Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Thursday, 8 January 2026 00:00 - - {{hitsCtrl.values.hits}}

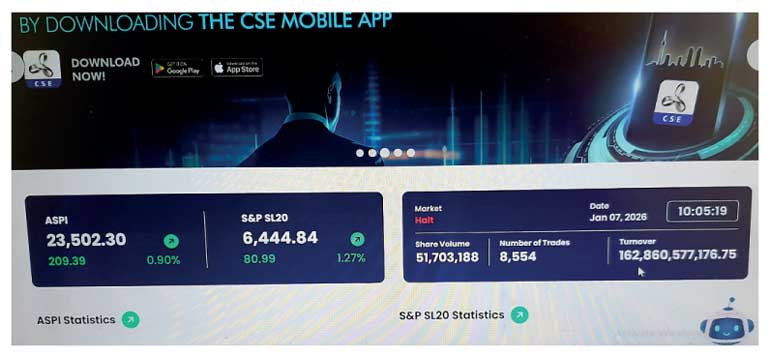

Screenshot of the website of the Colombo Stock Exchange showing on the right side the unprecedented turnover of Rs. 162.8 billion at the time trading was halted around 10 a.m. yesterday

By Nisthar Cassim

Asia’s third best performer, the Colombo stock market, yesterday suffered the worst humiliation in its 130-year history with trades and orders up to the first 24 minutes cancelled after questionable maiden transactions of shares of a new listing.

In a statement, the Colombo Stock Exchange (CSE) said it observed unusually high prices of certain transactions of Wealth Trust Securities Ltd., due to market orders being matched with these unusually high sell orders.

The CSE further observed that those clients who have sold the shares at unusually high prices had used the buying power through the sale of such shares and purchased shares of other listed entities.

“Since this will result in a significant systemic risk to the market, the CSE with the concurrence of the Securities and Exchange Commission of Sri Lanka (SEC) imposed a market halt at 9.54 a.m. and cancelled all orders and transactions carried out on 7 January 2026 in order to ensure a fair and orderly securities market,” the statement said.

The CSE said these steps were taken in order to ensure investor protection and maintain a fair and orderly securities market while preserving the integrity of the securities market. “As a preventive measure, the CSE has taken steps to disallow market orders on the first day of trading of securities of new listed entities in future,” it added.

The fiasco was triggered by a pre-opening trades of 6 million Wealth Trust Securities shares at Rs. 25,000 each for Rs. 150 billion. With the trades on Wealth Trust Securities going through, turnover at the time of the trading halt was a staggering Rs. 162.8 billion via a 51.7 million share volume.

Wealth Trust Securities had a stellar Rs. 500 million Initial Public Offering (IPO) in December (71,548,244 Ordinary Voting Shares at Rs. 7 per share) being oversubscribed by 15 times and drawing over 10,000 applications.

After the trades of Wealth Trust Securities was cancelled, turnover was down to Rs. 4.5 billion owing to Lanka Realty Investments buying 70% stake (18.2 million shares) of Lee Hedges for Rs. 3.9 billion from Chairman/Managing Director S. Vamadevan. Due to the cancellation of all trades, this transaction is still pending.

Prior to final suspension at 4 p.m., the market was expecting trading to resume no sooner all transactions were cancelled and all orders which have been placed after 9 a.m. on 7 January 2026 had been purged. Since orders have been purged, orders had to be re-entered to the Order Management System (OMS).

The CSE said the market will resume trading as usual today with all eyes likely to be on Wealth Trust Securities debut trading proper. Brokers said that the CSE had initiated an inquiry over the matter.

Brokers and analysts were furious over yesterday’s fiasco. Some claimed the Wealth Trust Securities sell order price was due to “human error,” whilst others ruled it out saying a five-digit selling price cannot be linked to human error. The latter view sparked speculation whether it was intentional causing chaos. Analysts also blamed that being a pre-opening order, surveillance staff at the CSE should have detected the bizarre price in advance and taken corrective action. While the CSE system has restrictions on companies which have previous closing prices, there are no similar restrictions on IPO shares without a trading history.

Separately, some brokers and analysts also questioned the very decision by the CSE and SEC to cancel the questionable trades of Wealth Trust Securities as there was no provision in trading rules, and whether the SEC and CSE were under undue influence to do so. The transactions went through amidst the existing T+1 regime.

The fiasco was also raised in Parliament by Opposition MP Dayasiri Jayasekera calling for the resignation of the CSE and SEC officials. In response, Labour Minister and Finance and Planning Deputy Minister Dr. Anil Jayantha Fernando said the CSE and SEC acted swiftly to ensure a fair and orderly securities market and action will be taken against anyone responsible for the original transactions.

Analysts warned that yesterday’s unprecedented fiasco will have a far greater impact on foreign and local investor confidence over the credibility and the reliability, as well as the safeguarding measures, of the CSE.

The Daily FT learns that the SEC has identified the investors who placed orders at excessive prices and has summoned them to appear today for a comprehensive inquiry into the matter.

The Colombo bourse with a 42% gain was the third best performer in Asia last year behind South Korea (+76%) and Pakistan (+45%). The active S&P SL20 index gained by 26.6%. The history of the Colombo stock market dates back to 1896, whilst the present-day CSE was formed in 1985.