Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 28 July 2022 00:00 - - {{hitsCtrl.values.hits}}

Leading blue chip John Keells Holdings (JKH) has kicked off the new financial year with strong performance in the first quarter with all businesses witnessing a sustained recovery momentum.

Leading blue chip John Keells Holdings (JKH) has kicked off the new financial year with strong performance in the first quarter with all businesses witnessing a sustained recovery momentum.

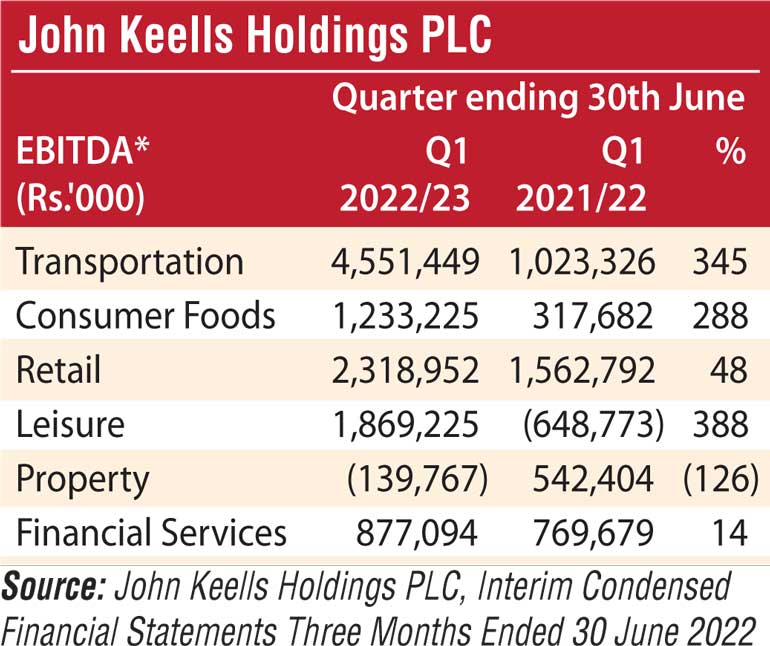

The Group revenue saw a 84% year-on-year (YoY) increase to Rs. 71.52 billion. Earnings before interest, tax, depreciation and amortisation (EBITDA) at Rs. 13.33 billion reflect a 180% increase from the 1Q of FY22.

The Group profit before tax (PBT) saw a significant increase to Rs. 14.8 billion from Rs. 1.3 billion a year ago. The Group PBT was positively impacted by the net exchange gains recorded on its US dollar denominated cash holdings at the Holding Company, net of the USD 175 million term loan from the International Finance Corporation (IFC), resulting from the steep depreciation of the Sri Lankan rupee against the US dollar during this quarter.

The profit attributable to equity holders was Rs.11.28 billion as against Rs. 1.53 billion in 1Q of FY22.

It reported an exchange gain of Rs. 10 billion in FY231Q as against Rs. 428 million a year ago and Rs. 14.5 billion in finance income as against Rs. 3.3 billion in FY221Q.

JKH noted that the comparative performance with the corresponding quarter in the previous year is somewhat distorted due to the business disruptions on account of the imposition of island-wide travel restrictions from mid-May to mid-June 2021.

“Despite the significantly challenging and volatile operating environment, the Group reported a strong performance during the quarter, which was a significant improvement with all businesses witnessing a sustained recovery momentum,” JKH Chairman Krishan Balendra said in a note accompanying interim results.

He said that Group’s Leisure businesses, in particular, continued to record a significant turnaround in performance primarily due to the Maldivian Resorts. The Leisure industry group posted an EBITDA of Rs. 1.87 billion as against a negative EBITDA of Rs. 649 million a year ago. JKH said the strong performance of the Maldivian Resorts and Destination Management segments and a better performance in the Colombo Hotels segment were the main contributors to the turnaround in performance.

The Group’s Bunkering business recorded a significant increase in profitability in its core ship bunkering operations driven by higher margins on account of the steep increase in fuel oil prices and volumes, whilst the profitability of the Group’s Ports and Shipping business recorded an increase as a result of higher revenue from ancillary operations and the translation impact due to the depreciation of the rupee.

The Consumer Foods industry group continued its strong recovery momentum with all three segments recording strong double-digit growth in volumes off a partially pandemic affected base. Volumes continue to exceed pre-pandemic levels.

The Supermarket business recorded a strong performance with same store sales recording encouraging growth driven by a combination of higher basket values due to high inflation and, notably, an increase in customer footfall compared to the comparative quarter which was impacted by the pandemic.

The Property industry group recorded a decline in EBITDA as the first quarter of the previous year included revenue and profit recognition from the handover of the residential apartment units at ‘Cinnamon Life’. The recognition of revenue of all units sold as at that date at ‘Cinnamon Life’ was completed by 31 March.

The Insurance business recorded double digit growth in gross written premiums. The Banking business recorded an increase in profitability aided by an increase in net interest margins, loan growth, focused recovery efforts and cost management initiatives.

“The quarter under review was characterised by the significant challenges to our businesses due to the numerous disruptions on account of fuel shortages, supply chain constraints, lack of foreign currency in the market, power disruptions, and significant increases in interest rates and the depreciation of the currency,” Balendra said. “While the performance of our businesses was resilient as a result of the pre-emptive actions undertaken, where relevant, the Group had to continuously manage the disruptions to supply chains and distribution to ensure our operations were managed with minimal impact,” he added.

It was emphasised that the financial strength, together with agility in planning enabled the Group to navigate and circumvent the macro [1] economic challenges encountered during the quarter. The impact of the fuel shortages on distribution and the mobility of people is relatively less during the quarter under review as the fuel shortages in the country reached a peak only after mid-June. Balendra said during the last few weeks, the shortage has been acute, resulting in a significant impact on the mobility of people and distribution of goods. At present, there are a few fuel shipments which have arrived in the country, and it is hoped there will be a more sustained supply, going forward. The Government is also in the process of rolling out a fuel rationing scheme, which, if successful, could help curtail domestic consumption and help sustain supplies, he added.