Thursday Feb 26, 2026

Thursday Feb 26, 2026

Friday, 19 April 2024 00:00 - - {{hitsCtrl.values.hits}}

President and Finance Minister Ranil Wickremesinghe

The Government yesterday issued an update on the progress of the divestiture of the initial set of State Owned Enterprises (SOEs) saying all transactions other than SriLankan Airlines will be concluded by August 2024. The timeline for SriLankan Airlines is likely to extend to end September 2024, said a statement from the SOE Restructuring Unit (SRU).The update comes amidst concerns from prospective investors and their advisors over the inordinate delay in concluding some of the divestitures.

There had been signs of the divestiture process being stalled due to lack of coordination between multiple parties and confusion overdue process.

Hotel Developers (Lanka) Ltd., the owning company of Hilton Colombo was first advertised way back in October last year and over five months have lapsed with no statement issued since receipt of bidders. Every divestiture has seen extension of deadlines for Expression of Interests (EOIs), and Request for Qualifications (RfQs). Accordingly, the rest of the timelines for key milestones have been revised as well. “There is certainly a lack of coordination and ambiguity on the due process to follow. This has caused concern among interested bidders and their advisors,” sources told the Daily FT. “Delay also means more cost and loss of interest,” they added.

The President Ranil Wickremesinghe-led administration has been trumpeting of SOE reforms for over a year with some claiming that the divestiture proceeds could run into billions of dollars. However, with the country in the second quarter of 2024, the first set of transactions are still pending.

The divestiture process of some of the entities such as SLT and Sri Lanka Insurance however were impacted by brief litigation whilst at least one exercise SriLankan Airlines had to undergo substantial debt restructuring to make it more attractive.

Some analysts argued entities such as Hilton Colombo, Hyatt were straightforward divestitures and could be concluded without much delay. Sale of Sri Lanka Telecom, Sri Lanka Insurance Corporation and SriLankan Airlines are advised by the International Finance Corporation whilst the transactional advisors for other entities are Colliers International Consultancy and Valuation (Singapore) Ltd. and its advisory partner Platinum Advisors Ltd., Deloitte India and Alvarez and Marsal.

The EOIs for Hilton Colombo was first published on 10 October with a deadline fixed on 9 November and was later extended to 16 November 2023. SRU on 17 November announced that 9 parties responded for EOIs. Prequalified Bidders to be notified on 30 November 2023 and RfPs expected to be released in the first week of December. However, SRU hadn’t made further announcements since 17 November.

Lanka Hospitals Corp. PLC RfQ was issued on 18 October 2023 and deadline was extended to 3 November 2023 with selection of pre-qualified bidders slated for end November 2023. Issuance of RfP and draft definitive agreement in early December 2023. Submission of bids was to happen in February 2024 and selection by March 2024 followed by issuance of Letter of Intent in March 2024. None of the latter have happened.

Sri Lanka Insurance Corp., notice of EOI was issued on 24 January 2024 and deadline for EOI set at 27 February but was extended to 6 March 2024. Issuance of RfP documents was scheduled in March was extended to end April and bidding in June and selection in July.

SriLankan Airlines’ RfQ was issued on 31 October 2023 and the deadline for pre-qualification application was 5 April. However, it was extended to 22 April 2024. This was to facilitate the transfer of select Dollar and Rupee debt to the Treasury which was done in March 2024. Selection of pre-qualified bidders is now extended to May from March and bid submission deadline from May to August and issuance of Letter of Intent from end June to August and Cabinet approval on definite agreement and its signing from June to end September 2024.

RfQ for SLT was published on 10 November 2023 and the deadline for submissions was set at 18 December but was extended to 12 January. Issuance of RfPs was slated to be between January and March 2024 and bid submission by March 2024 and selection of successful bidder by Q2 of 2024.

A possible delay could be linked to litigation by one of the bidders, Lyca Group which subsequently withdrew the application.

EOI for Canwill Holdings was published on 26 October 2023 with a deadline set at 28 November 2023 and was extended till 12 December 2023. Issuance of RfPs was scheduled for 2nd week of January 2024. Names of six bidders who responded were announced on 7 February.

Litro Gas Lanka Ltd., (LGL) and Litro Gas Terminals Ltd. (LGT), request for EOI was issued on 16 January 2024 with submission deadline first fixed for 16 February and extended twice to 1 March and finally to 15 March. The list of 14 bidders responding was announced on 15 March. Selection of Shortlisted Bidders was slated end March/early April and bids submission by June 2024, selection by mid-July and issuance of Letter of Intent end of July.

However, the SRU in its statement said yesterday as at date, pre-bid meetings have been held for all entities identified for divestiture. Clarifications raised at the pre-bid meetings and the responses provided were subsequently published on the website of the Treasury to ensure greater transparency.

“In certain instances, at the request of potential bidders and with the advice of the Transactional Advisors (TAs) and with approvals of the Special Project Committees (SPCs) and Special Cabinet Appointed Negotiating Committee (SpCANC), the RfQ closing dates were extended to foster greater competition. Such extensions were also published on the Treasury website,” SRU said.

It said Deadlines for the submission of RfQs for Hotel Developers Lanka Ltd. (HDL), Canwill Holdings Ltd. (CHPL), Lanka Hospitals Corporation PLC (LHCP), Sri Lanka Telecom PLC (SLT), Sri Lanka Insurance Corporation (SLIC) and Litro Gas Lanka Ltd./Litro Gas Terminals Ltd. (LITRO) have now closed whilst for SLA, it remains open until 22 April 2024.

