Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 12 January 2026 03:34 - - {{hitsCtrl.values.hits}}

Founding Partner Django Davidson

By Devan Daniel

Sri Lanka has emerged from its economic crisis with valuations that are difficult to ignore and assets that are priced well below their long-term potential, creating what Hosking Partners Founding Partner Django Davidson described as a “very compelling opportunity” for patient investors.

Hosking Partners is the largest foreign investor in Sri Lanka’s capital market which built its portfolio during Sri Lanka’s worst economic crisis, prompting Davidson at the outset to praise CT Smith Securities Consultant and CT Holdings Director Marianne Page for her pioneering service to attract foreign investment to Sri Lankan capital markets.

Speaking at a presentation on ‘The Capital Cycle Way,’ held in collaboration with CT Smith Securities last Thursday (8), Davidson said the scale of capital destruction during Sri Lanka’s recent downturn has reset the investment landscape in a way rarely seen outside deep emerging-market crises.

He said capital had been withdrawn across equities, bonds, and private investment during the crisis, leaving many established businesses trading below the cost of replacing their assets. Such conditions, Davidson argued, tend to discourage new capacity and instead reward consolidation, discipline, and long-term ownership.

Davidson noted that foreign portfolio participation in the Colombo Stock Exchange (CSE) has fallen sharply since 2020, following the Easter Sunday attacks, the pandemic, and the temporary market closure that year. While these events damaged investor confidence, he said they also created valuation distortions that can take years to unwind.

According to Davidson, Sri Lanka now sits at the lower end of a capital cycle, characterised by depressed valuations, limited new investment, and a relatively disciplined corporate sector.

“When assets trade below replacement cost, it makes little sense to build new ones,” he said, adding that investors are better served acquiring or partnering with existing businesses.

He pointed to property and hotels as sectors where this dynamic is already visible, provided policy stability holds. Mortgage credit, which he said stood at just 2.7% of GDP in 2024, remains extremely low by international standards, while private credit has contracted from around 60% to about 40% of GDP, underscoring both the severity of the contraction and the scope for recovery.

Davidson cautioned that Sri Lanka’s history of boom-bust cycles will not disappear automatically. While private companies can improve efficiency and returns on existing capital, he said sustained progress depends on disciplined fiscal and monetary policy, low inflation, and continued development of the domestic Bond market.

The investment framework Davidson outlined focuses on how high returns attract excessive capital, eventually eroding profitability, while periods of pessimism and under-investment create the conditions for recovery. Stock markets, he said, tend to exaggerate both phases.

Applying the same thinking globally, Davidson said the current surge in Artificial Intelligence (AI) data centre investment shows late-cycle characteristics. He cited estimates placing AI-related data centre spending at more than $ 5 trillion by 2030, warning that such scale risks pushing returns on capital at major technology firms sharply lower.

He noted that around one-third of global equity capital is concentrated in mega-cap technology and semiconductor companies, leaving other sectors and markets under-invested. By contrast, metals and mining represent a small share of global equity exposure despite rising demand driven by electrification and data centre construction after more than a decade of limited capital spending.

For Sri Lanka, Davidson said the opportunity lies not in competing with crowded global themes, but in benefitting from capital scarcity and valuation discipline. He contrasted Sri Lanka’s low market capitalisation per capita with high valuations in India, arguing that Sri Lanka stands to gain from India’s long-term economic expansion if closer economic integration is not obstructed.

“Successful technology doesn’t automatically make a good investment,” Davidson said, stressing that long-term equity returns are driven by returns on capital rather than short-term earnings momentum.

Whether Sri Lanka can turn today’s reset into sustained growth, he said, will ultimately depend on maintaining policy stability that allows capital to compound rather than repeat past cycles of excess and retrenchment.

A contrarian investment strategy

Hosking Partners says it began building significant equity exposure to Sri Lanka during the depths of the country’s economic crisis, citing extreme valuation dislocations and a sharp withdrawal of capital as the basis for its strategy.

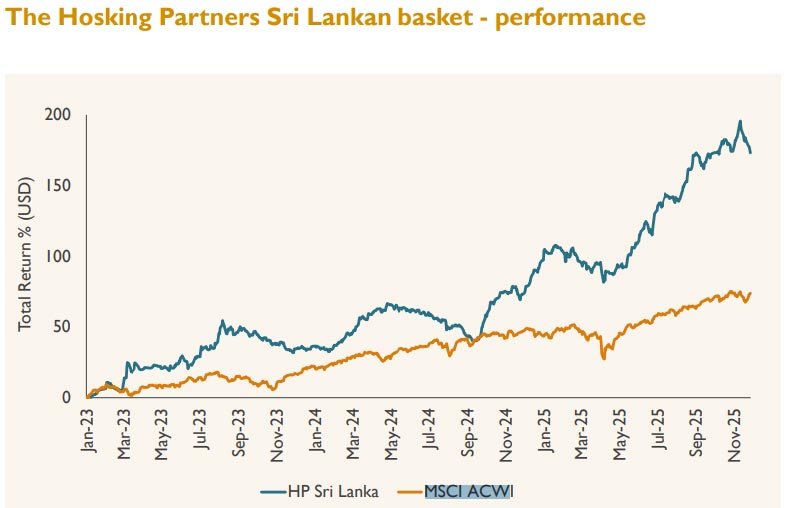

In a June 2025 commentary titled ‘Sri Lanka: You Will Come Back for More,’ the firm said it deployed capital in 2023 when Sri Lankan equities were trading at historic lows in US dollar terms, following currency depreciation, high inflation, and a collapse in foreign investor participation.

Hosking Partners said it does not operate with a dedicated emerging-markets allocation, but views severe economic crises as opportunities within a broader capital-cycle framework, particularly when established businesses trade well below their replacement cost.

The firm noted that the CSE’s market capitalisation fell by around 70% in dollar terms during the downturn, creating conditions where listed assets could be acquired at a fraction of the cost required to rebuild them. It said it invested tens of millions of dollars during this period and became one of the largest foreign equity holders in the market.

As examples, Hosking Partners cited investments in hotel, construction materials, and diversified conglomerates, where valuations reflected depressed demand rather than long-term earnings capacity. It said its investment decisions were based on conservative assumptions of economic normalisation, rather than a return to peak conditions.

The firm said that since early 2023, the value of its Sri Lanka holdings has more than doubled, alongside signs of macroeconomic stabilisation, including lower inflation, currency appreciation, and a recovery in tourism.

Despite the rebound, Hosking Partners said Sri Lanka remains under-owned by foreign investors and continues to trade at a valuation discount relative to other emerging markets. It argued that this gap could narrow over time if policy stability is maintained and capital allocation improves.

Hosking Partners added that while Sri Lanka appears to be entering a recovery phase in its capital cycle, sustained gains will depend on avoiding policy reversals and ensuring that future growth is driven by productive investment rather than renewed capital excess.

– Pix by Lasantha Kumara