.

“The latest fuel price reduction establishes my point and argument that previous increases were based on arbitrary formulae without any scientific rationale,” Ratnayake said. He dismissed the Rs. 10-20 reduction as a “joke” and insisted that actual reduction should have been Rs. 110-120 per litre.

During the year up to 15 July, the rupee depreciated against the dollar by 44.5%. CPC Import Price in May amounted to $ 110 per barrel up from $ 84 per barrel in January according to Central Bank data. Brent futures price in June was $ 117.30 per barrel as against $ 112 in May and $ 85 in January. Industry analysts also questioned the timing noting that CPC has been buying from the Spot market an exercise which is costly.

Separately CPC reassured of improved supply for fuel with already arrived and planned shipments. It requested the public not to congregate near petrol stations and avoid queuing up vehicles on both sides of the road.

Activists said that the Government should prioritise additional supplies thereby reducing days of queuing up instead of hoodwinking people with a paltry reduction.