Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 8 May 2023 04:14 - - {{hitsCtrl.values.hits}}

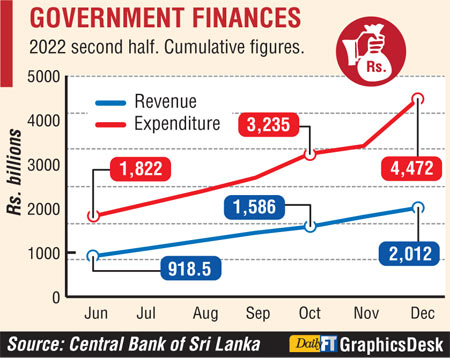

Government expenditure in December had swelled by Rs. 1 trillion despite the country declaring bankruptcy, a cash-strapped Treasury and multiple curbs on public sector spending.

Government expenditure in December had swelled by Rs. 1 trillion despite the country declaring bankruptcy, a cash-strapped Treasury and multiple curbs on public sector spending.

The spike in December saw overall expenditure in fiscal year 2022 (January to December) increase to Rs. 4.47 trillion.

In the first 11 months, cumulative expenditure amounted to Rs. 3.41 trillion. However in comparison to Rs. 3.52 trillion expenditure in 2021, the last year’s performance reflects a Rs. 950 billion increase or 27%.

The increase in expenditure was attributed to higher domestic interest payments following the increase in interest rate and lending to State Owned Enterprises.

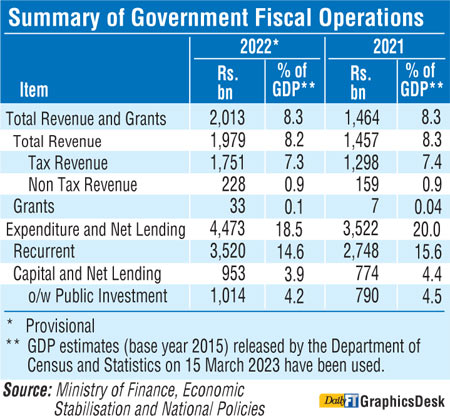

In terms of earnings, Government revenue crossed the Rs. 2 trillion mark for the first time finishing 2022 at Rs. 2.01 trillion as against Rs. 1.46 trillion in 2021 reflecting a Rs. 548 billion increase or a robust 37.5%.

In November 2022 Government rose by Rs. 220 billion whilst in December it gained by only Rs. 173 billion.

The spike in November and overall increase in 2022 was aided by upward revisions in taxation, improved enforcement and retrospective one-off surcharge tax collection. Tax revenue rose to Rs. 1.75 trillion in 2022 from Rs. 1.3 trillion in 2021 whilst non-tax revenue grew to Rs. 228 billion from Rs. 159 billion.

As per the Interim Budget 2022, the Government revenue to GDP target for the year was revised to 8.8% but achieved only 8.3%.

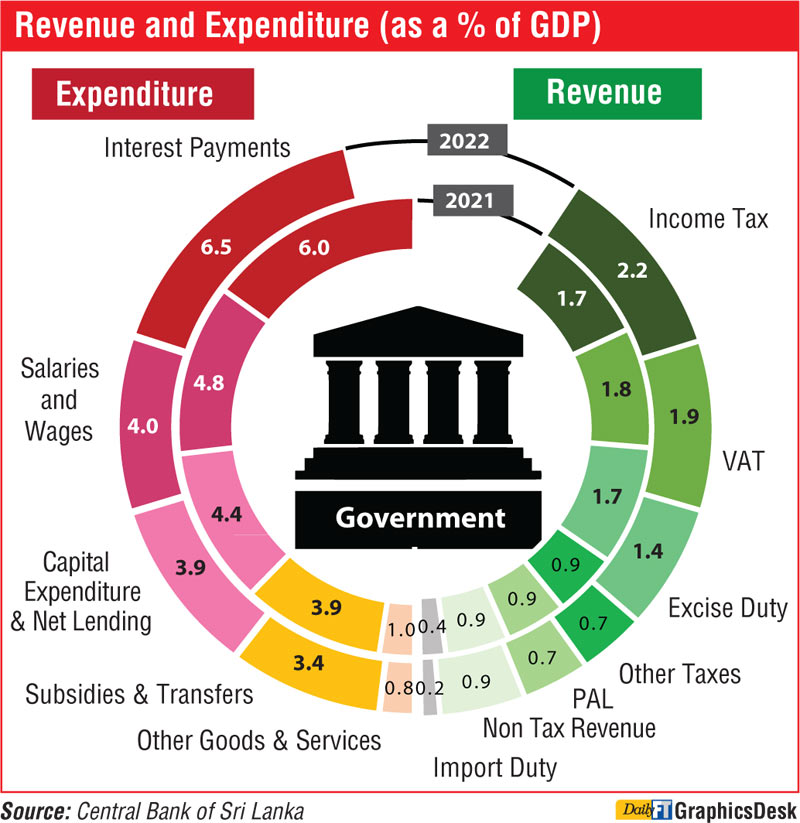

According to the Central Bank 2022 Annual Report, revenue from income taxes in 2022 grew by 76.8% to Rs. 534 billion (2.2% of GDP) mainly due to the surcharge tax, which accounted for more than one fifth of total income tax mobilised during the year. Consequently, the share of direct tax revenue in the total tax revenue collection improved to 30.5% in 2022 over 23.3% recorded in 2021.

