Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 5 September 2022 00:00 - - {{hitsCtrl.values.hits}}

The Paris Club has said that it is ready to start the debt treatment process of Sri Lanka following the conclusion of the Staff-Level Agreement with the International Monetary Fund (IMF) last week.

The Paris Club in a statement also reiterated its willingness to coordinate with non-Paris Club official bilateral creditors to provide the necessary financing assurances in a timely manner and ensure fair burden sharing, as already proposed to the largest other official bilateral creditors.

“The Paris Club remains at the disposal of Sri Lanka authorities and non-Paris official bilateral creditors to further discuss the next steps of the debt treatment process,” it said.

The statement said Paris Club members welcome the SLA between the Sri Lankan Government and the IMF for a 48-month arrangement under the Extended Fund Facility worth $ 2.9 billion. “This agreement represents an important step to restore macroeconomic stability and public debt sustainability,” the statement added.

The Paris Club was formed in 1956 and is an informal group of official creditors whose role is to find coordinated and sustainable solutions to the payment difficulties experienced by borrower countries.

Paris Club members are Australia, Austria, Belgium, Brazil, Canada, Denmark, Finland, France, Germany, Ireland, Israel, Italy, Japan, Netherlands, Norway, Russia, South Korea, Spain, Sweden, Switzerland, United Kingdom and United States. India has been an observer state since 2019.

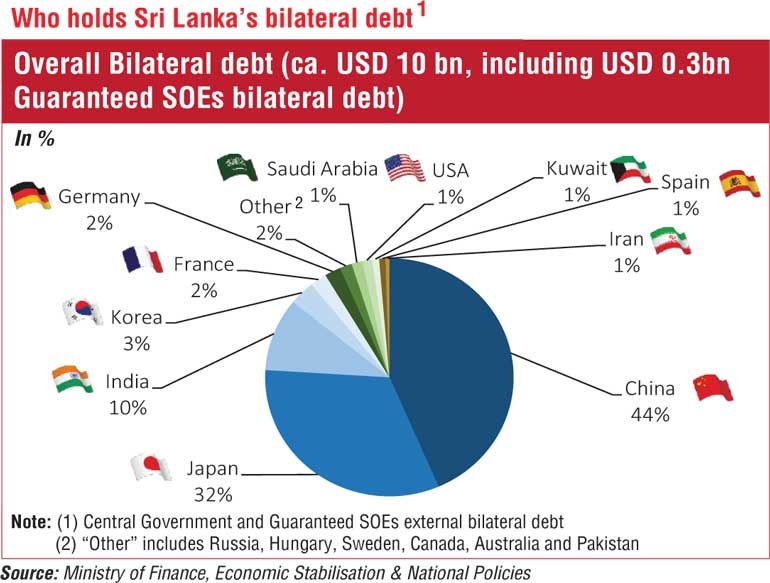

Sri Lanka's foreign currency bilateral debt as at end 2021 was $ 9.6 billion or 11% of GDP as against $ 20 billion held by private creditors. Guaranteed SOEs bilateral debt was $ 300 million and those held by the Central Bank of Sri Lanka was $ 1.8 billion. Of the Paris Club members, the giant share is held by Japan (32%) followed by Korea 3%, Germany and France 2% each, USA and Spain 1% each.