Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 25 November 2025 03:05 - - {{hitsCtrl.values.hits}}

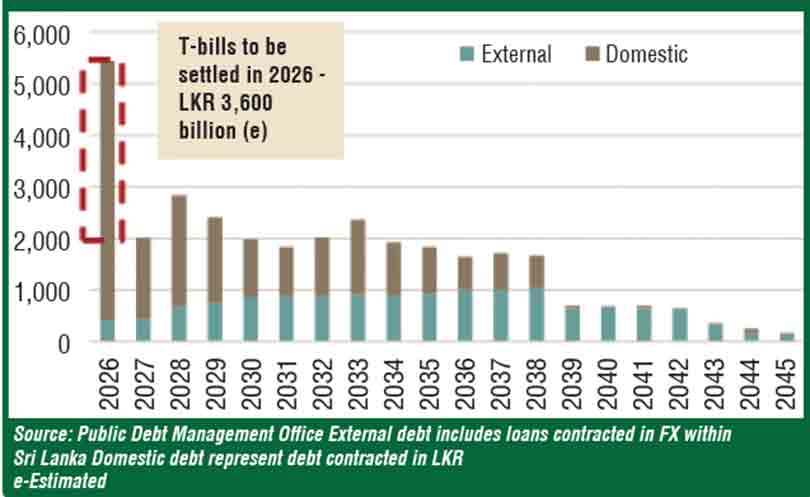

The Government’s Medium Term Debt Management Strategy 2026-2030 report warns that refinancing pressure is heavily concentrated in the domestic debt portfolio, even as external debt obligations appear more spread-out following restructuring.

The Government’s Medium Term Debt Management Strategy 2026-2030 report warns that refinancing pressure is heavily concentrated in the domestic debt portfolio, even as external debt obligations appear more spread-out following restructuring.

The report compiled by the Public Debt Management Office said the composition and maturity structure of domestic liabilities present the most immediate risks to liquidity and rollover management, despite improving market conditions.

Sri Lanka’s total Government debt stood at Rs. 30.8 trillion at end June 2025. Domestic debt accounts for 64% of the total, while external debt makes up the remaining 36%.

The debt to GDP ratio has fallen to 99.1 % in 2024 from 114.2% in 2022 due to restructuring and revenue driven fiscal consolidation under the IMF program.

The PDMO highlighted the size of short-term domestic instruments as a key vulnerability.

Treasury Bill stocks are estimated at Rs. 3.6 trillion at end 2025 and will come due in 2026.

“This concentration of short-term maturities underscores the need for effective revenue and cash flow management,” the PDMO said. Treasury Bill stocks were Rs. 4.09 trillion and Rs. 4.07 trillion at the beginning of 2024 and 2025 respectively and were refinanced.

Treasury Bonds dominate the broader domestic redemption profile, with maturities peaking at Rs. 2.15 trillion in 2028. Issuance shifted to short term maturities following the 2022 crisis, leading to a cluster of redemptions between 2027 and 2033.

The PDMO said investor appetite has begun to move back toward medium- and long-term maturities in the second quarter of 2025, reflecting improved market stability.

According to the PDMO, 12% of the total debt stock of Rs. 30.8 trillion comprises T-Bills and 48% is in T-Bonds as of September 2025.

“The shorter average time to maturity and the higher proportion of debt maturing within one year in the domestic segment present clear rollover risks,” the PDMO said. It added that efforts are underway to lengthen maturities and improve the structure of domestic liabilities.

In contrast, external debt shows lower near-term risk due to restructuring with the Official Creditor Committee and the China Exim Bank. Repayments have been smoothed across future years.

Sri Lanka has received capital grace periods until 2028, reduced interest rates and amortising repayment structures with final payments on restructured debt extending to 2043. The restructuring of international sovereign bonds extended average maturities by around six years.

Foreign currency debt accounts for 37.8% of total Government debt. Most is denominated in US dollars, with smaller shares in Japanese yen, Chinese Yuan and SDRs. The PDMO said exchange rate management, hedging and reserve build-up remain central to reducing FX risk.

The strategy for 2026 to 2030 sets out a shift toward deeper domestic financing.

The Government aims for 90% of borrowing to come from domestic sources by 2030, reducing domestic financing by 5% annually to balance domestic and external exposure in preparation for post 2030 external repayments.

The PDMO said it will also explore Samurai, Panda, Sukuk and syndicated loans while maintaining concessional borrowing where possible.

On the domestic market, benchmark maturities of 5, 8, 10, 12 and 15 years will be reopened and new maturities introduced. Inflation linked and other innovative instruments will support smoother refinancing.

The PDMO said it will widen the investor base and strengthen the primary and secondary markets for Government securities as part of its domestic bond market development plan.

Liability management operations will target refinancing risk and debt servicing costs across both domestic and external portfolios.

“We intend to manage the structure and risk profile of the existing portfolio proactively, including the use of currency swaps to reduce external currency risk,” the PDMO said.

The PDMO also plans to enhance transparency with upgraded debt bulletins, semi-annual data reports and a dedicated website. A monthly auction calendar will support predictable issuance.

While the MTDS offers a medium-term framework, the PDMO cautioned that data gaps, macroeconomic uncertainty, exchange rate volatility and a shallow domestic market continue to impact debt management.

It said improved coordination among fiscal, monetary and economic agencies is required to ensure consistency across policy fronts.

The PDMO said the strategy aims to strengthen debt sustainability by extending maturities, reducing short term debt and lowering the interest payment to revenue ratio. It added that effective implementation will be essential to maintaining stability and investor confidence over the next five years.

Sri Lanka’s external debt service profile over the next four years reflects rising obligations. Debt service in 2025 totals $ 2.45 billion, comprising $ 1.4 billion in principal and $ 1 billion in interest.

In 2026, scheduled payments amount to $ 1.2 billion million in principal and $ 931 million in interest. For 2027, repayments include $ 1.2 billion in principal and $ 893 million in interest. Obligations increase in 2028, when $ 2.13 billion in principal and $ 974 million in interest fall due.