Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 29 May 2025 14:22 - - {{hitsCtrl.values.hits}}

By Securities and Exchange Commission

of Sri Lanka

Sukuk

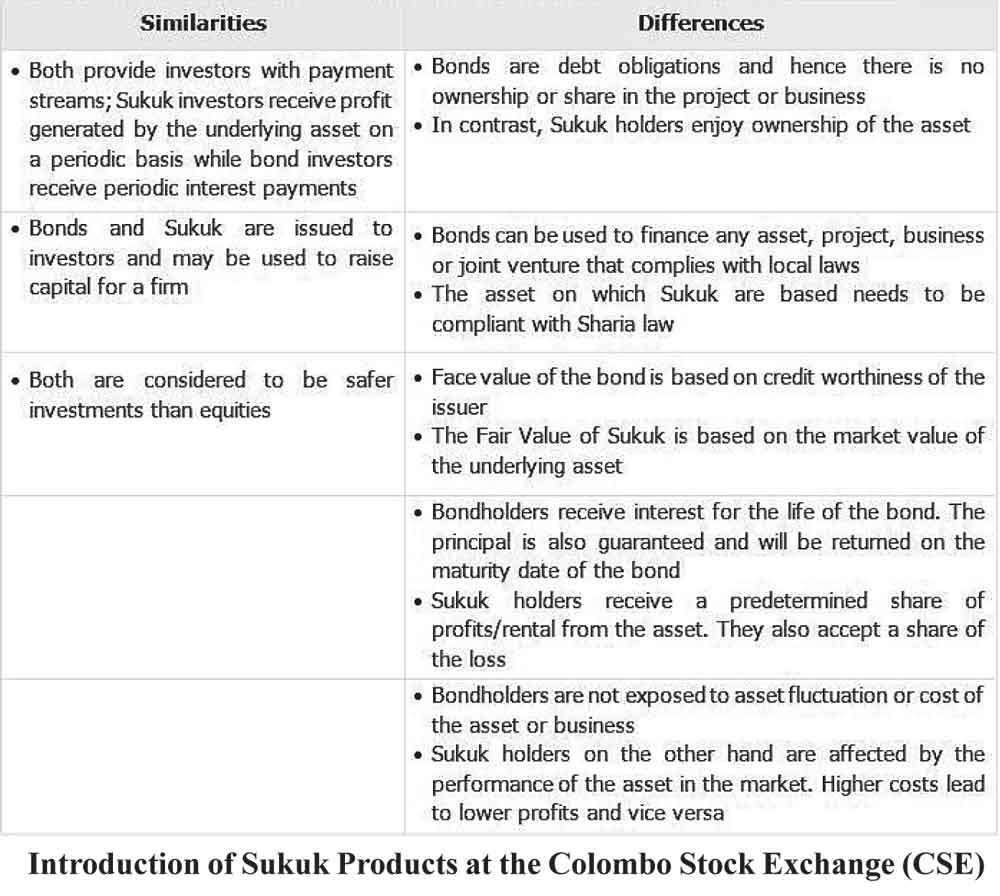

A Sukuk is a financial instrument similar to conventional debt securities and is linked to an underlying asset (normally tangible). From the perspective of investors, holding a Sukuk represents partial ownership of the relevant asset. Sukuk exist because in Islamic finance, the charging or receiving of interest is prohibited; under Shariah, an investor should realize no profit or gain merely for the employment of money.

Whereas conventional bonds evidence a debt owed by the issuer to the bondholders, sukuk certificates evidence the investors’ ownership interest in the underlying sukuk asset, which entitles them to a share of the income generated by that asset. However, in practice, the contractual structure is such that the return is predetermined and the dominant risk is the credit risk of an ultimate obligor. They are thus very similar to conventional debt securities in economic terms.

The underlying Sukuk assets must be Shariah-compliant, as must the use of the Sukuk proceeds. The assets or businesses underlying the Sukuk cannot be related to gambling, manufacture or sale of tobacco-based products or related products, conventional banking amongst other things.

