Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 15 September 2025 04:27 - - {{hitsCtrl.values.hits}}

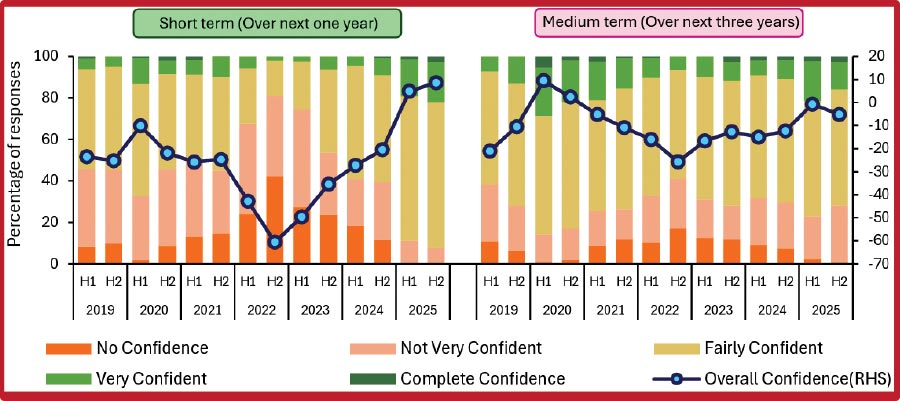

Confidence in Sri Lanka’s financial system improved in the short term but slipped slightly in the medium term, according to the Central Bank of Sri Lanka’s (CBSL) latest Systemic Risk Survey (SRS) for the second half of 2025.

The survey found that respondents were more confident about stability over the next 12 months compared to the previous round, while medium-term confidence over the next three years saw a marginal decline. Overall, the probability of a high-impact negative event was seen as lower in the short term, but slightly higher in the medium term.

The CBSL noted that “global macroeconomic risks” had increased significantly amid rising geopolitical tensions and a challenging global economic outlook.

Fitch Ratings last week said it expects global GDP growth to slow to 2.4% in 2025, down from 2.9% in 2024 and below trend levels. US consumer spending and job growth have already weakened, with tariffs adding inflationary pressure that is likely to feed through later this year. It expects the Federal Reserve to cut rates twice in 2025 and further in 2026. In China, fiscal easing and a weaker currency are supporting exports, though domestic demand remains weak. In Europe, growth is set to stagnate in 2H 2025, with limited momentum despite German fiscal easing.

The agency highlighted that US effective tariff rates now average 16%, dampening growth prospects globally, while long-term Bond yields in major economies remain under upward pressure.

The CBSL’s SRS, introduced in 1H 2017 and conducted biannually by the Macroprudential Surveillance Department, is used to monitor market participants’ perceptions of risks to the Sri Lankan financial system. The latest round, covering 2H 2025, was conducted between 27 June and 20 July with the participation of 146 firms.

The survey sample included risk officers from licenced banks, finance companies, a specialised leasing company, insurance firms, unit trust managers, margin providers, underwriters, stock brokerage firms, licenced microfinance companies, and rating agencies.

The survey reflects trends in banking sector loans to the private sector.

Total private sector borrowings increased by Rs. 201.5 billion in July 2025, resulting in the outstanding amount crossing Rs. 9.5 trillion during the first seven months of the year. However, the new credit in July was lower than the Rs. 221.5 billion recorded the previous month.

The CBSL’s banking sector’s Willingness to Lend Index released in August showed that it had grown in Q2 2025, continuing a nine-quarter upward trend to reach a five-quarter high.

The CBSL said in its Credit Supply Survey: Trends in 2Q and Outlook for 3Q 2025 that the increasing trend is expected to continue during Q3 2025 due to favourable liquidity positions of banks, economic revival, and a positive economic outlook.

However, the Index value shows a dip from 59.6 in Q2 2025 to 41.4 in Q3 2025, lower than the previous three quarters and Q4 2024’s Index value of 47.5.