Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 18 March 2024 05:01 - - {{hitsCtrl.values.hits}}

Chairman Ashok Pathirage

Showing signs of turnaround, Softlogic Holdings Plc (SHL) has witnessed renewed business revival recording improved financial performance in core sectors in the third quarter of FY23 amidst on-going challenges.

SHL saw a consolidated revenue growth of 4.2% to Rs. 75.6 Bn during the nine-month period under review while the quarter recorded a revenue growth of 9.3% to Rs. 27.6 Bn.

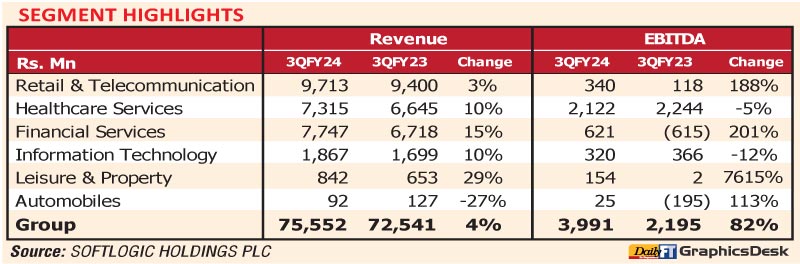

During the cumulative period, the Retail sector contributed 34% to Group revenue while Healthcare Services made up 28%. 27% of Group topline was generated from Financial Services while 7% was from the IT sector. Leisure & Property and Automobile together took up 3.1% of Consolidated revenue.

Gross Profit declined 4.6% to Rs. 25.5 Bn during the cumulative period as a result GP margin contraction from 36.9% to 33.8%. SHL said this margin contraction was particularly led by the import-oriented sectors which witnessed rapid cost increase amid local and global inflation and Rupee depreciation. However, the positive economic developments supported the Group to register a GP margin improvement due to inflation containment and strengthening of the Rupee during the quarter from 34.4% to 36.2% resulting in quarterly Gross Profit to reach Rs.10 Bn, up 14.8%.

The Group achieved an EBITDA growth of 82% to Rs. 4 Bn during the quarter while cumulative EBITDA was Rs. 7 Bn. Cost optimisation initiatives coupled with inflation contraction led the quarterly operating cost to decline 7.1% to Rs. 7.4 Bn as opposed to Rs. 7.9 Bn recorded in the comparative quarter. Operating cost margins improved from 11% in 3QFY23 to 9.8% in 3QFY24. Subsequently, quarterly operating profit was Rs. 3 Bn compared with Rs. 1.2 Bn in the corresponding quarter. Cumulative operating profit was Rs. 3.8 Bn.

Finance Income, predominantly derived from the insurance business’s investment income, was Rs. 6.1 Bn for the cumulative period while Rs. 1.8 Bn was recorded for the quarter.

Softlogic Group benefited from the reducing interest rates as it witnessed finance cost reducing 25.8% to Rs. 16.2 Bn for the nine-month period while a solid 44.4% reduction in finance cost to Rs. 5 Bn was incurred during the quarter.

The transfer of Rs. 2.9 Bn to the Life Fund during the cumulative period compared with Rs. 2 Bn in the comparative period signifies the difference between income and expenditure attributable to life policyholders during the period. The quarter registered a transfer of Rs. 1.5 Bn as opposed to Rs. 254 Mn recorded in the comparative quarter.

The Group’s performance witnessed a strong revival during the quarter where PAT improved 76.7% to trim the losses to Rs. 1.7 Bn during the quarter while taking cumulative losses to Rs. 10.5 Bn (post-adjustments) compared with Rs. 13.9 Bn loss in the comparative period. As at 31 December 2023 retained losses amounted to Rs. 64.5 Bn.

Retail sector recorded a 3% increase in quarterly revenue to Rs. 9.7 Bn while the cumulative sector

revenue was Rs. 25.7 Bn. Quarterly sector EBITDA achieved more than two-fold growth to Rs. 340 Mn while Rs. 141 Mn was recorded for the cumulative period.

In his review accompanying the interim results, Softlogic Holdings Plc Chairman Ashok Pathirage said the Group anticipates continued challenges in the macroeconomic environment, particularly concerning consumer disposable income with imposition of unrealistic personal taxes and VAT. The effects of various tax adjustments and inflationary pressures are expected to persist, impacting the purchasing power of the general population, he added.

“The Government should consider reducing taxes to stimulate economic activity by ensuring disposable income in the hands of consumers is adequate for spending purposes otherwise SMEs will not survive going forward,” Pathirage stressed. Despite these challenges, he said the Group remains optimistic about its ability to minimise those challenges while harnessing opportunities that evolve positively.

He said as part of the Group's revival plan, the Rs. 10 Bn equity infusion through Rights and Warrants is expected to significantly alleviate financial pressure, with the proceeds being allocated for debt settlements. Additional equity infusions are proposed at sector levels along with assets and investment optimisation amounting to an aggregate of Rs. 20 Bn to support further revival of the Group's financial position.

Pathirage also said Softlogic has entered into a 99-year lease agreement with Colombo's Port City Development to establish a state-of-the-art hospital with 500 beds, in partnership with the prestigious Mayo Clinic. This initiative targets the regional medical tourism markets. The hospital will enjoy a 25-year tax exemption from the commencement of operations, with a reduced tax rate of 50% for a further 10 years thereafter, offering substantial tax benefits. Softlogic Life Insurance has submitted a bid for the acquisition of Sri Lanka Insurance Corporation, while the Asiri Group has placed a bid for the acquisition of Lanka Hospitals Corporation PLC.

“Pre-arranged funding for these potential acquisitions would be sourced through external offshore counterparties. The completion of these acquisitions, which is subject to a transparent and competitive bidding process, is expected to yield substantial synergies, propelling the Group to dominant market positions in their respective sectors,” Pathirage added.

He also said with the economy rebounding, while the CBSL’s and the Ministry of Finance’s policy initiatives are geared to supporting economic growth while containing inflation and interest rates the Group is expected to reap significant financial cost savings while an uptick in consumer demand supports greater viability of the Group despite legacy overhangs. Looking forward, coupled with a rebound in economic activity, these strategic actions, taken together, are expected to contribute significantly to the Group's financial rewards.