Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 15 October 2025 00:00 - - {{hitsCtrl.values.hits}}

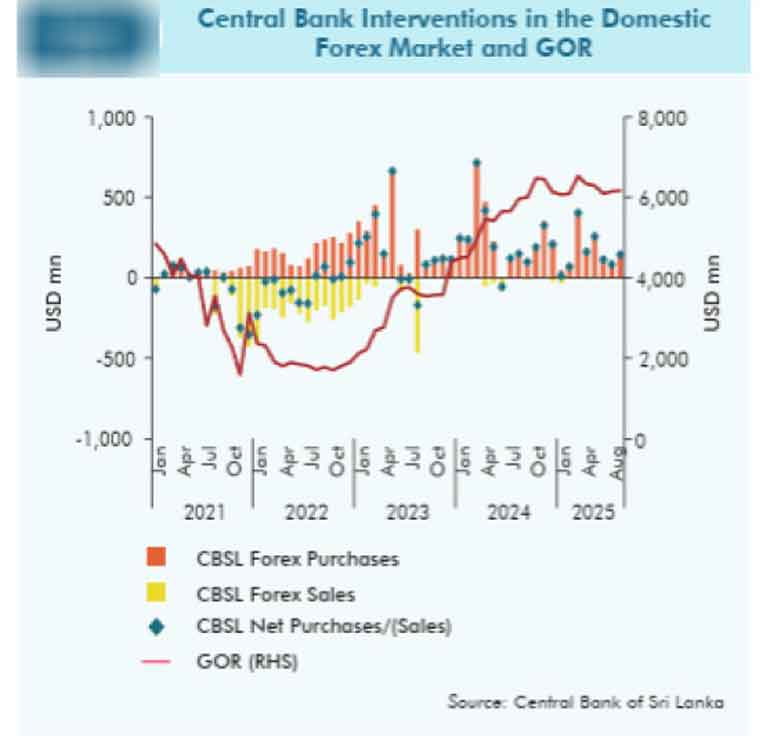

The Central Bank of Sri Lanka (CBSL) remained a net purchaser of foreign exchange from the domestic forex market during the first eight months of 2025, continuing the positive trend seen in 2023 and 2024, according to the Financial Stability Review 2025 released last week.

From January to August 2025, the CBSL absorbed $ 1.3 billion from the domestic forex market and injected $ 63.3 million, resulting in a net absorption of $ 1.24 billion. This compares with $ 2 billion recorded during the corresponding period in 2024.

Gross Official Reserves stood at $ 6,164.2 million at the end of August 2025, slightly above the $ 6,122.0 million reported at the end of 2024.

The report noted that this accumulation occurred despite rising import demand and ongoing external debt servicing by the Government and the CBSL.

“To sustain this positive trend amidst increasing import demand, scheduled repayment of external Government debt, and the CBSL’s foreign currency obligations, consistent foreign currency inflows will be essential,” the report stated.

The review said liquidity conditions in the domestic forex market improved, reflected by a narrowing bid-ask spread for the USD/LKR rate.

This downward momentum continued from 2024, indicating reduced volatility and lower transaction costs. A temporary widening of the spread in April 2025 was attributed to market uncertainty following the announcement of reciprocal tariffs on Sri Lankan imports by the US and seasonal import-related pressures during the festival period.

The CBSL noted that maintaining improved liquidity through stronger export earnings, tourism receipts, and workers’ remittances will be critical for sustaining confidence and attracting foreign investment.

Interbank foreign exchange transaction volumes also strengthened during the review period. In January 2025, the market recorded the highest monthly volume since October 2020, reaching $ 1,668 million, and later increased to $ 1,722.9 million in August 2025. The surge early in the year was likely due to the anticipated resumption of vehicle imports and hedging activities amid expectations of increased demand for foreign exchange, the CBSL said.

Forward transactions rose 22% compared to the same period in 2024, reaching $ 622 million in August, or 36.1% of total transactions for the month.

Spot transactions increased by 19%, TOM transactions by 39%, and cash transactions by 85%, reflecting stronger liquidity needs at various points during the year.

The one-month forward premium continued its declining trend from 2024, indicating stable expectations in the forex market.