Thursday Feb 26, 2026

Thursday Feb 26, 2026

Thursday, 11 December 2025 06:25 - - {{hitsCtrl.values.hits}}

|

President and Finance Minister Anura Kumara Dissanayake

|

Sri Lanka’s tax exemptions and concessions reached Rs. 285.7 billion in the first six months of 2025, equal to 57% of the total tax expenditure recorded since April 2023, according to the latest Tax Expenditure Statement published by the Ministry of Finance in November.

The data shows that the scale of foregone revenue remains substantial despite efforts to broaden the tax base and meet revenue objectives under the economic recovery program.

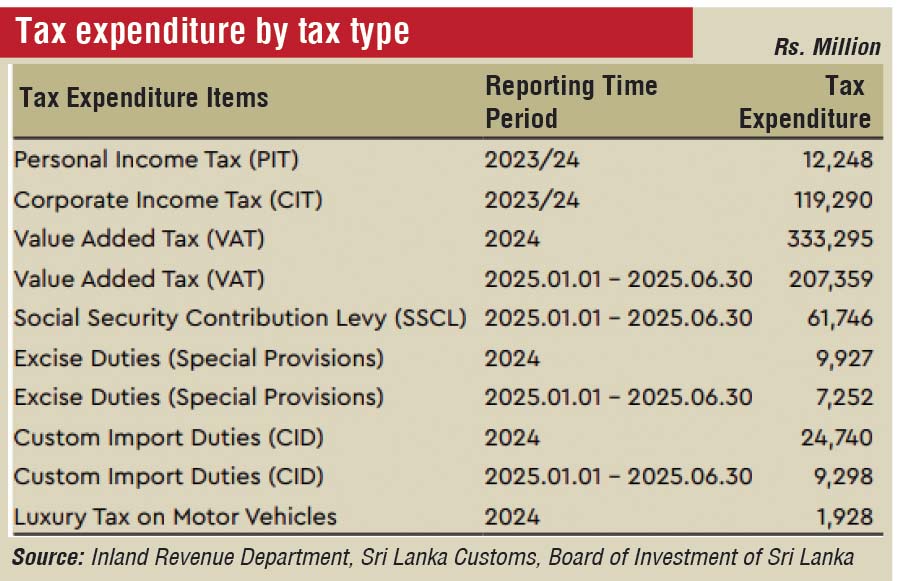

The statement records Rs. 501.4 billion in tax exemptions for the financial period 2023/24 and 2024 fiscal year across Corporate Income Tax, Personal Income Tax, Value Added Tax, the Social Security Contribution Levy, Excise Duty, Customs Import Duty and the Luxury Tax on Motor Vehicles.

Combined with the Rs. 285.7 billion recorded from January to June 2025, total exemptions since April 2023 period amount to a staggering Rs. 787.1 billion.

Sri Lanka’s Tax Expenditure Statement presents two distinct reporting periods, and the totals must be viewed separately because they do not use the same fiscal cycle. The 2023/24 values relate only to income taxes assessed for that year, while the 2024 values capture expenditure from consumption and trade taxes on a calendar-year basis.

For 2023/24, the report quantifies only Personal Income Tax and Corporate Income Tax. Personal income tax expenditures amount to Rs. 12.2 billion, while corporate income tax expenditures amount to Rs. 119.3 billion. Together, these come to Rs. 131.5 billion. No VAT, customs, excise or levy-related tax expenditures are reported under the 2023/24 assessment period, so this figure reflects only income-tax-related concessions for that year.

The 2024 reporting line reflects a broader set of taxes calculated on a calendar-year basis. VAT exemptions account for Rs. 333.3 billion, excise duty exemptions for Rs. 9.93 billion, Customs duty exemptions for Rs. 24.7 billion and luxury motor vehicle tax exemptions for nearly 2 billion. These items total Rs. 369.9 billion, representing the fiscal cost of consumption and import-related concessions granted in 2024.

Exemptions on the Luxury Tax on Motor Vehicles were granted under Gazette No. 2318/53 of 10 February 2023 and later extended by Gazette No. 2368/24 of 24 January 2024. These exemptions remained valid until 30 September 2024, after which the concession lapsed.

