Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 22 November 2021 00:00 - - {{hitsCtrl.values.hits}}

|

| LOLC Vice Chairman Ishara Nanayakkara

|

LOLC Holdings on Friday completed the transfer of the shares of three finance companies to LOLC Ceylon Holdings Ltd., (LOCH) in a bid to attract large foreign investors to the latter whilst the move triggered bizarre performance of the stocks, fuelling concerns and criticism.

The three companies are LOLC Finance PLC (LOFC), Commercial Leasing and Finance PLC (CLC) and LOLC Development Finance PLC (NIFL).

The off-the-floor transfer was following approval of the Securities and Exchange Commission of Sri Lanka, whilst the move was first announced in January this year.

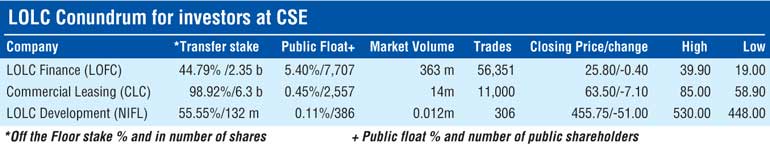

A 44.79% stake of LOLC Finance (LOFC), amounting to 2.35 million shares were transferred. A stake of 98.92% or 6.3 million shares of Commercial Leasing and Finance (CLC) as well as 55.55% stake or 132.18 million shares of LOLC Development Finance (NIFL) were also transferred.

This transaction exceeds 10% of the equity of LOLC as per the latest Audited Financial Statements. The Related Party Transactions Review Committee of LOLC is of the view that the transaction is on normal commercial terms, and is not prejudicial to the interests of the entity and its minority shareholders.

The Related Party Transaction Review Committee is not obtaining an opinion from an independent expert prior to forming its view on the transaction.

Bizarre investment sentiment on these three stocks on Friday triggered a 3.3% or 366 points plunge in the All Share Price Index. Commercial Leasing contributed 214 points to ASPI's dip, followed by LOFC (134 points), NIFL (24 points). LOFC was the biggest loser in percentage wise – down 30.6% to Rs. 25.80, though it topped in terms of turnover of Rs. 2.8 billion with 91.2 million shares changing hands via 15,936 trades. It touched an intra-day high of Rs. 36.

CLC had an intra-week high of Rs. 85 and a low of Rs. 58.90 before closing at Rs. 63.50, down by Rs. 7.10 from the previous week. Nearly 14 million shares changed hands via 11,000 trades for Rs. 1 billion. CLC’s public holding percentage is 0.452%, held by 2,557 shareholders.

NIFL closed the week down by Rs. 51 to Rs. 455.75, whilst it hit an intra-week high of Rs. 530 and a low of Rs. 448. Just 12,000 NIFL shares changed hands via 306 trades for Rs. 6 million. NIFL public shareholding as of 30 September 2021 was 0.11%, comprising 386 shareholders.

LOFC saw 363 million shares changing hands via 56,351 trades for Rs. 12 billion. It hit a high of Rs. 39.90 and a low of Rs. 19 before closing at Rs. 25.80, down by 40 cents from the previous week. LOFC public holding was 5.40% as of 30 September 2021 with 7,707 shareholders.

Some investors who bought these stocks on the up complained of manipulation, including allegations of ‘pump and dump’. This, however, was dismissed by the more seasoned and medium to long-term investors. Independent analysts have cautioned retail investor play on these highly illiquid counters.

CLC is the second largest in terms of market capitalisation of Rs. 405 billion, whilst NIFL and LOFC market capitalisation is above Rs. 100 billion. In that context, bad sentiments, following Friday’s performance, have fuelled concerns over how the Colombo Stock Exchange will behave when it opens today.