Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 22 May 2024 00:00 - - {{hitsCtrl.values.hits}}

|

| Chairperson Krishan Balendra

|

Top blue chip John Keells Holdings Plc (JKH) yesterday reported a strong fourth quarter reflecting buoyancy though FY24 overall was lower than the previous year given the unprecedented challenges faced by the country.

JKH said during the fourth quarter, the Group reported a strong performance across most businesses, with consumer foods, transportation and leisure, in particular, recording significant growth. The performance seen in most of the businesses is a reflection of the improving macroeconomic conditions in the country and is a continuation of the growth momentum witnessed in the third quarter of 2023/24.

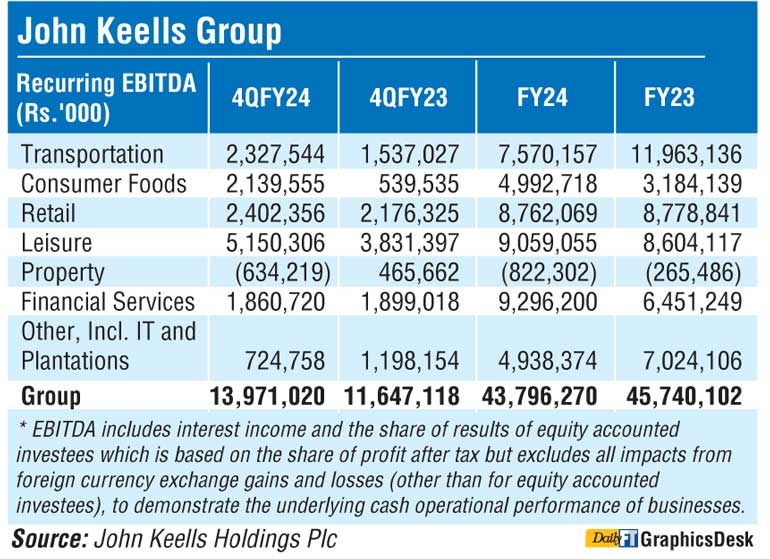

Recurring Group EBITDA in the fourth quarter of 2023/24 grew year on year by 20% to Rs. 13.97 billion. This growth was despite a higher surplus recognition at UA in the fourth quarter of the previous year due to a timing difference, and the appreciation of the Sri Lankan Rupee by approximately 12%. The average exchange rate was Rs. 355 in the fourth quarter of 2022/23 compared to Rs. 313 in the fourth quarter 2023/24, which had a negative translation impact on businesses with foreign currency denominated revenue streams. Further, the Group recognised an asset write-off amounting to Rs. 639 million in the Property industry group.

Group revenue rose by 16% to Rs. 80.6 billion in 4Q and profit from operations rose by 97% to Rs. 7.5 billion.

Pre-tax profit was up 389% to Rs. 11.3 billion and after tax figure was up 119% to Rs. 8.3 billion. Net profit attributable to equity holders of parent was up 123% to Rs. 7.36 billion in 4Q.

The strong growth in the transportation industry group was driven by the Bunkering business, Lanka Marine Services, on account of a significant growth in volumes over 50% due to the Red Sea crisis which resulted in an increase in vessel traffic to the coastal waters of Sri Lanka. The Group’s Port and Shipping business, South Asia Gateway Terminals (SAGT), recorded an increase in throughput of 13% which drove growth in profitability.

Both the Frozen Confectionery and Beverages businesses recorded strong growth in profitability, driven by improved margins and significant volume increases of 24% and 42%, respectively. It should be noted that volumes in the fourth quarter of the previous year were lower given the reduction in consumer discretionary spend. The volume growth is encouraging, particularly in beverages, where selling prices of certain SKUs were increased to cover the higher sugar tax and VAT rate increase. Favourable weather conditions, where the country encountered higher than usual temperatures, also supported the growth in volumes.

Profitability of the supermarket business was driven by growth in same store sales of 11%, driven by a growth in footfall of 14%. EBITDA recorded growth despite the cost escalations compared to the previous quarter, primarily due to the significant increase in electricity tariffs. The business is expected to see an improvement in energy costs in 2024/25 due to the downward revision of electricity tariffs in March.

Profitability of the leisure industry group was driven by a strong recovery in the Sri Lankan leisure businesses, on the back of a sustained recovery in tourist arrivals to the country, which resulted in higher occupancy and a significant improvement in ARRs across the portfolio. The Maldivian Resorts and Destination Management businesses also saw encouraging growth in EBITDA. The costs pertaining to the ramp up associated with the ‘Cinnamon Life’ hotel at ‘City of Dreams Sri Lanka’ increased on account of the impending opening of the hotel in Q3 2024/25.

The Property industry group EBITDA includes an asset write-off amounting to Rs. 639 million relating to the closure of the ‘K-Zone’ mall in Ja-Ela for the development of the ‘VIMAN’ residential project, resulting in the existing assets becoming redundant. Given the demand for suburban living spaces, the Group is of the view that the project is an optimum monetisation of such land through development and sales. Excluding the asset write-off, the Property industry group EBITDA was Rs. 5 million.

NTB recorded a significant growth in profitability driven by robust loan growth. UA recorded a higher surplus and shareholder profit although this did not reflect in the quarterly performance due to a timing difference of the recognition of the surplus in the previous year which impacted the base.

For full FY24, Group revenue rose by 1% to Rs. 280.7 billion and operating profit was up 21% to Rs. 15.36 billion. Pre-tax was down by 20% to Rs. 18 billion in FY24 and after tax by 36% to Rs. 12 billion. JKH’s bottom line was down by 38% to Rs. 11.2 billion in FY in comparison to FY23.

JKH Chairperson Krishan Balendra in his review in the FY24 Annual Report said that the Group recorded a satisfactory financial performance during the year, in line with expectations that it was a year of consolidation considering the priority of reaching stability and gradual recovery, thereon, post the economic crisis, coupled with the strong focus of the Group on operationalising our two large investments in the ensuing financial year.

“Although overall growth was muted, on a positive note, the momentum gathered pace towards the latter half of the year, with the Group recording a strong performance in the third and fourth quarters of 2023/24, which has continued into the new financial year,” Balendra said.

“Overall, the year under review was rewarding and defining in that we were able to conclude on the much-awaited commercial arrangements for the Group’s iconic and largest investment to date, the ‘City of Dreams Sri Lanka’,” he said.

“This landmark project, which has been 10 years in the making, encountered numerous unprecedented challenges due to events beyond our control, will be transformational for your Group, and the country as a whole,” he added.

Balendra said the project is coming together as ambitiously conceptualised and visualised over a decade ago, with the potential to transform Colombo as a destination for leisure and entertainment. “That vision is fast becoming a reality as we look forward to launching operations by the third quarter of 2024, with the full commencement of operations, including the casino and the mall, expected in mid-2025. We are of the view that a convergence of the timing of an economic revival and our own landmark projects, which have moved from conceptualisation to operationalization, or from ‘Dreams to Life’, will be a catalyst for tremendous opportunities for the country and the Group,” JKH Chairman emphasised.

JKH also announced a final dividend of 50 cents per share bringing the total for FY24 to Rs. 1.50 consisting of 50 cents each in first and second interim.