Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 21 September 2018 00:00 - - {{hitsCtrl.values.hits}}

Central Bank Governor

Dr. Indrajit Coomaraswamy

- Pic by Upul Abeyasekara

By FT News Desk

Central Bank Governor Dr. Indrajit Coomaraswamy yesterday declared the rupee was under pressure more due to exogenous factors, but reassured it would ease as a follow up to ongoing stabilisation measures whilst being wary of overly aggressive propping up, saying past exercises led to doublewhammies.

The reassurances on the currency as well as insights to the challenges faced were shared by the Governor during his speech at the inaugural session of the Daily FT co-hosted 6th annual Cyber Security Summit yesterday at the Cinnamon Grand with over 400 participants from private and public sectors.

Dr. Coomaraswamy opted to comment on the recent dip of the rupee as the FT Summit was the first public event he was addressing since the currency had come under increased pressure.

He said the rupee’s dip was largely driven by three external developments whilst some of the characteristics of the domestic economy also contributed although the economy had been stabilising considerably.

One is the increase in US interest rates on a sustained basis following three revisions so far and fourth one anticipated in December. This the Governor said had resulted in large capital outflows from emerging markets back to the US, reversing the inflows out of the US experienced earlier due to low interest rates there and attractive options elsewhere.

However, he noted Sri Lanka hadn’t seen a major outflow though foreign investments had relinquished some of their positions from Government Securities and listed equity raising the demand for US dollars from the market as against the weak supply.

The second exogenous factor listed by Dr. Coomaraswamy was more geopolitical. One is the trade war between the major economies, US and China, with the former slapping higher tariff on $ 200 billion worth of more Chinese imports and the latter countering with a similar move on $ 60 billion worth of imports from US. The other is the tensions between US-Iran and within the Middle East.

“Due to the elevated uncertainty at global level, money and investors shift to safer havens i.e. US Dollar, the currency of the reserve of the international financial system, thereby strengthening the currency,” the Governor explained at the FT Cyber Security Summit, co-hosted by CICRA Holdings Ltd.

The third external factor is the rise in oil prices and since Sri Lanka is a net importer, there is pressure on reserves and exchange rate. “These are the three major reasons for the pressure on the rupee,” he added.

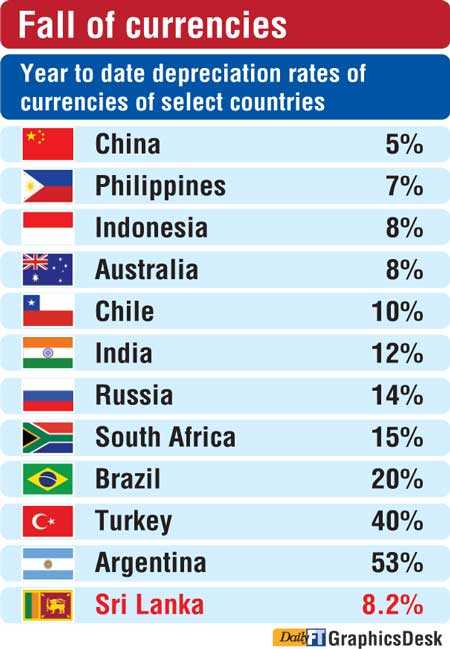

“Though Sri Lanka has made progress in terms of stabilising the economy, the external factors are too powerful and we don’t have the capacity to withstand without experiencing some pressure on reserves and exchange rate leading to depreciation,” Governor added.

It was also pointed out that countries with current account deficit in the balance of payments such as Sri Lanka are most vulnerable to these external shocks.

“The deficit aspects is our own doing due to wrong economic policies of the past which saw exports as a percentage of GDP shrinking to 12.4% by 2015 from 33% in 2000 and heavy foreign borrowings some in commercial terms and funding projects with low or no return,” Dr. Coomaraswamy recalled.

The Governor also strongly responded to queries as to why the Central Bank is not defending the falling rupee more aggressively. He revealed that past exercises of defending the rupee had disastrous effect and must remember the lessons.

According to him, in 2011/12 the then Central Bank administration spent a staggering $ 4.2 billion (current reserves are at $ 8 billion) to defend the rupee yet eventually the currency depreciated by 13.5%. Then in 2015 around $ 1.2 billion was spent but that failed to prevent the rupee from depreciating by 9%.

“So trying to spend large amount of our reserves to defend a particular (exchange) rate, in the end you up with a doublewhammy – depleting the reserves and eventually ending up with a depreciating rupee,”he added.

Dr. Coomaraswamy said that in that context, the Central Bank had of late been pursuing a flexible exchange policy with the rate more determined by the market and intervened selectively to smoothen out any sharp volatility and if necessary will get aggressively but not overly.

“We also haven’t been just sitting back but have taken a few more remedial measures,” he added.

Additionally, the Central Bank addressed the loss of foreign exchange due to the excessive import of duty free gold only to be smuggled to India where a 15% duty applies. He said gold imports which were around $ 250 million had ballooned to $ 600 million in 2017 and in early this year it was growing at a rate by which we would have ended with nearly $ 1 billion spent by end 2018. This prompted the Government to impose a 15% tax as a counter measure as gold smugglers were arbitraging with Indian situation.

The Governor also said that motor vehicles import was another big challenge on the reserves as they accounted for the two-thirds of trade deficit increase from $ 5.3 billion from last year to $ 6.4 billion this year. Duty on small vehicles was hiked and as a further measure the Central Bank on Tuesday imposed 100% Letters of Credit margins deposit requirement on vehicle imports.

“In our toolkit we have several other options too, such as changing the duration for repatriation of export proceeds and revision of the interest rates to even out the differences between US rates and Sri Lanka. However the Monetary Board is reluctant to increase the interest rates as of now because the growth of the economy is subdued though there is an uptick witnessed in the second quarter,” Dr. Coomaraswamy pointed out.

“If necessary we have that tool (adjusting the interest rate) but as I said earlier that is the option we are reluctant to take because we don’t want to slow the economy at this point of time,” he reiterated.

“For Sri Lanka the best buffer and resilience is develop exports to boost reserves and attracting Foreign Direct Investment,” added the Central Bank Chief during his speech at the FT-CICRA Cyber Security Summit yesterday where 17 experts, foreign and local, shared key insights to latest threats and solutions for cyber security.

Defence Secretary Kapila Waidyaratne PC was the Chief Guest.

The Summit which was preceded by a CEOs Forum on Wednesday drawing over 100 participants, was supported by Cisco as the Principal Sponsor, Visa as the Strategic Partner and Infowatch and Tufin as Co-Sponsors. LankaPay is the Official Payment Partner while Dialog is the Telecommunication Partner. Sri Lanka Insurance is the Insurance Partner. The Ministry of Telecommunication and Digital Infrastructure and ICT Agency of Sri Lanka have endorsed the event. Cinnamon Grand is the Hospitality Partner of the summit while Triad is the Creative Partner. The Electronic Media Partners of the event are TV Derana, FM Derana, Ada Derana and Derana24X7.