Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 11 June 2025 00:00 - - {{hitsCtrl.values.hits}}

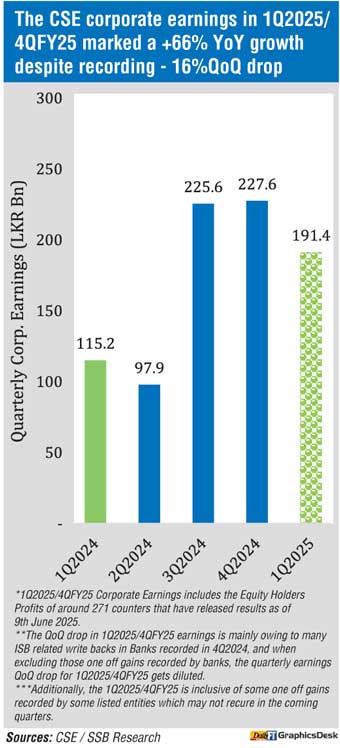

Momentum of earnings of listed corporates has dropped in the March 2025 quarter though 1Q2025/4QFY25 marked a 66% YoY growth, according to Softlogic Stockbrokers.

Momentum of earnings of listed corporates has dropped in the March 2025 quarter though 1Q2025/4QFY25 marked a 66% YoY growth, according to Softlogic Stockbrokers.

December 2024 quarter earnings amounted to Rs. 227.6 billion whilst in March 2025 the figure dropped to Rs. 191.4 billion. However the latter figure is higher in comparison to Rs. 115 billion achieved a year ago.

It said that 1Q2025/4QFY25 Corporate Earnings included the Equity Holders Profits of around 271 counters that have released results as of 9 June 2025.

The QoQ drop in 1Q2025/4QFY25 earnings is mainly owing to many ISB related write backs in Banks recorded in 4Q2024, and when excluding those one off gains recorded by banks, the quarterly earnings QoQ drop for 1Q2025/4QFY25 gets diluted.

Additionally, the 1Q2025/4QFY25 is inclusive of some one-off gains recorded by some listed entities which may not recur in the coming quarters.

Softlogic Stocbrokers also said 2024 earnings witnessed a +47% YoY growth to Rs. 666.3 billion, becoming the highest annual corporate earnings over the past decade, owing to ISB reversals of Banks too getting consolidated in 4Q2024.

Banks, and Food, Beverage and Tobacco sectors have contributed the most to 1Q2025/4Q2025 and TTM Earnings.

The 1Q2025/4QFY25 earnings are mainly dominated by the Banking sector, while when considering earnings on a TTM basis, Food, Beverage and Tobacco sector has the highest contribution.

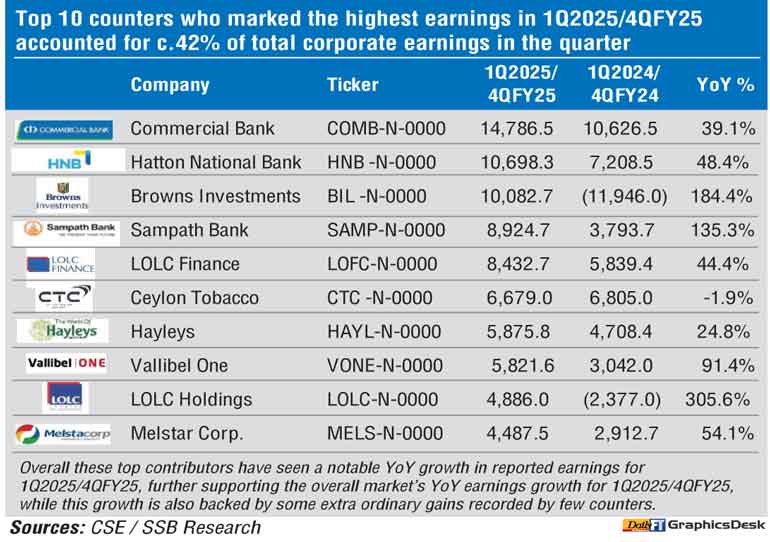

Softlogic Stockbrokers said overall the top 10 contributors (see chart) have seen a notable YoY growth in reported earnings for 1Q2025/4QFY25, further supporting the overall market’s

YoY earnings growth for 1Q2025/4QFY25, while this growth is also backed by some extraordinary gains recorded by few counters.

Softlogic Stockbrokers opined that earnings are likely to normalise in 2025E and hover around Rs. 615 – 640 billion levels, amidst a 5-10% YoY drop.

“Given that 2024 cumulative earnings witnessed some substantial write backs in the Banking sector from ISB’s, we can expect the corporate earnings to normalise and market’s forward PER to be around 10.5x – 10.7x by end 2025E. Thus, by end 2025E we expect the ASPI to hover around 18,250 – 18,500 levels,” it added.