Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 7 November 2025 00:00 - - {{hitsCtrl.values.hits}}

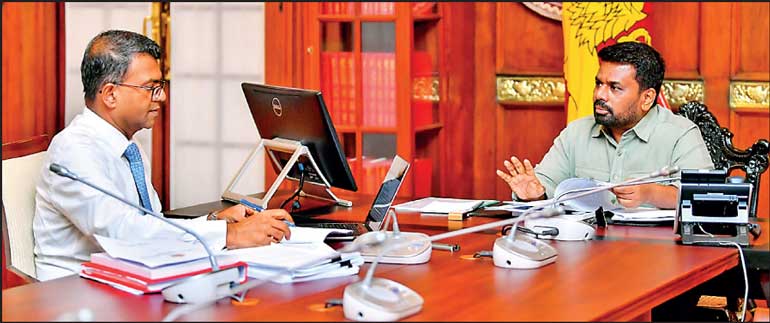

President and Finance Minister Anura Kumara Disanayake (right) along with Treasury Secretary Dr. Harshana Suriyapperuma yesterday discuss the final touches to the Budget 2026 to be presented in Parliament at 1:45 p.m.

President and Finance Minister Anura Kumara Disanayake will today afternoon unveil his Government’s first fully fledged Budget amidst pressure to reignite economic growth and incomes via higher investments and exports which will also generate new jobs.

Analysts opined that the phase of natural growth after two years of contraction and stability was over and the country needs a fresh round of stimulus.

Despite having the best-ever macroeconomic indicators post-Independence and political stability with a Government intent on good and clean governance, foreign investors haven’t queued up to tap prospects in Sri Lanka internally, as well as regionally—especially the Indian market and elsewhere.

However, proving the ground situation is different, the Board of Investment (BOI) last month revealed that up to September, the realised Foreign Direct Investment (FDI) was up 138% year-on-year (YoY) to $ 827 million. However, it was inclusive of equity capital of $ 133 million, reinvested retained earnings of $ 132 million, intra-company foreign borrowings of $ 231 million, and long-term commercial loans of $ 331 million.

Some critics said that Sri Lanka needs fresh green field FDIs and pointed to Disanayake appointing proven business leader Hanif Yusoof as special Presidential envoy for that task as proof of the bigger challenge.

In that context, the 2026 Budget is expected to announce new incentives to boost investments despite strictures from the International Monetary Fund (IMF) to desist. The Government is speculated to offer relief on the tax burden on the middle-income segments as well, though rates won’t be altered.

In September, a World Bank report slammed Sri Lanka’s Value Added Tax (VAT) hike as among reasons for a dramatic rise in poverty.

Previously, the IMF had maintained that the Government can be flexible as long as it meets Extended Fund Facility (EFF) program targets. The confidence within the Government to be flexible also stems from the robust Government revenue so far in 2025. The Inland Revenue Department (IRD) has exceeded its tax revenue target for the first nine months of 2025, collecting 102% of the estimate. It collected Rs. 1.64 trillion by the end of September, against an expected Rs. 1.61 trillion, reaching 75% of its full-year goal of Rs. 2.19 trillion. Customs too has marked its highest collection of Rs. 2 trillion by end-October and is poised to surpass the 2025 target of Rs. 2.115 trillion.

Other analysts emphasised that the Government needs to step up ease of doing business, liberalisation, and reforms, which are more credible measures to boost investments than mere incentives.

Given the poor performance of public investments and capital expenditure in 2025, they also stressed that President Disanayake must come up with firm measures to speed up decision-making and implementation of proposals by bureaucracy.

The disbursement of the sixth tranche worth $ 347 million under the IMF is pending approval from the IMF Executive Board and will depend on the 2026 Budget successfully passing in Parliament and meeting required criteria, with a potential release scheduled for December 2025.

Expectations from equity investors appear to be positive. The Colombo stock market yesterday surged past the 23,100-points mark and gained by 159 points ahead of the Budget 2026 presentation.