Under the terms of the gazettes, eligible vehicles had to be registered with the Department of Motor Traffic by that date. Sri Lanka Customs has begun recovery action against beneficiaries who did not meet this requirement, and the number of qualifying cases, as well as the final tax expenditure recorded under this category, may change once recovery efforts are concluded.

Taken together, the report shows Rs. 131.5 billion in tax expenditures arising from the income-tax system in 2023/24 and Rs. 369.9 billion in consumption and import-related tax expenditures reported for 2024.

Value Added Tax continues to account for the largest share.

Exemptions under the tax were Rs. 333.3 billion in 2024 and Rs. 207.4 billion in the first half of 2025. Most of this is linked to companies outside the Board of Investment regime and reflects exemptions for essential goods, utilities, medicines, food supply chains and specific priority sectors. The scale of relief indicates that recent structural changes to the Value Added Tax system have not yet reduced the size of the exemption base.

The Social Security Contribution Levy created Rs. 61.7 billion in exemptions during the first half of 2025, reflecting the decision to protect sectors where turnover-based taxation would otherwise raise consumer prices. Relief for electricity, water supply, pharmaceuticals, and fuel and core transport services form most of this amount. The Treasury notes that updated sector classifications within the Inland Revenue Department limit comparability with previous years.

Customs duty exemptions totalled Rs. 9.3 billion in the first half of 2025. The largest relief was for agricultural and food-related inputs, machinery for the Ceylon Electricity Board and materials linked to specific construction and infrastructure projects. Duty exemptions linked to Port City activity remain a small component of the total.

Excise Duty exemptions reached Rs. 7.3 billion in the first half of 2025, almost entirely due to relief for locally assembled motor vehicles and commercial transport units. Other categories contributed marginally.

Corporate Income Tax exemptions remain a long-standing feature of the system.

The statement records Rs. 119.3 billion in corporate tax expenditure for 2023/24, arising from concessionary rates under Board of Investment and non–Board of Investment frameworks and legacy provisions from earlier tax laws. Exemptions linked to Port City operations and Strategic Development Projects currently remain modest but are expected to grow as activity expands. Personal Income Tax exemptions amount to Rs. 12.2 billion for 2023/24.

These trends carry direct implications for Sri Lanka’s commitments under the International Monetary Fund program. The medium-term revenue strategy relies on higher collections from Value Added Tax, income taxes and improved administration of the Social Security levy.

The continuation of large exemption categories, particularly in indirect taxes, reduces the revenue impact of recent base-broadening measures. With the first half of 2025 already reaching 57% of 2024’s total tax expenditure, the data suggests that exemption volumes have not yet begun to decline.

The Finance Ministry identifies the need for closer scrutiny of exemptions and intends to integrate tax expenditure analysis into the annual budget cycle. Future revisions are expected to include clearer benchmark definitions, regular evaluation of high-cost concessions and deeper analysis of sectoral impacts.

The statement also notes limitations in estimating behavioural responses to tax changes and the effects of overlapping incentives.

The structure of exemptions reflects a mix of policy decisions and legacy concessions. Policy-driven relief includes exemptions for essential goods, utilities, public transport services, food supply chains and medical supplies.

Relief for electricity generation inputs and core transport categories under the Social Security levy also fall into this group. Customs duty exemptions for food inputs and energy-related imports are similarly positioned as measures to stabilise costs.

Legacy exemptions stem from older investment regimes and previous versions of the tax law.

These include long-standing corporate concessions, concessionary rates under outdated frameworks and relief that has remained in place despite shifts in the broader economic environment.

Transitional exemptions linked to Port City operations and Strategic Development Projects currently have a smaller fiscal impact but may increase as these projects expand.

The combined picture shows that although indirect tax reforms have widened the base, large exemption categories continue to limit the full revenue impact.

With exemptions in the first six months of 2025 already exceeding half of the 2024 total, the figures suggest that the overall structure of exemptions remains largely unchanged. The Ministry’s stated intention to embed tax expenditure analysis within the budget cycle marks an effort to align exemptions more closely with fiscal consolidation goals.