Monday Feb 23, 2026

Monday Feb 23, 2026

Saturday, 19 July 2025 01:13 - - {{hitsCtrl.values.hits}}

The Central Bank has issued a new directive, revising Loan-to-Value (LTV) ratios for vehicle financing, effective 18 July 2025.

The Central Bank has issued a new directive, revising Loan-to-Value (LTV) ratios for vehicle financing, effective 18 July 2025.

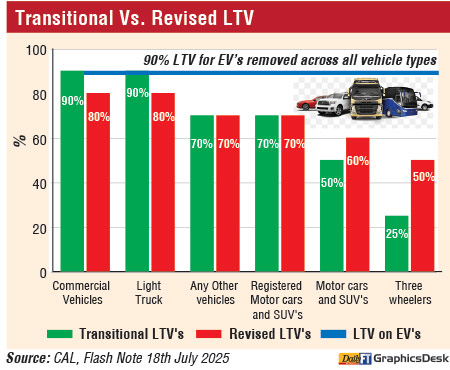

Notably, the preferential 90% LTV cap previously applicable to electric vehicles (EVs) has been removed, bringing EVs under the same financing thresholds as conventional vehicles.

The move is expected to tighten credit access for EV purchases, especially impacting lending by Licenced Commercial Banks (LCBs), which have had greater exposure to EV financing.

According to the updated directive, upward revisions in LTV ratios for unregistered motor cars, SUVs, vans and three-wheelers are likely to improve affordability for consumers in these categories. This development is seen as providing a moderate improvement for both LCBs and Licenced Finance Companies (LFCs) with exposure to these vehicle segments.

The revised LTV ratio for unregistered motor cars has been increased from 50% to 60%, while three-wheelers now see a significant rise from 25% to 50%. These changes are expected to stimulate demand and ease consumer entry into ownership, helping to partially offset any negative impact from LTV tightening elsewhere.

As per an analysis by Capital Alliance (CAL), LFCs however are likely to feel pressure from the reduction in LTV ratios for commercial vehicles, a segment where they traditionally hold substantial market share. Given the larger loan sizes typically involved in commercial vehicle financing, the downward revision may reduce credit flow to the segment and strain asset growth in the near term.

The removal of the higher LTV allowance for EVs is anticipated to have a limited downside for LFCs, which historically have had minimal exposure to EV financing. On the other hand, LCBs which have driven most EV-related lending thus far may face a more pronounced impact from the policy shift.

Following the Government’s decision to ease restrictions on vehicle imports in February, Sri Lanka has registered over 73,000 new vehicles during the first five months, pushing the country’s total vehicle population to 8,528,002 (https://www.ft.lk/front-page/First-five-months-vehicle-registrations-top-73-000/44-777928).

As per the latest data by the Department of Motor Traffic, a total of 73,489 new vehicles and electric car registrations were made in 2025. The newly registered vehicles include 7,542 cars, 58,943 motorcycles, and 1,666 three-wheelers.

Additionally, 239 buses, 156 special-purpose vehicles, 1,817 land vehicles, and 1,123 dual purpose vehicles were added to the nation’s fleet from January to May 2025. With these additions, the total number of motor cars in Sri Lanka has reached 912,871. The motorcycle population has grown to 4,981,211, while the number of three-wheelers stands at 1,186,220. Dual-purpose vehicles registered are 452,819, while land vehicles have increased to 403,096 and the total number of buses has climbed to 114,362.

The Government has set a target of Rs. 450 billion in total revenue from vehicle imports for the year 2025. During the first four months, the Government has generated Rs. 136 billion in revenue from motor vehicle imports (https://www.ft.lk/top-story/Govt-earns-Rs-136-b-from-vehicle-imports-in-4-months/26-777355).

The Committee on Public Finance (CoPF) last month raised serious concerns over how used-vehicle imports are being valued; warning that the Government could be losing billions of rupees each year due to outdated Customs practices. The Committee called for an urgent review of the valuation procedures and for authorities to close legal loopholes that could be enabling significant revenue leakage from the sector (https://www.ft.lk/front-page/CoPF-flags-massive-revenue-losses-from-vehicle-import-valuation-practices/44-778385).