Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 21 March 2023 02:25 - - {{hitsCtrl.values.hits}}

|

| IMF Managing Director Kristalina Georgieva |

|

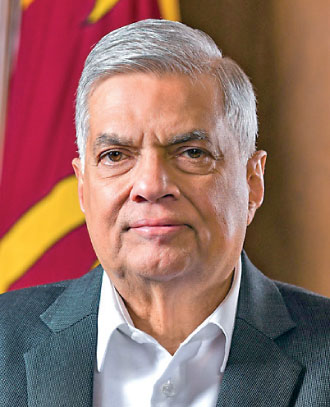

| President Ranil Wickremesinghe

|

The International Monetary Fund’s Executive Board yesterday approved a lifeline for bankrupt Sri Lanka saying its $ 3 billion four year Extended Fund Facility arrangement will deliver stability and stimulate much needed growth.

It said the program supports (395% of quota) Sri Lanka’s economic policies and reforms with the objectives of the EFF-supported program being to restore macroeconomic stability and debt sustainability, safeguarding financial stability, and stepping up structural reforms to unlock Sri Lanka’s growth potential. All program measures are mindful of the need to protect the most vulnerable and improve governance.

IMF said close collaboration between Sri Lanka and all its creditors will be critical to expedite a debt treatment that will restore debt sustainability consistent with program parameters.

It recalled that Sri Lanka has been hit hard by a catastrophic economic and humanitarian crisis. The economy is facing significant challenges stemming from pre-existing vulnerabilities and policy missteps in the lead up to the crisis, further aggravated by a series of external shocks.

The EFF-supported program aims to restore Sri Lanka’s macroeconomic stability and debt sustainability, mitigate the economic impact on the poor and vulnerable, safeguard financial sector stability, and strengthen governance and growth potential.

The Executive Board’s decision will enable an immediate disbursement equivalent to SDR 254 million (about $ 333 million) and catalyse financial support from other development partners.

Following the Executive Board discussion on Sri Lanka, Managing Director Kristalina Georgieva, issued the following statement:

“Sri Lanka has been facing tremendous economic and social challenges with a severe recession amid high inflation, depleted reserves, an unsustainable public debt, and heightened financial sector vulnerabilities. Institutions and governance frameworks require deep reforms. For Sri Lanka to overcome the crisis, swift and timely implementation of the EFF-supported program with strong ownership for the reforms is critical.

“Ambitious revenue-based fiscal consolidation is necessary for restoring fiscal and debt sustainability while protecting the poor and vulnerable. In this regard, the momentum of ongoing progressive tax reforms should be maintained, and social safety nets should be strengthened and better targeted to the poor. For the fiscal adjustments to be successful, sustained fiscal institutional reforms on tax administration, public financial and expenditure management, and energy pricing are critical.

“Having obtained specific and credible financing assurances from major official bilateral creditors, it is now important for the authorities and creditors to make swift progress towards restoring debt sustainability consistent with the IMF-supported program. The authorities’ commitments to transparently achieve a debt resolution, consistent with the program parameters and equitable burden sharing among creditors in a timely fashion, are welcome.

“Sri Lanka should stay committed to the multi-pronged disinflation strategy to safeguard the credibility of its inflation targeting regime. As the market regains confidence, the authorities’ recent introduction of greater exchange rate flexibility will help to rebuild the reserve buffer.

“Maintaining a sound and adequately capitalised banking system is important. Implementing a bank recapitalisation plan and strengthening financial supervision and crisis management framework are crucial to ensure financial sector stability.

“The ongoing efforts to tackle corruption should continue, including revamping anti-corruption legislation. A more comprehensive anti-corruption reform agenda should be guided by the ongoing IMF governance diagnostic mission that conducts an assessment of Sri Lanka’s anti-corruption and governance framework. The authorities should step up growth-enhancing structural reforms with technical assistance and support from development partners.”

Separately, the Government said the IMF program will allow Sri Lanka to access financing of up to $ 7 billion from the IMF, International Financial Institutions (IFIs) and multilateral organisations.

“This is a historic milestone for the country as the Government seeks to restore macroeconomic stability and achieve debt sustainability. Earlier this month, Sri Lanka received IMF-compatible financing assurances from its official creditors, including Paris Club members, India and China, allowing the IMF to convene an Executive Board and consider Sri Lanka’s request for a loan,” a statement by President Media Division said.

The program is expected to provide much-needed policy space to drive the economy out of the unprecedented challenges and instil confidence amongst all the stakeholders. It said that President Ranil Wickremesinghe welcomed the announcement.

“In the 75 years of Sri Lanka’s independence, there has never been a more critical period for our economic future,” Wickremesinghe said.

“Our official creditors have declared their support following continuous and positive engagements over the last few months, and we are pleased that the IMF Executive Board approved our program, enabling Sri Lanka to access up to $ 7 billion in funding from the IMF and IFIs. From the very start, we committed to full transparency in all our discussions with financial institutions and with our creditors. I express my gratitude to the IMF and our international partners for their support as we look to get the economy back on track for the long term through prudent fiscal management and our ambitious reform agenda,” the President said.

He stressed that since taking office last July, it has been my priority to stabilise Sri Lanka’s economy and achieve sustainable levels of debt.

“To do so, we have taken some tough decisions, but we did so with a commitment to widening our social safety nets, protecting the vulnerable, rooting out corruption and ensuring we can grow an inclusive and internationally attractive economy,” Wickremesinghe said.

According to the President the IMF program is critical to achieving this vision for Sri Lanka. “We are committed to successfully completing the IMF program and achieving debt sustainability. We will continue to engage with all our creditors, and I encourage both our bilateral and commercial creditors to strengthen and foster coordination in the context of our forthcoming engagement. The IMF program will also be imperative to improving Sri Lanka’s standing in and access to international capital markets, and it will demonstrate that Sri Lanka is once again a country attractive to talent, investors and tourists,” the President added.