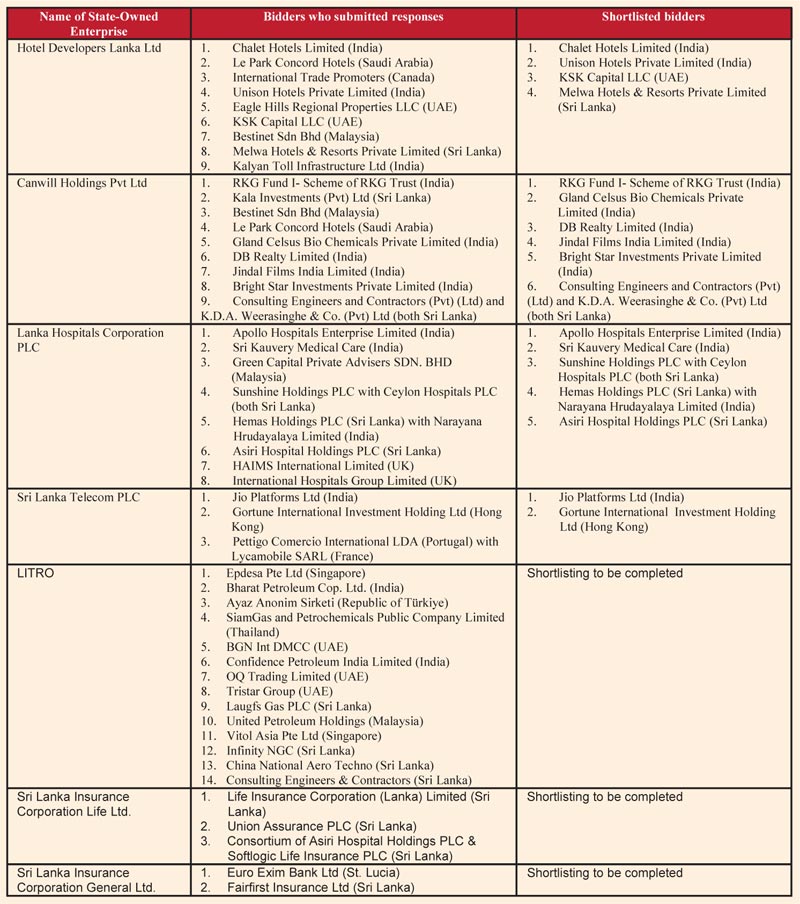

See table which highlights those who have submitted responses to the respective RfQ’s. The responses received were evaluated by the respective SPC and the SpCANC and bidders were shortlisted as follows for the RFP.

“Shortlisted bidders are being provided access to a comprehensive data room created for each entity for purposes of buy-side due diligence. Thereafter, the shortlisted bidders will be required to respond to an RfP and proposals received will be evaluated by the respective SPC and the SpCANC. Finally, the SpCANC will make the necessary recommendations to the Cabinet of Ministers in order to conclude each transaction,” SRU said.

It recalled that in March 2023, the Cabinet of Ministers granted in-principle approval for the divestiture of shares held by the Government of Sri Lanka (GoSL) in HDL, CHPL, LHCP, SLT, SriLankan Airlines Ltd. (SLA), LITRO, SLIC. Following GoSL’s procurement processes, Transaction Advisors (TA) were appointed for these entities. The TAs were tasked with inter-alia, comprehensive sell-side due diligence, market sounding, valuation and document drafting.

The Cabinet of Ministers approved divestiture guidelines that set out the framework when divesting a state-owned entity. These guidelines ensure greater transparency and accountability and provide investors the confidence of a credible process. The Cabinet of Ministers also appointed Special Project Committees (SPC) for each entity being divested together with a Special Cabinet Appointed Negotiating Committee (SpCANC).

SRU said each SPC comprising members from both the public and private sectors was tasked with preparing the Request for Qualification (RfQ) and Request for Proposal (RfP) documents and for evaluating proposals received. The SpCANC comprising of senior public officers, was tasked with validating the work of each SPC including the clearance of all RfQ and RfP documents, shortlisting bidders and making recommendations to the Cabinet of Ministers as mandated by the Divestiture Guidelines. Thereafter, GoSL acting through the Ministry of Finance, Economic Stabilisation and National Policies (MoF) called for RfQs from potential investors for the divestiture of these entities.

SRU said the RfQs were advertised in both the local and international press, including amongst others, Daily Mirror, Daily News, Daily FT, The Morning (all from Sri Lanka), Economic Times (India), Business Times (Singapore), The Bangkok Post (Thailand), Gulf News, The National, Meed.com (all in UAE), South China Morning Post (Hong Kong), Nikkei Asia (Japan), The Star (Malaysia), PR Newswire Global (US), Australian Financial Review (Australia) and The Global Times (China).

In addition, industry specific publications such as Comms Update, Aviation Week and Oil and Gas Journal (all in USA), Asia Insurance Review (Singapore), Hotel Conversation (Australia), Oil and Gas Middle East and Simple Flying (Canada) were also used as appropriate. Further, social media platforms such as LinkedIn and WeChat were also used. Prior to the RfQs being published, the respective TAs approached both appropriate entities within the respective sectors and financial services firms, locally and internationally, to canvas the divestitures.