Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 1 February 2023 00:33 - - {{hitsCtrl.values.hits}}

|

| Chairperson Krishan Balendra

|

Diversified blue chip John Keells Holdings (JKH) yesterday reported impressive growth in revenue and operating profit for the third quarter but profit before tax (PBT) was impacted by much higher interest costs in comparison to a year earlier.

JKH said 3Q witnessed the continuation of normal day-to-day consumer and business activity, supported by continued political and social stability and less disruptions on account of the macroeconomic challenges.

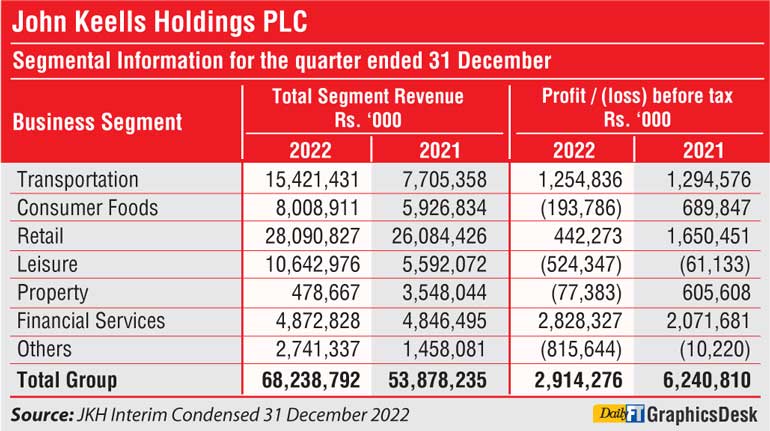

The Group revenue grew in 3Q by 27% to Rs. 68.24 billion and by 47% to Rs.208.82 billion in the first nine months of FY23. Group earnings before interest expense, tax, depreciation and amortisation (EBITDA) grew by 9% to Rs.10.41 billion in 3Q.

Balendra said this growth is despite the significant decrease in the contribution from the Group’s Property business, as compared with the third quarter of financial year 2021/22, which included the revenue and profit recognition from the handover of the residential apartments and commercial office floors at ‘Cinnamon Life’.

During the quarter, Group EBITDA was negatively impacted as a result of a one-off deferred tax charge in the Group’s Ports and Shipping business, South Asia Gateway Terminals (SAGT) on account of the significant change in income tax rates, amounting to Rs. 764 million, as the share of results of equity accounted investees are consolidated net of all related taxes.

Excluding the impact of the one-off deferred tax charge, Group EBITDA at Rs. 11.17 billion in 3Q is a 17% increase. Cumulative Group EBITDA for the first nine months rose by 60% to Rs. 33.04 billion.

Group profit before tax (PBT) declined by 53% to Rs. 2.91 billion in 3Q and excluding the impact of the one-off deferred tax charge, it was a 41% increase to Rs. Rs. 3.68 billion in 3Q.

JKH Chairperson Krishan Balendra said apart from the impact of the lower contribution from the Group’s Property business as compared to the corresponding period of the previous year, and impact of the SAGT deferred tax charge, the lower PBT is mainly the result of higher finance expenses due to the significant increase in interest rates and working capital facilities, particularly in the Retail, Leisure and Consumer Foods industry groups.

“The increase in working capital is largely temporary on account of interventions to ensure continuity of supplies to minimise disruptions. The improvement in supply chains will enable the businesses to gradually revert to more normalised levels of working capital,” he said.

The PBT of the Holding Company was impacted by the translation impact of the IFC loan interest payment and the notional non-cash interest charged on the convertible debentures issued to HWIC Asia Fund in August 2022, in line with the accounting treatment, due to the significant difference between the market interest rates and the 3% interest payable on the instrument. Cumulative Group PBT for the first nine months doubled to Rs. 20.28 billion.

Profit attributable to equity holders of the parent grew by 60% to Rs. 1.98 billion in 3Q and for the nine months it was up by a similar percentage to Rs. 14.87 billion.

JKH declared a second interim dividend of 50 cents per share to be paid on or before 1 March 2023, taking into consideration the recent trend of dampened consumer sentiment amidst the continued elevated inflation and high interest rates and the possible business impact on account of the significant increase in personal income taxes from January 2023 onwards.

Apart from the Consumer Foods and Property industry groups, the Group’s businesses recorded growth in EBITDA compared to the third quarter of the previous year.

Following are highlights of JKH Group’s sectoral businesses.

The Transportation industry group recorded an increase in profitability due to its USD denominated revenue streams and resultant translation gains due to the depreciation of the Rupee as compared against the previous year.

The groundwork on the West Container Terminal (WCT-1) at the Port of Colombo is progressing well with the dredging works being rapidly completed. The contract for the quay wall construction, a significant component of the overall construction works, was awarded in October 2022. Overall timelines for the project remain as originally envisaged.

The Leisure industry group recorded a strong performance driven by the Maldivian Resorts and Colombo Hotels segments.

The Supermarket business recorded an EBITDA growth of 26% to Rs.1.99 billion due to an increase in same store sales driven by a combination of higher customer footfall and basket values due to high inflation. The overall profitability in the Retail industry group was impacted by a substantial decline in the EBITDA of the Office Automation business compared to the third quarter of the previous year.

Profitability in the Consumer Foods businesses were impacted by volume declines reflective of dampened consumer sentiments, and lower margins, although margin pressure is expected to ease off from the fourth quarter of 2022/23 onwards.

The Property industry group recorded a decline in profitability as the third quarter of the previous year included revenue and profit recognition from the handover of the residential apartments and commercial office floors at ‘Cinnamon Life’. The recognition of revenue of all units sold at ‘Cinnamon Life’ up to 31 March 2022 was recorded across 2021/22.

The Insurance business recorded a growth in the life insurance surplus and gross written premiums whilst Nations Trust Bank recorded an increase in net interest margins and a reduction in costs.

Balendra noted that the Central Bank expects inflation to reduce to low single digits by the end of this year aided by the continued tight monetary policy and favourable base effects together with the easing of global inflationary pressures.

“The gradual tapering of inflation, reduction in global commodity prices and a less disruptive operating environment are expected to ease the pressure on margins from the fourth quarter onwards, particularly as we deplete raw material inventory acquired at higher costs,” he added.