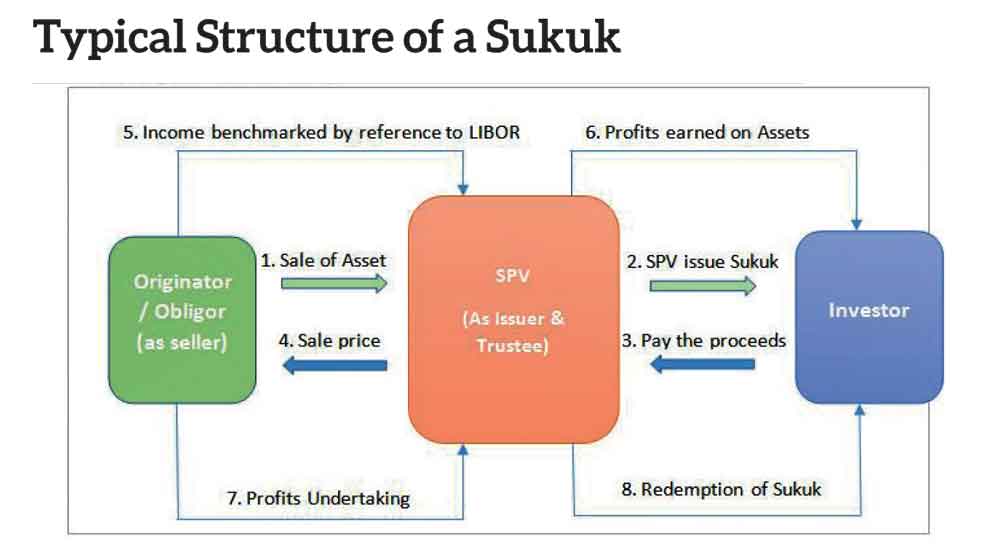

The nature ofSukuk structures vary. A few examples of Sukuk structures include, Ijarah, Murabaha, Salem, Wakala and Mudaraba. However, typically, a company that requires capital (referred to as the “originator”) establishes a Special Purpose Vehicle (SPV) and sells assets to the SPV. This SPV issues Sukuk certificates that are sold to the investors. The originator then contracts to use the assets in its business, for example, byleasing them back; the payments received for this provide the return to the investors. It also contracts to buy back the assets at the end of the period. A well-known variation on this structure involves transferring the beneficial but not the legal ownership of the underlying assets.One way of doing this is for the originator to grant the SPV a long lease over the assets (e.g. 15 years) and to lease them back for a shorter period (e.g. 5 years).

Sukuk may be issued in a domestic or foreign currency (usually USD). Where they are aimed at an international market it is common for them to be listed on more than one exchange; Kuala Lumpur, Dublin and Dubai are popular listing venues for non-local issuers. Sukuk vary in tenor; short-termandwith durations in excess of 10 years. However, the majority of Sukuk issued up until now have a maturity of three or five years.

Similarities and Differences between Conventional Bonds and Sukuk

At a time when there is a growing appetite and demand for ICMPs from investors and, with the success of other jurisdictions entwining the product into the Capital Market framework, by introducing a product such as Sukuk at the CSE, Sri Lanka would be able to tap into the much needed foreign funds as the product offers investment opportunities to groups who are interested in Shariah compliant investment options,especially from the Middle Eastand source it for development goals through the Capital Market framework.

In the above backdrop,the Secretariat obtained in-principle approval from the Commission for introducing ICMPs to the Sri Lankan Capital Market. Thereafter, subsequent to conducting a market survey to identify demand for the product, technical experts sourced through the Capital Market Development Program of the ADB in consultation with the SEC and the CSE formulated the policy and regulatory framework for introducing Sukuk products which was approved by the Commisson.

At this juncture, giving due consideration to the fact that Islamic Finance is a specialist area of expertise, and observing that the professional services provided by the Shariah Scholar attributes to the product’s credibility and, enhances its attractiveness amongst investors seeking Shariah compliant capital market products, the SEC recognized a “Shariah Scholar” who provides the service of certifying the Shariah compliance of ICM Products to be listed on the CSE in terms of the Listing Rules as a Supplementary Service Provider under the SEC Act No. 19 of 2021 and published Guidelines for the same. As per the published Guidelines, the SEC requires an issuer seeking to list ICM products at the CSE to obtain certification from three (3) Accredited Shariah Scholars, confirming that the product is Shariah compliant for investment and include constituents such as duties of a Shariah Scholar, qualifications and experience, requirement to submit reports and maintain records, requirements for Governance and conflict of interest and fit & proper criteria. Thereafter following a standard selection process that also consisted of an interview, the SEC approved a list of six (6) Accredited Shariah Scholars to be recognized as Supplementary Service Providers under the SEC Act No. 19 of 2021 and further via Directive dated 2nd May 2024, instructed the CSE to covey same to any entity that wishes to issue ICM products to engage any three (03) of the approved list Scholars for the purpose of obtaining the sign off for the Shariah Compliance Certificate for the product.