Tuesday Mar 03, 2026

Tuesday Mar 03, 2026

Monday, 27 June 2022 02:27 - - {{hitsCtrl.values.hits}}

By Nisthar Cassim

The rupee value of the country’s foreign debt has ballooned by near 50% in 1Q to Rs. 9.55 trillion following the sudden free flotation of the currency, latest Central Bank data reveals.

The rupee value of the country’s foreign debt has ballooned by near 50% in 1Q to Rs. 9.55 trillion following the sudden free flotation of the currency, latest Central Bank data reveals.

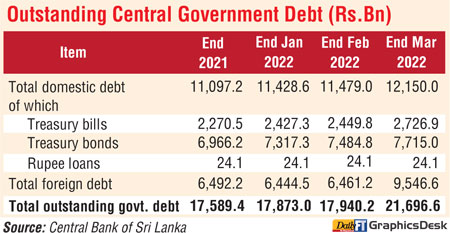

Sri Lanka ended 2021 with a foreign debt of Rs. 6.5 trillion and by February this year it was down to Rs. 6.4 trillion.

In a highly contested move, the Government in the first week of March all of sudden decided to let the exchange to float free plunging the rupee by over 50%. This caused the foreign debt to swell by nearly 40% to Rs. 9.54 trillion (around $ 2.65 billion in current exchange rate).

The total outstanding debt had risen from Rs. 17.6 trillion by end 2021 to Rs. 21.7 trillion by March this year. Foreign debt component was around 44%. The Government has suspended repayment of all foreign debt as of 12 April.

The sudden flotation of the currency after it was artificially managed for six months has come under renewed criticism. The subsequent doubling of policy rates added more fodder for the debate. The twin move sans safeguards or stabilisation measures only further aggravated the economic crisis than bringing in stability as per some analysts.

Current CBSL Governor Dr. Nandalal Weerasinghe faulted the sequencing of some of the measures by his predecessor and a degree of damage control was needed. Then CBSL Governor Nivard Cabraal took cover from the fact that the new regime pursued the same flexible exchange rate policy until recently.

In a statement last week, Cabraal shed more insights. He said that the decision to allow flexibility in the exchange rate was taken by the Monetary Board based on a Monetary Board Paper dated 7 March 2022 submitted by all three Deputy Governors Mahinda Siriwardene, Dammika Nanayakkara and Director – Economic Research Department and Director – International Operations Department Yvette Fernando.

The Board Paper stressed the need for changing the exchange rate policy immediately in order that the exchange rate acts as a “shock absorber” in the face of adverse developments in the global front on Sri Lanka’s already fragile Balance of Payments, including the increase of the crude oil price to nearly $ 140 per barrel and the worsening Russia-Ukraine war.

Based on that Board Paper and the discussion at the meeting, the Monetary Board decided to “allow the market to have a greater flexibility in the exchange rate with immediate effect and communicate that the Central Bank is of the view that forex transactions would take place at levels which are not more than Rs. 230 per dollar”.

When he resigned on 4 April, Cabraal said the rupee was trading at Rs. 289.73/299.99 per dollar in accordance with the new “flexible” exchange rate policy as announced by the Monetary Board.

After Governor Cabraal’s exit, the Monetary Board chaired by new Governor Dr. Weerasinghe continued with the “flexible” exchange rate policy, whist the Government and CBSL also took a series of far reaching decisions which included the decisions to; sharply increase policy interest rates by 700 bps from 8 April onwards, and to discontinue repayments of forex loans and interest from 12 April onwards.

Cabraal recalled that in the meantime, the rupee continued to depreciate to a range of Rs. 364.23/377.50 against the dollar by 12 May, at which point, the Monetary Board had apparently once again decided to “fix” the exchange rate at a new range between Rs. 355/Rs. 365 per dollar.

“Such a move to ‘fix’ the exchange rate seems quite similar to the policy adopted by the Monetary Board chaired by Governor Prof. W.D. Lakshman which ‘fixed’ the rupee exchange rate at a range of Rs. 199/203 per dollar from 6 September 2021 onwards,” Cabraal pointed out.