Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 11 April 2022 00:00 - - {{hitsCtrl.values.hits}}

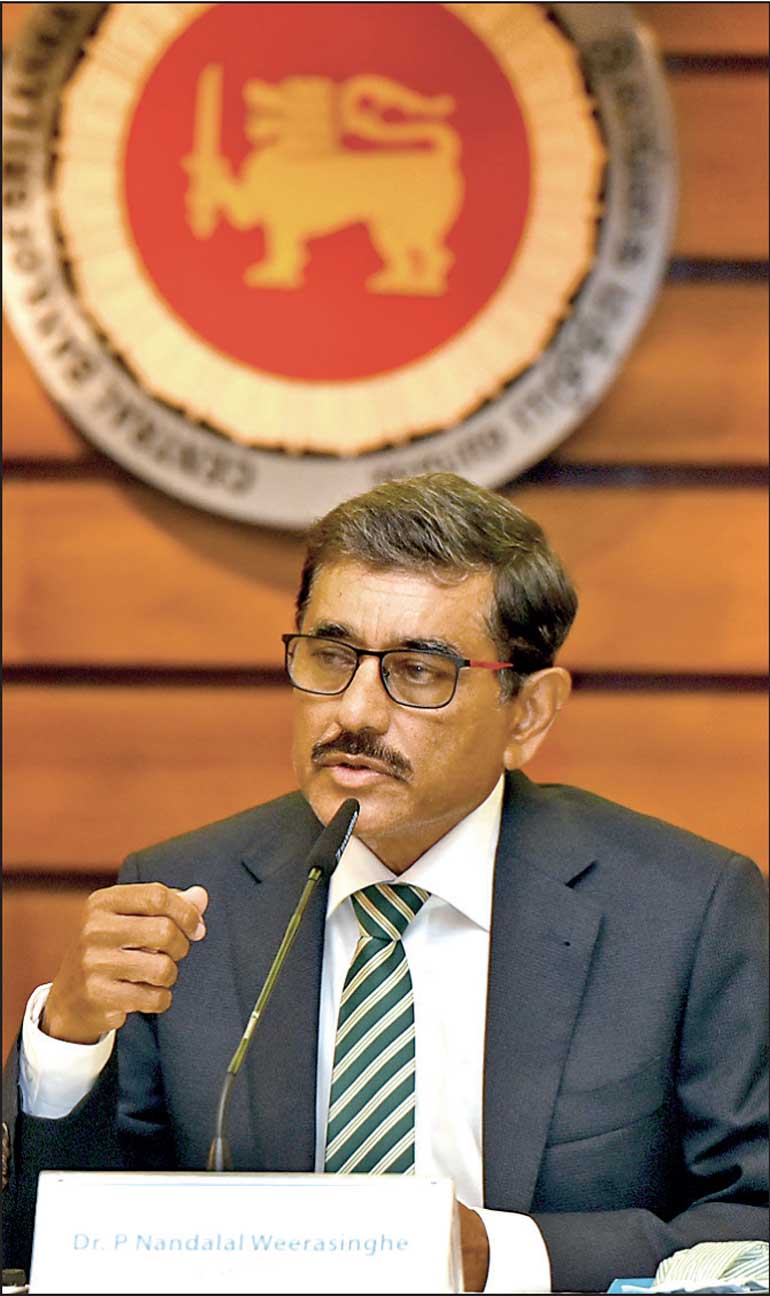

Central Bank Governor Dr. Nandalal Weerasinghe – Pic by Ruwan Walpola

By Nisthar Cassim

New Central Bank Governor Dr. Nandalal Weerasinghe on Friday faulted the way the exchange rate was managed by his predecessor saying the fixed rate was too long whilst on the other hand free float was not credible in terms of timing and sequencing.

He said that the rupee was artificially protected for too long with a fixed maximum rate thereby incentivising the black market.

He implied that if a fixed rate was to be maintained it should have been gradually adjusted upwards in tandem with the market conditions.

“The root cause of the Balance of Payment crisis should have been properly addressed,” the new CBSL Chief opined, adding that the failure made the sudden free float less credible in the eyes of the market.

It was pointed out that free float could have been better sequenced and timed and implemented after further tightening of the monetary policy thereby curbing demand as well as imports, a more prudent fiscal policy, and upward adjustment of prices of fuel and other utilities and starting talks with the International Monetary Fund (IMF).

In fact, the excessive depreciation of the exchange rate amidst the lacklustre performance in foreign exchange inflows, according to the Monetary Board statement on Friday warranted certain policy actions.

The result was the announcement of the highest ever increase of policy rate by 7% on Friday in a show of the tightest monetary policy stance in the history of CBSL to ensure greater macro-economic stability.

The Monetary Board said the move will help raise the cost of funds, thereby containing the expansion of money and credit; inducing the return of excessive currency in circulation to the banking system; eliminating interest rate anomalies; easing the pressure on the exchange rate and containing the build-up of demand pressures in the economy.

Dr. Weerasinghe also noted that the apparent “state of denial” by the previous Governor did not help improve the macroeconomic situation. Neither did the issuance of multiple gazettes to deal with the issue of foreign currency and reserves.

However, the new Governor said: “What has happened has happened and we can’t reverse the past. I am here to serve the people, not a political party. I am positive thinking and forward-looking.”

The career central banker Weerasinghe also said that CBSL has competent and qualified people, and he will give proper leadership along with following best practices.

“We will be very transparent in terms of flagging off future risks in the economy rather than hiding them. We will be honest and truthful,” he added.

The new Governor promised to restore the independence and credibility of the CBSL. “An independent Central Bank is the only way to ensure prudent policies irrespective of politics. The existing Monetary Law Act provides for such independence. I will not tolerate political interference during my tenure, and I have the fullest support of the Government, the Opposition, and the public,” he said.

“CBSL is accountable and responsible to the people, not a political party. I have to live up to public expectations of ensuring CBSL independence and credibility,” added Weerasinghe, who was previously a Senior Deputy Governor and took early retirement in October 2020 after he was side-lined in the early part of the Gotabaya Rajapaksa administration.