Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 8 September 2023 00:00 - - {{hitsCtrl.values.hits}}

|

| Verite Research Executive Director Dr. Nishan de Mel |

The Parliament yesterday passed by majority vote the bill to amend the Inland Revenue Act, No. 24 of 2017 amidst strong opposition by political parties, trade unions and analysts given the new legislation’s impact on private sector employees pensions.

During the second reading the Inland Revenue (Amendment) Bill was passed by a majority of 45 votes in Parliament yesterday, where a total of 103 MPs voted in favour whilst 58 voted against it.

The conclusion follows Speaker Mahinda Yapa Abeywardana on Tuesday informing the Supreme Court's determination on the Bill, citing it can be passed by a simple majority vote in the Parliament. On Wednesday President Ranil Wickremesinghe speaking in Parliament insisted the Bill must be passed to ensure debt sustainability – a key requirement under the IMF’s $ 3 billion 4-year Extended Fund Program and the country’s efforts to emerge from bankruptcy and external debt default.

The “Statement of Legal Effect” in the bill states as follows: “Clause 2: This clause amends the First

Schedule of the Inland Revenue Act, No. 24 of 2017 and the legal effect of that Schedule as amended is to increase the income tax rate applicable to the Employees Trust Fund, an approved provident or pension fund, or an approved termination fund up to 30% and the income tax rate applicable to the funds which effectively participate in the process of domestic debt optimization to continue as 14%.”

Verite Research’s Parliamentary Research Support Service (PReSS) said the bill seeks to change the status quo of the 14% tax rate on superannuation funds – the largest of which is the Employees’ Provident Fund (EPF) – by increasing the tax rate to 30%; but to exempt from that change (and continue with the status quo the tax rate) the superannuation funds that “voluntarily” participate in an offer made by the government to receive a reduced yield on the government bonds they hold, by exchanging a selected set of those bonds for a new set of bonds with lower yields.

Verite sent a thorough analysis of the Bill to all MPs prior to its vote.

It examined a claim and counter-claim with regard to whether the EPF (and such superannuation funds) currently receive favourable or adverse tax treatment. The argument made for the Bill is that the treatment is favourable. However, the analysis finds support for the claim that the existing tax treatment is adverse rather than favourable for those earning a monthly income below 183,667, and potentially favourable only for those earning above that amount.

Verite Research Executive Director Dr. Nishan de Mel yesterday via a series of tweets warned of serious implications as well as repercussions.

He said the Bill puts a “tax gun” at the head of EPF trying to force “voluntary” bond exchange and noted the Monetary Board would be wrong to accept the proposed Domestic Debt Optimisation (DDO).

“Shouldn’t it not make the analytical basis public and open to prior external scrutiny first?,” queried de Mel.

He was of the view that the Monetary Board (MB) and CBSL is in a highly conflicted place.

“The CBSL cannot be a neutral advisor on the calculations on the decision for EPF. Making the data transparent, seeking external advice and publishing prior, protects the MB from future charges of irresponsibility,” de Mel argued.

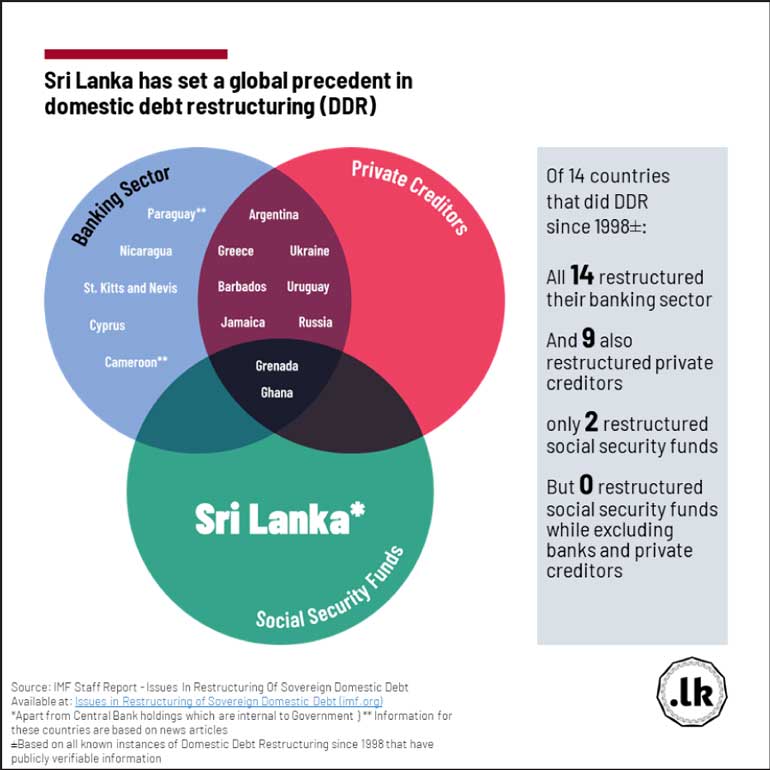

He said Sri Lanka is the only country in the world (based on published data) that is putting the entire burden of local currency bond restructuring exclusively on the social security funds of workers. (See chart)

To overcome the unconstitutionality of such unequal treatment, the Government presented it as a "voluntary" debt exchange. The Central Bank Monetary Board is the custodian of the largest social security fund, and will make the decision. But how to justify such an action?, queried de Mel.

“The Government brings a law to more than double the taxation on (already adversely taxed) social security funds, if they don't "voluntarily" agree to the debt exchange and bring down the returns to workers on their retirement savings. The Central Bank proposed this "solution" to reduce Government debt. It is now conflicted in advising its monetary board on what is best for the EPF. How can the MB make a responsible decision without seeking external analytical advice and publishing it with data and assumptions?,” questioned Verite Research’s Executive Director Dr. de Mel.