Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 17 February 2026 03:30 - - {{hitsCtrl.values.hits}}

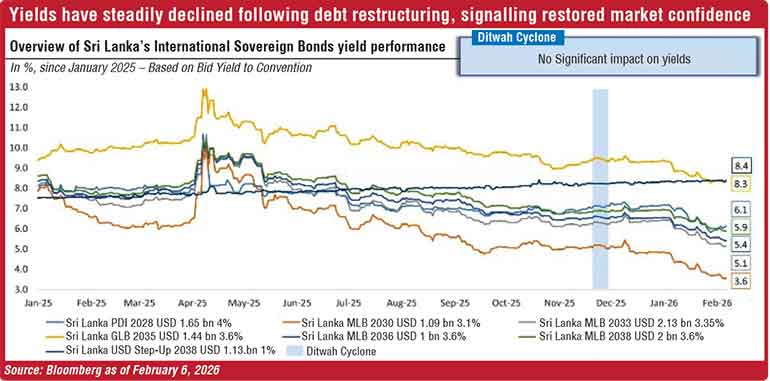

Yields on Sri Lanka’s restructured International Sovereign Bonds (ISBs) have declined steadily since the debt exchange, with Treasury Secretary Dr. Harshana Suriyapperuma telling investors the trend reflects renewed confidence in the country’s reform path despite the devastating impact of Cyclone Ditwah.

Speaking during an investor call last week (https://www.ft.lk/top-story/Sri-Lanka-tells-ISB-investors-Govt-locks-in-IMF-targets-reforms/26-788240), Dr. Suriyapperuma said: “This restored trust is also reflected by the trading performance of our newly issued Sovereign Bonds. Since their issuance in 2024, yields have consistently decreased, with the exception of a sharp rise in early 2025 driven by global geopolitical tensions.”

“This steady decline reflects the market’s confidence in Sri Lanka’s ongoing recovery and growing appeal in international markets,” he added.

An official slide presented during the call, based on Bloomberg bid yields as of 6 February 2026, shows yields ranging between 3.6% and 8.4% across maturities. Short-dated instruments trade near the 8–8.5% range, while longer tenors have compressed towards 5–6%, with the longest maturity indicated at 3.6%.

The chart, which tracks post-default instruments (PDI), Governance-Linked Bonds (GLB), Macro-Linked Bonds (MLB), and USD Step-Up Bonds, marks the period of Cyclone Ditwah and states that there was “no significant impact on yields.”

Dr. Suriyapperuma said: “This confidence is underscored by the fact that Cyclone Ditwah had no material impacts on yields, even though it represents a significant shock for the country.”

The Treasury Secretary said Sri Lanka remains on track to meet the performance triggers embedded in its newly issued restructuring instruments, including the GLBs and MLBs.

“Interestingly, for investors, we remain on track to trigger the features of our innovative GLB, whose coupons will be linked to our revenue performance starting in 2028,” he said, referring to the GLB structure that ties coupon adjustments to fiscal outcomes.

On the macro-linked instruments, he noted that debt indicators have continued to improve relative to earlier International Monetary Fund (IMF) program reviews. “We are on track to achieve all targets set by the IMF debt sustainability analysis, with a certain margin even assuming that the first threshold of the variable MLBs is triggered,” he said.

Dr. Suriyapperuma added that the trading performance of the newly issued Bonds since the 2024 exchange reflects market confidence in the reform trajectory and the sustainability framework underpinning both instruments.

He told investors Sri Lanka is “very close to completing a debt restructuring fully aligned with IMF program parameters,” noting that agreements have been reached with creditors representing nearly 99% of external debt, with more than 92% already restructured.

On the IMF Extended Fund Facility (EFF), Dr. Suriyapperuma said the Government’s continued adherence to structural reforms has allowed Sri Lanka to maintain strong IMF program performance. He confirmed that IMF staff reached a Staff-Level Agreement on the Fifth Review at end-2025, with Executive Board consideration expected shortly.

Upon approval, Sri Lanka would gain access to a further $ 350 million, bringing total IMF disbursements under the arrangement to about $ 2 billion. The program is scheduled to run through 2027.

Dr. Suriyapperuma said the cyclone’s fiscal impact has been fully incorporated into the 2026 Budget without derailing consolidation targets, with stronger-than-expected 2025 revenues helping absorb recovery costs.

“Our program remains on track,” he said, adding that policy continuity and reform implementation remain central to sustaining market confidence and restoring durable access to international capital markets.