Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 16 June 2022 00:00 - - {{hitsCtrl.values.hits}}

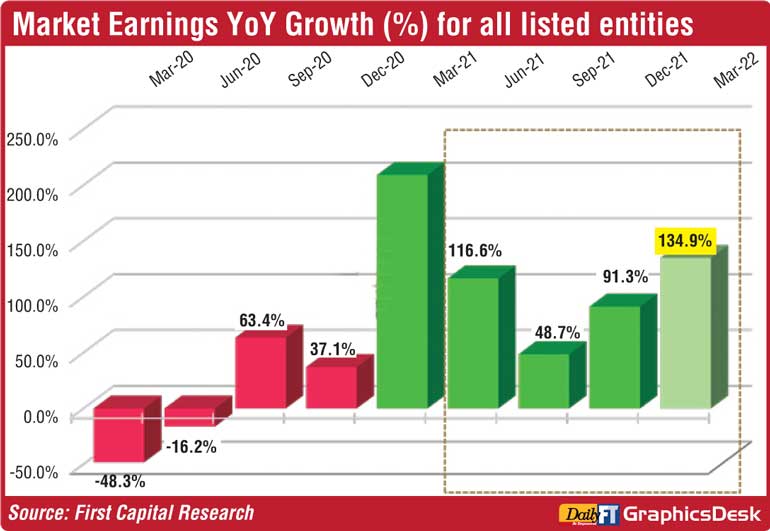

Listed companies combined March quarter earnings saw a whopping 135% increase year on year to Rs. 262 billion largely on account of substantial forex gains, First Capital Research revealed yesterday. Quarter on Quarter up 51% to Rs. 173.2 billion.

It said March earnings upsurge were influenced by the remarkable performance in Food, Beverage and Tobacco (303.3% YoY), Capital Goods (210.2% YoY), Diversified Financials (138.8% YoY), Transportation (682.1% YoY) and Consumer Services (173.6% YoY) sectors.

The Telecommunications (-386.6% YoY), Utilities (-111.4% YoY), Materials (-12.0% YoY) and Retailing (-46.0%YoY) sectors contributed negatively towards the earnings.

“However, the earnings boom is partially attributable to the massive devaluation in rupee against dollar which inflated the earnings of dollar earning counters. Accordingly, identifiable net forex gains for such selective counters have accounted for approximately Rs. 82 billion of the total quarterly earnings,” First Capital said. During the quarter of March, Food, Beverage and Tobacco, Capital Goods, Diversified Financials and Transportation sectors delivered extraordinary results while the Consumer Services sector exhibited a turnaround of performance.

Food, Beverage and Tobacco sector earnings displayed a tremendous growth of 303.3% YoY predominantly led by BIL which recorded a profit of Rs. 33.6 billion as against a loss of Rs. 0.7 billion in March 2021. Improved performance is attributable to the gain on bargain purchase of Rs. 14 billion along with a substantial revaluation gain on its investment properties.

First Capital said MELS delivered the next best results within the sector with enhanced performance in the Diversified and Beverage sectors. Diversified sector is mainly represented by tourism and has aided the earnings growth in the midst of noteworthy contribution from their overseas hotels prospered by the rebound in tourism in Maldives coupled with the rupee devaluation.

MELS’ Beverage sector, which is the largest contributor to both top line and bottom line of the group, produced strong performance owing to the upward price revisions across its entire alcoholic beverage product range, First Capital added.

Capital Goods sector earnings surged by 210.2% YoY with outstanding results in the counters of SPEN, JKH and HAYL whose operations are largely attached to dollar earning income streams as well as outpacing tourism and leisure operations overseas. Privileged by the steep devaluation of the rupee against dollar (49% during the quarter), these counters were blessed with a cumulative net forex gain of Rs. 28.8 billion during the quarter. Moreover, BRWN, the parent of BIL, topped the sector earnings growth on the ground of high scores achieved by its subsidiary.

First Capital said the Diversified Financial sector delivered an immense earnings growth of 138.8%YoY solely led by the most diversified LOLC group. LOLC recorded a profit growth of 443.8% YoY to Rs. 39.3 billion against Rs. 7.2 billion in the comparative quarter. The historic profit growth of LOLC mainly originated as a result of the major portion of revenue flowing from its global operations.

Its financial arm represented by LOFC also produced impressive results sweetened by the forex gains and reduction in impairment charges.

Transportation sector rose by 682.1% YoY exclusively out of the outstanding performance in EXPO which registered a profit of Rs. 31.4 billion (+684.0% YoY) as against Rs. 4 billion in the comparative quarter. The depreciation of the rupee has resulted in an exchange gain of Rs. 11.6 billion during the quarter while also benefiting from the increase in North American trade businesses.

The Consumer Services sector exhibited a turnaround of performance with a growth of 173.6% YoY while emerging out of the consistent losses incurred during the previous quarters. AHUN, KHL and RENU were in the spotlight of uppermost performances within the sector as the March quarter experienced the highest number of tourist arrivals in Sri Lanka since 2020 while also making the most out of the fast-tracked tourism growth in other regions like Maldives via their overseas operations.

Telecommunications, Utilities, Materials and Retailing sectors demonstrated subdued performance, First Capital said. The Telecommunications sector earnings plunged by 386.6% YoY owing to the large exchange losses incurred by DIAL as a result of substantial dollar denominated debt obligations that got hammered by the steep rupee depreciation. This gave rise to an exchange loss for the quarter of Rs. 20 billion.

Utilities sector earnings dropped by 111.4% YoY mainly due to the losses made in LPL as a result of a significant impairment adjustment for its fair value measurement of investment in subsidiaries after accommodating for the massive increase in risk free rates.

Materials sector earnings slipped by 12.0% YoY owing to the large losses in TKYO caused by the decline in GP margins and significant exchange losses (Rs. 4.8 billion). Retailing sector earnings dipped by 46.0% YoY primarily on the losses made by COLO, UML and DIMO with the unfavourable movement in exchange rate.