Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 27 December 2023 00:00 - - {{hitsCtrl.values.hits}}

The extent of the economic crisis since last year is telling on households and has now been documented officially via a comprehensive survey done by the Department of Census and Statistics (DCS).

Released last week, the survey assessed the impact of the economic crisis on the education sector; on employment; on persons’ income; on household income and expenditure and its coping; on health; on the indebtedness of the households and household food consumption.

As per the survey, the impact of the economic crisis on household finances, including both income and expenditure is significant. “This crisis has led to significant changes on how households manage their finances. Many households have experienced a decrease in their income due to various economic factors that has subsequently affected their spending pattern,” DCS said.

It said the economic crisis has significantly impacted household income and expenditure patterns, compelling households to make strategic adjustments and implement coping mechanisms to manage their financial stability in these challenging times.

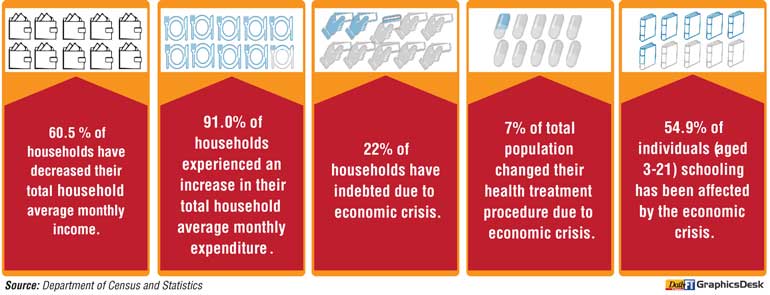

As per the survey a majority, comprising 60.5% of households, have experienced a decrease in their total income as a result of the economic crisis.

The survey findings indicate that 54.9% of households in Sri Lanka are currently indebted. It highlights that over half of the households in Sri Lanka have some financial obligations or outstanding debts they are managing or repaying. This level of indebtedness could have implications for household finances, budgeting, and financial stability, especially during periods of economic challenges or uncertainties.

Giving context, the DCS said during an economic crisis, household indebtedness can sharply rise due to the hardship experienced by households facing income reductions, job losses, and financial uncertainties. This often compels them to borrow more to cover essential expenses, leading to increased debt burdens.

Repayment challenges emerge due to the inability to meet financial obligations, potentially resulting in late payments, defaults, or reliance on credit. High levels of household debt induce stress and financial strain, impacting mental well-being. The crisis might also lead to adverse consequences such as foreclosures or bankruptcy filings as households struggle to manage their debts. Efforts to manage this situation typically involve policies aimed at debt relief, financial education, and economic stimulus measures to mitigate the impact on households and support for economic recovery.

The highest proportion of indebtedness is from mortgage matters (31.0%), followed by banks (21.9%) and money lenders (9.7%). Notably, 22.3% of indebtedness arises from loans taken to meet daily food needs, highlighting severe financial constraints in fulfilling basic necessities.

The survey revealed that 21.9% of the households nationwide had implemented crisis strategies to address the scarcity of food or financial constraints. This was followed by stress strategies, and it is about 19.2%. Notably, in the rural sector, this crisis strategy used proportion rose to 22.8% of households.

During the income decline, households employed various coping strategies to mitigate the impact of the economic crisis. The most commonly reported coping strategy, utilised by 6.6% of households experiencing reduced income, was «Turning to a secondary job or an additional source of income.»

Conversely, the least reported coping strategy among these households was «Loans, mortgages, or seeking food/money from others.» It›s noteworthy that a substantial majority, comprising 73.6% of households facing reduced income, did not adopt any specific coping strategy during this period.

DCS said the survey aimed to provide a detailed account of the strategies adopted by households to navigate economic challenges. It said the data collected through this survey will be invaluable in informing government policies, social interventions, and support mechanisms to alleviate the hardships faced by households across the country.

DCS said the economic crisis has brought about diverse effects on household income and expenditure, prompting the adoption of various coping strategies to mitigate its impact.

DCS recalled that Sri Lanka is facing one of its most challenging economic crises since independence in 1948. The beginning of this can be traced to the Easter Sunday attacks in 2019 and further exacerbated by the COVID-19 pandemic. In the face of this economic uncertainty, the Sri Lankan Government undertook a series of measures aimed at stabilising the situation. The economic downturn trickled down to households, where the real impact of the crisis became most evident. Many Sri Lankan households found themselves grappling with a range of challenges in managing their daily activities. These challenges extended to income management, fulfilment of commitments, and ensuring the well-being of family members. It was in recognition of the importance of understanding how households were coping with the crisis that the DCS initiated the comprehensive survey.

The survey aimed at understanding how the economic crisis is affecting individuals within the country. This survey is specifically designed to gauge how households are responding to this crisis. Its findings help evaluate the various strategies households are using to cope with the situation.

Additionally, it assesses the alterations in access to crucial services like healthcare, education, and overall living standards brought about by the crisis. By shedding light on the effects of the economic downturn on households, the survey provides insights into the coping mechanisms employed by these households and the shifts in their access to essential services.