Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 28 October 2021 00:00 - - {{hitsCtrl.values.hits}}

Seeds for a smart culture of financial management

Whether you take a personal or a societal viewpoint, smart saving and investing isn’t just a process. It’s a culture, and as ‘lifestyle inflation’ is a crucial issue today, what would it take to develop a culture of wise savings and investing? Improvement of financial literacy and reforming the perspective of financial management principles and its basic fundamentals, such as investing and saving.

Investing and saving are vital concepts for establishing a solid financial foundation, but they are not the same. While both can help you build a more secure financial future, it’s important to understand the distinctions and know when to save and when to invest.

What is saving?

Savings is the amount that is kept aside from your current earnings without being utilised for compensation. It’s the act of setting money aside for a future expense you anticipate. When you decide to save money, you have the cash available relatively quickly, even to use immediately. Bank savings and deposits are popular saving options but there could be a significantly lower interest rate benefit with inflation.

What is investing?

Investing consumes current consumption and uses it to earn future wealth. You would be setting money aside for future use in investing as well, but when you decide to invest, you are exploring the opportunities to achieve a higher profit in exchange for more risk. Stocks, bonds, mutual funds and exchange-traded funds (ETFs) are common investment avenues.

Benefits of investing

Savings may appear to be a safer option than investing, but it will almost certainly not result in the highest accumulation of wealth over time. Asset growth, substantially better returns/profits than savings accounts, receiving capital gains, and the ability to use as collateral are just a few of the advantages of investing.

Why the stock market?

When it comes to different types of investments, the stock market is often regarded as one of the best options available for individual investors. But the majority of people avoid the stock market, because they do not understand its fundamentals, or they believe in the myth that the stock market is too risky. While investing may seem difficult to grasp at the initial stage, there are simple ways to begin. The first step is to gain a better understanding of investing and why it may be the best option for your financial future.

The best thing about the stock market is that buying stocks today in a digitalised age is a simple and affordable investment avenue available for people from all walks of life. Whether you are a newcomer, a long-term investor, or someone who is simply enjoying a good growth story, the stock market will give you options to explore.

Potential gain with stocks

The primary advantage of investing through the secondary market is that investors get the opportunity to buy and sell securities to achieve higher returns. Smart investors can take advantage to buy undervalued securities due to market fluctuations and sell the securities at a profit when they go up in value. You also have the option to buy securities that pay good dividends and create a stream of income irrespective of market price movements.

Understanding the risks involved

The main difference between investing and saving is the measure of risk taken to take maximum advantage. Investing in securities involves taking risks as security prices can go up as well as down and therefore is subject to uncertainty of returns. Hence an investor should be prepared to accept volatility or change in the value of the principal invested in securities and dividend payments. Before buying shares you need to decide what level of risk you are prepared to take.

The equity investor is usually compensated for this uncertainty or risk by better returns than any other asset class, as investment value grow over time, provided the investor follows prudent investment principals. People invest in equities of companies and undertake entrepreneurial activity as there is tremendous long-term value creation in properly governed companies.

Choose wisely and learn intently

Diversify your financials and choose the right approach for you at the right time to reap personal financial freedom. Therefore, proper understanding and gathering correct knowledge is the key for a successful financial portfolio. Especially with share investments, you have to be prepared to ‘do the homework’. This means you have to keep abreast of what’s happening in the country, industry and elsewhere which may affect your investment.

It is imperative that investors follow credible research material and make their own investment decisions. Investors need to be financially literate, have the time to read and understand company research reports and financial reports to invest wisely.

Familiarise yourself with the manner in which the share market moves just by observing it via the CSE website (www.cse.lk).

Getting started with CSE

The Colombo Stock Exchange (CSE) operates the only stock market in Sri Lanka and is responsible for providing a transparent and regulated environment where companies and investors can come together. CSE has witnessed a significant growth over the years providing a viable platform for all stakeholders.

Investing in securities listed on the CSE can be done by simply opening a Central Depository System (CDS) Account and you can now open a CDS account at the comfort of your home via the CSE mobile app which is a one stop hub navigating you through the investment journey.

For questions or comments email [email protected].

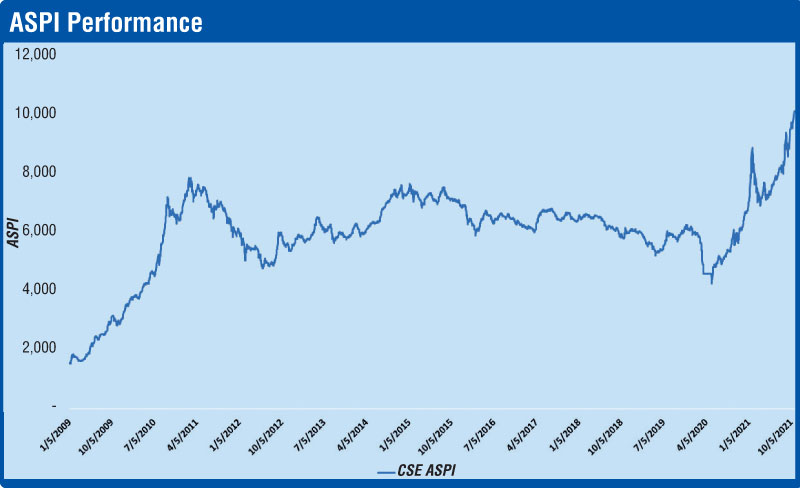

The benchmark All Share Price Index (ASPI) of CSE is one of main indicators of growth and market performance of CSE. Compound annual growth rate (CAGR) of ASPI from 2009 to 2021 October is recorded as 17.15%.