Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 21 November 2025 05:52 - - {{hitsCtrl.values.hits}}

Ending months of speculation and delays over completing the country’s debt restructuring, national carrier SriLankan Airlines and the Government of Sri Lanka yesterday said that they have reached an agreement in principle with six members of the Ad Hoc Group of Bondholders on the financial parameters of restructuring the national carrier’s $ 175 million Guaranteed Bonds due June 2024.

Ending months of speculation and delays over completing the country’s debt restructuring, national carrier SriLankan Airlines and the Government of Sri Lanka yesterday said that they have reached an agreement in principle with six members of the Ad Hoc Group of Bondholders on the financial parameters of restructuring the national carrier’s $ 175 million Guaranteed Bonds due June 2024.

Delivering the 2026 Budget in Parliament on 7 November, President and Finance Minister Anura Kumara Dissanayake had pledged that the restructuring of Sri Lanka’s outstanding Bonds and interest worth $ 210 million would be completed by the end of 2025.

SriLankan in a statement yesterday said that it held restricted discussions with the Group between 23 October and 19 November on the restructuring of the Notes.

The discussions were supported by the company’s financial and legal advisers, Lazard and Norton Rose Fulbright LLP, and by the Bondholder Group’s legal adviser, Akin Gump Strauss Hauer & Feld. The six restricted members of the Bondholder Group control approximately 55% of the aggregate outstanding amount of the Notes.

According to SriLankan, the agreement in principle remains subject to final Cabinet approval, as well as non-objection from the International Monetary Fund (IMF) and Sri Lanka’s Official Creditor Committee, in line with the Government’s wider public debt restructuring commitments.

Implementing the in-principle agreed terms will help the airline complete the full normalisation of its relations with external creditors and allow it to focus on the continuation of its operations.

SriLankan Airlines Chairman Sarath Ganegoda said: “We are very pleased to have finally reached an agreement with the Ad Hoc Group of Bondholders, allowing us to now look to the future of our company with greater optimism”.

SriLankan...

“We thank them for their patience and for the pragmatic approach they adopted to avoid an unnecessary escalation of this situation, which would have been detrimental to everyone. Our island nation should rely on a well-functioning airline company for its economic prosperity,” he added.

Under the agreed terms, and subject to successful implementation, the Government will be discharged from its liability under the Guarantee and will receive substantial debt and immediate liquidity relief to maintain the hard-fought long-term sustainability of its public finances.

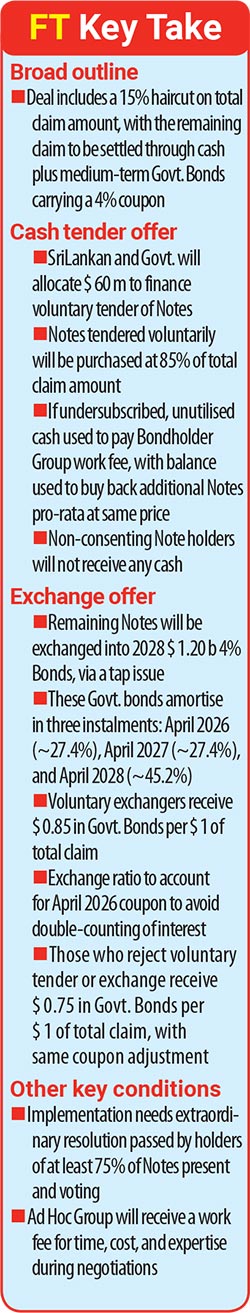

The agreement in principle includes a 15% haircut on the total claim amount relating to the Notes, with the balance to be exchanged for a mix of cash and medium-term Government Bonds carrying an interest rate of 4%.

Treasury Secretary Dr. Harshana Suriyapperuma said: “We are taking a new step in the full normalisation of our relations with our external partners and in our efforts to restore our public finances. Thanks to this agreement, 99% of our external debt will now be settled.”

“We count on the support of our official partners to assist us in this crucial new phase, which should also enable us to bolster our credit rating and prepare our eventual return to international capital markets,” he added.

The terms have been communicated to Sri Lanka’s Official Creditor Committee for non-objection and to the IMF to ensure alignment with long-term debt sustainability. Upon confirmation, the parties expect to implement the transaction by the end of the year.

SriLankan Airlines and the Government thanked the Bondholder Group and its advisers for their patience and constructiveness throughout the discussions and said they look forward to prompt implementation of the transaction.

Terms of the agreement in principle

The agreement-in-principle consists of an offer to Note holders to participate in a mandatory and concurrent cash tender offer and exchange offer for Government Bonds issued under a tap of the Sri Lankan Government 2028 $ 1.20 billion 4% Bond.

Cash tender offer

Under the tender offer, the airline and the Government will allocate $ 60 million in cash to finance the voluntary tender of the Notes at a fixed price equivalent to 85% of the total claim amount (principal, accrued interest, and past due interest) as of the effective closing date.

If the offer is undersubscribed, any allocated and unutilised cash will be used first to cover the agreed Bondholder Group work fee, with the remaining balance reallocated to buy back additional Notes from consenting holders at the same fixed price on a pro-rata basis.

Non-consenting Note holders will not receive any cash.

Exchange offer

Under the exchange offer, Note holders will exchange remaining Notes for Sri Lankan Government Bonds (the 2028 $ 1.20 billion 4% Bond). These bonds will amortise in three instalments: April 2026 (~27.4%), April 2027 (~27.4%), and April 2028 (~45.2%). Government Bonds distributed under the exchange will be issued via a tap of the existing instrument.

Note holders who voluntarily exchange will receive $ 0.85 in principal amount of Government Bonds for every $ 1 of total claim. The exchange ratio will be adjusted to reflect the first full interest coupon paid in April 2026 to avoid double-counting.

Any Notes not voluntarily tendered or exchanged will be mandatorily exchanged for Government Bonds at a rate of $ 0.75 per $ 1 of total claim, with the same coupon adjustment.

Other key features

The transaction will only proceed once an extraordinary resolution is passed at a meeting of Note holders to implement the agreed terms. Approval requires at least 75% of the principal amount of Notes present and voting.

Members of the Bondholder Group will also receive a work fee to compensate them for the time, cost, and expertise devoted during the negotiations.