Revenue from Advance Personal Income Tax (APIT) and Withholding Tax (WHT) also increased in 2022 by Rs. 10.2 billion and Rs. 7.4 billion, respectively, to Rs. 25.5 billion and Rs. 19.8 billion, respectively, compared to 2021, due to improved tax administration in 2022, compared to 2021 when revenue collection activities were hampered by the pandemic.

Revenue from VAT increased by 50.2%, mainly reflecting the impact of the rise in price levels and upward revisions made to the VAT rate from June and September 2022. Since revisions to the general VAT rate were effective during the second half of 2022, revenue from VAT, as a percentage of GDP, recorded only a marginal increase from 1.8% of GDP in 2021 to 1.9% of GDP in 2022. Revenue from VAT on domestic services increased to Rs. 291.6 billion in 2022, compared to Rs. 185.5 billion in 2021, while revenue from VAT on import related activities increased to Rs. 171.5 billion in 2022 in comparison to Rs. 122.8 billion in the previous year.

Reflecting the nominal growth in VAT revenue, the share of revenue from VAT on total revenue and total tax revenue increased to 23.4% and 26.4%, respectively, compared to 21.2% and 23.7%, respectively, recorded in 2021.

Revenue from excise duties grew by 11.6% in 2022, to Rs. 342.5 billion in nominal terms, over the preceding year, benefitting from the increased collection of excise duties on liquor and cigarettes. Revenue from excise duties on liquor increased by 19.2% to Rs. 165.2 billion in 2022, while revenue from excise duty on cigarettes and tobacco increased by 17.6% to Rs. 104.2 billion, which could be mainly attributable to the upward revisions made to the excise duty structure on liquor and cigarettes effective from November 2021. In addition to the increase in excise duties, growth in cigarette sales contributed to higher revenue collection from cigarettes.

Revenue from excise duty, as a percentage of GDP, declined from 1.7% in 2021 to 1.4% in 2022, reflecting the necessity of implementing the inflation indexed excise duty structure for liquor and cigarettes, according to the Central Bank.

Revenue collection from PAL increased to Rs. 180.6 billion in 2022, compared to Rs. 154.1 billion in 2021. Increase in international prices on several items, such as petroleum products, cement clinker, steel, raw materials, and other consumable commodities, along with the impact of the depreciation of the Sri Lanka rupee, contributed to the increased collection from PAL.

Non tax revenue collection increased by 43.4%, mainly due to the improved revenue collection from fees and charges and profits transferred by the Central Bank based on the financial statements of 2021. Accordingly, revenue from fees and charges increased by Rs. 47.4 billion to Rs. 90.1 billion in 2022 mainly due to the revision of fees and charges of postal and railway departments. The profits transferred by the Central Bank increased to Rs. 30 billion in 2022 in comparison to Rs. 15.0 billion recorded in 2021. In addition, social security contributions also increased by 8.1% to Rs. 37.4 billion in 2022 over 2021.

Key developments in Govt. Expenditure

Government recurrent expenditure grew significantly in 2022, mainly due to the increased domestic interest payments owing to large borrowing requirements and elevated interest rates, along with the rise in expenditure on salaries and wages, and subsidies and transfers.

Expenditure on interest payments, which accounted for 44.5% of total recurrent expenditure, grew by 49.3% to Rs. 1.5 trillion while domestic interest payments rose by 80.8% to Rs. 1.4 trillion in 2022.

Expenditure on interest payments accounted for 79.1% of government revenue in 2022. Expenditure on goods and services increased by 12.3% in 2022, compared to 2021.

Salaries and wages, which accounted for 27.2% of the total recurrent expenditure in 2022, increased by 13.1% to Rs. 956 billion owing to the additional monthly allowance paid to public sector workers based on the relief package introduced in January 2022 as well as the impact of general annual increments.

Similarly, expenditure on other goods and services grew by 8.2% in 2022, in comparison to the preceding year. Expenditure on subsidies and transfers were up 19% to Rs. 719.4 billion mainly due to the additional monthly allowance paid to pensioners and Samurdhi recipients (Rs. 121 billion up from Rs. 55.4 billion in 2021) increased expenses on fertiliser subsidy. Capital expenditure and net lending rose by 28.5% to Rs. 1 trillion mainly due to higher lending to SOEs.

According to the Central Bank in view of the widening budget deficit and limited budgetary financing avenues for the Government, several expenditure rationalisation measures were introduced in March 2022. The Ministry of Finance, Economic Stabilisation and National Policies (MOF) issued a circular instructing government institutions to suspend non-essential, non-urgent capital expenditure, restrict recurrent expenditure on overtime payments, loans granted to public sector employees, and stationery and printing costs, etc., while freezing new recruitments to the public sector. A similar circular was issued in August 2022, instructing to curtail expenditure of commercial corporations, statutory boards, and government owned companies. In consideration of the energy crisis faced by the country and increasing government expenditure, in March 2022, the Ministry of Public Services, Provincial Councils, and Local Government issued a circular instructing to reduce expenditure on fuel and electricity of these institutions.

The Cabinet of Ministers granted approval to reduce 6% of the approved recurrent expenditure estimates of all government institutions for 2023. Finance Ministry issued a circular to all ministries, departments, provincial councils, district secretariats, state corporations, statutory boards, and government owned companies to cut down 6% of their recurrent expenditure, other than essential expenses, such as salaries, retirement benefits, medicines, rents and local taxes, interest payments, and mandatory welfare benefit payments.