Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 29 September 2025 00:00 - - {{hitsCtrl.values.hits}}

A September 2025 International Monetary Fund (IMF) Working Paper has said Sri Lanka’s debt restructuring is nearing completion, but cautioned that fiscal discipline, stronger institutions, and careful debt management are essential to prevent a return to crisis.

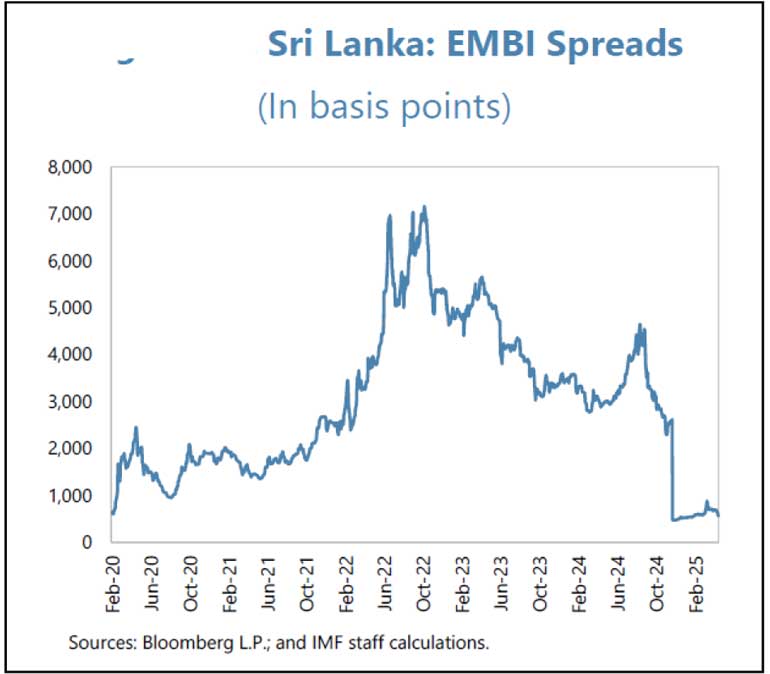

The report, titled ‘Sri Lanka’s Sovereign Debt Restructuring: Lessons from Complex Processes,’ said spreads on the country’s international bonds had fallen to post-restructuring norms and ratings agencies had lifted sovereign credit scores. Treasury Bill yields eased to around 8.5% by March 2025, and the Government shifted more borrowing into longer-dated Treasury Bonds, reducing refinancing risk.

Debt operations had eased the domestic overhang, while a banking crisis was avoided and private credit began to grow again.

But the IMF cautioned that “significant efforts in improving the debt management function are needed to fully restore the functioning Treasury Bond market Sri Lanka had before the debt crisis.”

The paper stressed that restructuring alone would not secure long-term stability. “It also requires continued prudent fiscal and macro policies and stronger institutions during and after the current Extended Fund Facility (EFF) arrangement. There is no room for slippage on the fiscal front,” it said.

The IMF credited the Public Finance Management and Public Debt Management Acts as milestones but urged further reforms. These included a disciplined public investment program, transparent procurement, and rigorous cost-risk analysis of new borrowing. “A thorough cost-risk analysis before signing any new debt contract would help the authorities work out the debt service consistent with preserving sustainability,” it said.

The report traced the debt crisis to weak public finances and external shocks. By 2019, Sri Lanka’s tax revenues had fallen to one of the lowest levels among emerging markets. The COVID-19 pandemic exposed Balance of Payments vulnerabilities, while an overvalued exchange rate and heavy issuance of international bonds in the 2010s created mounting repayment pressures. Combined with lax fiscal policy, the result was a first-ever sovereign default in April 2022.

The EFF aimed to restore viability through fiscal consolidation, external adjustment, debt relief, and exceptional financing. The macroeconomic framework, informed by other post-default cases, recognised that recovery would be slow where fiscal tightening weighed on growth, banks faced balance sheet strain, and exchange rates required sharp realignment.

Debt sustainability targets were calibrated to Sri Lanka’s circumstances, setting limits on external service, gross financing needs, and public debt. These targets guided negotiations and helped chart an adjustment path that balanced stability with growth.

The IMF underlined the complexity of creditor talks. With no forum for coordination across bondholders, bilateral lenders, multilaterals, and domestic institutions, the Government initially pursued a parallel approach to secure assurances. An official creditor platform was later created to improve transparency.

“Negotiations were guided by program debt targets and the macroeconomic framework,” the paper said. Still, disputes over comparability of treatment and the use of State-contingent instruments prolonged the process.

The domestic debt operation began in September 2023, followed by agreements in principle with official creditors in the first half of 2024, which cleared the way for talks with private bondholders. The paper said the process demanded balancing diverse interests but achieved progress towards sustainability.

The IMF said Sri Lanka’s case offers lessons for other emerging markets: domestic debt operations must weigh social and financial stability, comparability rules should be clearer, and State-contingent instruments need refinement. It also stressed the importance of swift action and clear communication to reduce uncertainty and limit economic damage.

“Safeguarding hard-earned debt sustainability requires ongoing prudent macroeconomic policies and strengthened public debt management,” the paper concluded. With financing conditions still difficult, it said Sri Lanka must normalise quickly, keep borrowing aligned with program goals, and maintain fiscal discipline to regain durable market access.