Sunday Feb 22, 2026

Sunday Feb 22, 2026

Saturday, 2 September 2023 01:26 - - {{hitsCtrl.values.hits}}

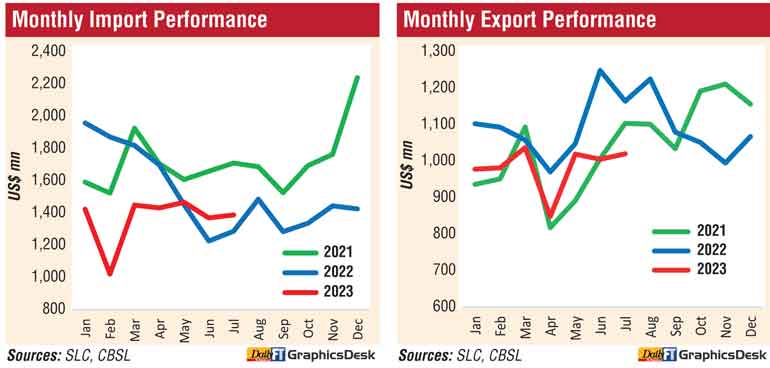

Indicating a robust turnaround of economic activities, Sri Lanka’s imports expanded sharply in July by 7.8% year-on-year (YoY) to $ 1.36 billion marking significant shifts in trade dynamics.

As per the latest data from the Central Bank, imports in July increased compared to $ 1,287 million in July 2022 and $ 1,369 million in June 2023.

Central Bank noted that consumer goods and investment goods were the driving forces behind this import surge, whereas expenditure on intermediate goods imports declined.

Despite this monthly upswing, cumulative import expenditure for the period from January to July 2023 decreased by 15.6% compared to the previous year, amounting to $ 9.54 billion.

The Central Bank noted that, subject to the economy’s recovery, the gradual easing of import restrictions, which began in June 2023, has the potential to steadily raise import expenditure in the coming months.

On the export front, earnings from merchandise exports faced a challenging scenario in July 2023, experiencing a 12.4% YoY decline to $ 1.02 billion. The Central Bank said this decline was primarily attributed to sluggish external demand, particularly in industrial exports such as garments. Nevertheless, earnings from exports in July showed progress compared to June 2023. The export earnings in the first seven months also saw a 10.3% YoY slump amounting to $ 6.89 billion.

The terms of trade, representing the ratio of export prices to import prices, faced a 0.4% drop in July compared to July 2022. This was driven by a more pronounced decline in export prices compared to import prices. Import volumes surged significantly by 35.1% YoY; while the unit value index dropped by 20.2% YoY, indicating that increased import volumes played a pivotal role in the overall increase in imports. In contrast, the export volume index rose by 10.2%, while the unit value index decreased by 20.5%, signifying that lower unit prices were primarily responsible for the decline in export earnings in July 2023.

Digging deeper into the trade landscape, the Central Bank said July 2023 witnessed a substantial expansion in the merchandise trade account deficit, surging to $ 367 million. This marked a substantial increase compared to the $ 122 million recorded in July 2022.

However, when taking a holistic view, the cumulative trade deficit for the period from January to July 2023 narrowed by 26.7% YoY to $ 2.65 billion, down from the $ 3.62 billion reported during the same period in 2022. This shift was primarily attributed to reduced imports during this timeframe.

Analysing July’s imports, the Central Bank’s report highlighted a surge in expenditure on the importation of consumer goods. This surge was driven by increased spending on both food and non-food consumer goods. Food and beverage expenditures, in particular, showed a widespread increase, with significant rises in the import of dairy products (mainly milk powder), vegetables (primarily lentils and onions), and oils and fats (mainly coconut oil).

On the other hand, expenditure on non-food consumer goods was buoyed by the importation of medical and pharmaceuticals and telecommunication devices (mainly mobile phones). Similarly, expenditure on the importation of intermediate goods experienced a marginal decline in July 2023 compared to the previous year. This was primarily due to reduced spending on textiles and textile articles (primarily fabrics and yarns) and rubber and articles thereof. Several other categories of intermediate goods, including fertilisers, chemical products, base metals, plastics, and unmanufactured tobacco, also witnessed declines.

However, these declines were partially offset by increased import expenditure on fuel. Despite lower import volumes of refined petroleum and coal, fuel bill increased by 10.3% YoY to $ 381 million due to the import of crude oil in July 2023.

Categories of intermediate goods that recorded an increase encompassed diamonds and precious stones and metals (primarily industrial diamonds), wheat, agricultural inputs, and vehicle and machinery parts. In contrast, import expenditure on investment goods experienced growth in July 2023 compared to July 2022. This expansion was primarily driven by higher imports of machinery and equipment (primarily machinery and equipment parts and turbines). Furthermore, expenditure on the importation of building materials increased, although imports of transportation equipment witnessed a decline in July 2023 compared to the previous year.

Detailing July exports, the Central Bank highlighted a decline in earnings from the exports of industrial goods in July 2023 compared to July 2022, with garments being a significant contributor to this decrease. Consequently, exports of garments to major markets such as the US, the EU, and the UK experienced declines. Additionally, a notable decrease was recorded in the exports of rubber products (mainly gloves and tires), transport equipment, gems, diamonds, jewellery, and chemical products (mainly activated carbon), among others.

However, earnings from petroleum products bucked this trend, registering an increase in July 2023 due to both higher prices and volumes of bunker and aviation fuel exports. On the agricultural front, earnings from the exports of agricultural goods showed improvement in July 2023 compared to the previous year. This was primarily due to increased earnings from minor agricultural products (mainly edible nuts) and spices (primarily pepper). Export earnings from unmanufactured tobacco and vegetables also saw marginal increases. Nevertheless, earnings from tea exports declined slightly, driven by lower export prices, while export volumes remained similar in July 2023 compared to July 2022. Additionally, there was a decline in export earnings from seafood (mainly crustaceans), coconut-related products (mainly coconut oil and desiccated coconut), and natural rubber.

Notably, earnings from mineral exports experienced an upswing in July 2023 compared to July 2022, primarily attributable to increased export earnings from earths and stone.