Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 8 December 2025 05:00 - - {{hitsCtrl.values.hits}}

The Central Bank of Sri Lanka (CBSL) as the regulator has directed all licenced banks to implement a series of relief measures for individuals and businesses whose income or operations were directly affected by the recent cyclonic-related natural disasters.

The directive, issued through Circular No. 04 of 2025 on 5 December, follows proposals submitted by the Sri Lanka Banks’ Association and aims to support borrowers without undermining financial system stability.

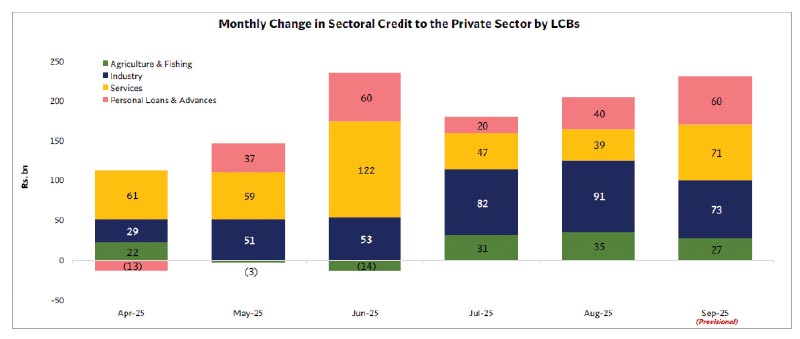

In the first nine months of this year, credit to private sector expanded by Rs. 1.36 trillion as per the CBSL data, reflecting a growth of 22.1%. In the past four months, from June to September, private sector borrowing averaged over Rs. 200 billion.

The circular instructs banks to provide the specified relief measures upon receiving written or electronic requests from affected borrowers by 15 January 2026.

According to the directive, banks are required to offer temporary debt relief by suspending repayments of capital and interest on existing credit facilities for a period of three to six months on a case-by-case basis.

During the suspension period, banks have been told not to charge interest above the applicable contract rate and to ensure that no interest is charged on deferred interest payments.

Banks are also required to extend new loan facilities to affected individuals and businesses, subject to repayment capacity assessments. These loans must include a grace period in which repayment begins only after at least three months from the end of the suspension period on existing facilities.

For new loans with a tenor of up to two years, banks may charge a maximum fixed interest rate of 9% p.a. or the borrower’s applicable contract rate for overdrafts or loan facilities as at the date of the circular, whichever is lower.

New loans with longer tenors may carry interest rates linked to the Average Weighted Prime Lending Rate after two years, as specified in the loan agreement.

The CBSL has also directed banks to suspend charging cheque-return fees, stop-payment charges, late payment fees, credit restructuring or modification fees, and penal interest on all credit facilities of affected borrowers until 31 January 2026.

Where such charges are automatically generated, banks must refund the amounts to the relevant accounts within three business days.

Banks have further been instructed to clearly communicate the terms and conditions of any loan restructuring or rescheduling to borrowers, including a breakdown of capital, interest, and other charges, and to obtain borrower consent in writing or electronically.

If a bank rejects a request for relief, it must inform the borrower in writing, provide reasons, and advise that an appeal may be lodged with the Director of the Financial Consumer Relations Department of the CBSL.

The Circular also advises banks not to reject new loan applications solely on the basis of adverse Credit Information Bureau (CRIB) records.

The CBSL notes that these measures may be used in addition to disaster relief initiatives implemented by the Government to support the restoration of livelihoods and the revival of affected businesses.