Tuesday Mar 03, 2026

Tuesday Mar 03, 2026

Wednesday, 11 December 2019 00:19 - - {{hitsCtrl.values.hits}}

- Acknowledges potential boost to demand from stimulus

- But says broadening tax base and continuing fiscal consolidation essential to avoid macroeconomic instability

- Highlights lack of fiscal space given high debt payments, public expenditure

- Says effective tax rates impediment to private sector expansion

- Recommends restricting debt, controlling public recruitments, reforming SOEs

- Against removing fuel price formula

- Raising non-tax revenue in short term unlikely

The wide-ranging fiscal stimulus package outlined by the Government will boost aggregate demand in the short-run, ICRA Lanka, which is the local arm of ratings agency Moody’s, said  yesterday, but warned it could create instability in the long-run and called for the expansion of the tax base to continue fiscal consolidation.

yesterday, but warned it could create instability in the long-run and called for the expansion of the tax base to continue fiscal consolidation.

The Government reduced a variety of taxes substantially in an attempt to revive the economy, which could possibly cost over Rs. 500 billion according to the Government’s own estimates. Whilst acknowledging the potential boost to the aggregate demand and corporate profitability from the fiscal stimulus in the short-run, ICRA Lanka recommended Sri Lanka should broaden the tax base and continue fiscal consolidation to avoid macroeconomic instability to benefit from the tax buoyancy effect.

Releasing its latest analysis this week ICRA Lanka pointed out Vietnam was a case in point where the country’s low tax environment had not translated to increasing tax revenue compared to the size of the economy.

In the span of four years from 2012, Vietnam’s tax incentives for businesses accounted for 7% of the total State budget revenue. However, revenue from corporate income tax fell sharply from 6.9% of the GDP in 2010 to 4.3% in 2016.

“Given very little fiscal space the Government is presented with, the prudent way forward is to expand the tax base to exploit the trickledown effect of the stimulus and to continue fiscal consolidation to curb expansion of the fiscal deficit. Strong consumer sentiment is vital for economic revival but sustaining it in the long-run requires structural reforms and fiscal discipline.”

It also pointed out that Sri Lanka was not the only country struggling with sluggish growth in South Asia. India, as of end June, has seen its GDP growth rate fall for six straight quarters. To spur growth, India introduced the biggest corporate tax reduction in 28 years in September 2019 which could cost Indian Rupees 1.45 t.

ICRA Lanka’s interviews with a cross-section of top business leaders in the country just before the fiscal stimulus revealed the heightened effective tax rates are one of the main factors impeding the profitability and growth of the corporate and finance sectors.

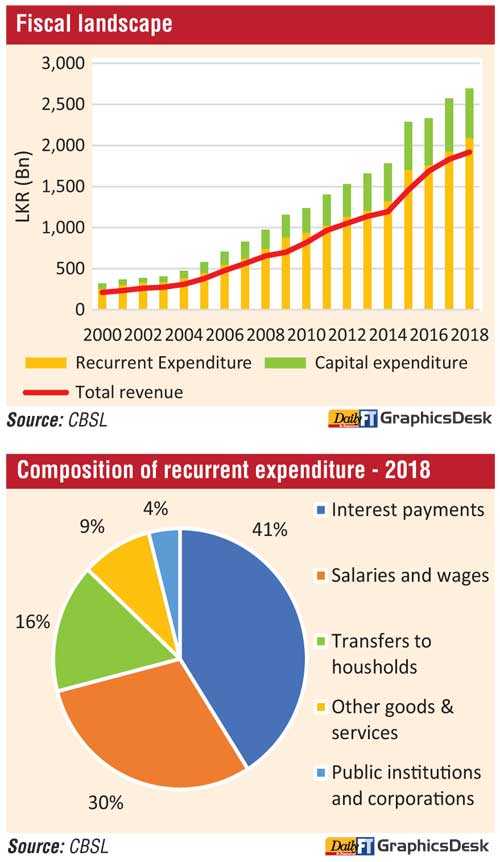

“The key problem faced by the Sri Lankan Government for past few decades is that its recurrent expenditure has been above the total revenue, thereby leading to accelerated debt formation. In the process, much-needed capital expenditure, which is critical for long-term economic growth, has not grown substantially,” the report said.

“Therefore, growth of recurrent expenditure should be curtailed to the maximum extent possible to avoid facing headwinds to economic growth. With exploding recurrent expenditure, Sri Lanka has very little fiscal space to reduce the expenditure side. Two largest components of recurrent expenditure, interest payments and salaries and wages, takes up about 71% of the whole item. Sri Lanka spent just over Rs. 500 billion, an amount roughly equal to the fiscal stimulus, on interest payments to treasury bond holders alone in 2018.”

Reducing interest payment component is extremely challenging amidst a widening fiscal deficit as government requires to continue issuing bonds. ICRA Lanka believes the Government should attempt to restructure debt to bring down the debt servicing cost.

“As much as 30% of the recurrent expenditure goes to pay salaries and wages for public sector employees. There were Rs. 1.4 million employed in the public sector by 2018, up 1% from the year before. It would be critical to control the state sector recruitment to stop further expansion of the salaries and wages component.”

Reducing the transfers to households will be difficult, but by improving the efficiency of public institutions and corporations, the Government can reduce the cost of transfers to State-Owned Enterprises (SOEs).

In this context, ICRA Lanka feels that the Government’s commitment to fiscal consolidation can be seriously undermined by a move such as removing fuel price formula.

“In 2018, the total Government revenue was Rs. 1.9 t. Going by the Government’s estimates, the cost of the tax cuts is about one fourth of the total Government revenue. Reduction in tax revenue is highly unlikely to be compensated by raising non-tax revenue in the short-run, therefore we expect the Government may consider raising some taxes to counterbalance the loss in revenue.”

Furthermore, increasing profitability of SOEs can also improve nontax revenue. The impact of the fiscal stimulus on the economy cannot be looked at in isolation. Given Sri Lanka’s external debt obligations scheduled for 2020 ($ 3.7 billion) and beyond, strengthening of rupee is required for reserve accumulation, the report added.

“More Government revenue means lesser requirement for monetary financing consequently preserving the value of the currency. Therefore, the importance of enhancing Government revenue in the light of current stimulus cannot be left to its own devices.”