Friday Jan 09, 2026

Friday Jan 09, 2026

Wednesday, 16 August 2023 00:00 - - {{hitsCtrl.values.hits}}

The post-pandemic boom that helped the global container port sector recoup COVID-induced volume losses, started to fade in 2022.

The post-pandemic boom that helped the global container port sector recoup COVID-induced volume losses, started to fade in 2022.

For the world’s container ports, this meant a return to the days of moderate demand growth — a trend that had become a firm fixture for the industry pre-COVID.

The 100 ports featured in our latest rankings count achieved combined volume growth of 1.5% in 2022, with total liftings stacking up to 685.8m teu.

This compared to the 7.2% increase reported in 2021, making it the weakest growth level — the post-COVID year aside — seen by the world’s largest container ports since the fallout of the global financial crisis back in 2009.

China’s strong showing and resilient Middle East economies provided at least some relief to 2022’s otherwise subdued growth environment, helping offset the demand shortfall from a post-pandemic hangover — one felt most notably in Europe and across the Americas.

Of course, the plus point of a more moderate demand picture was that it granted ports — and container shipping in general — much-needed respite from the chronic congestion that had choked supply chains throughout 2021 and a large chunk of 2022.

With one challenge over, however, another began. Indeed, the operational landscape for the world’s top container ports did not get any easier in 2022.

Russia’s invasion of Ukraine at the start of the year triggered a massive shock to a global economy still reeling from the effects of the worst pandemic in a century.

Energy and food prices skyrocketed amid a supply squeeze, doing little to lift the lid on inflationary pressure or quell sky-high interest rates in the Western world.

Consumers have been hit hard — and so too has the demand for consumer goods.

For the elite container ports, the turmoil in Eastern Europe further dampened an already bleak demand setting and quashed any hopes of a quick return to pre-pandemic norms.

For the elite container ports, the turmoil in Eastern Europe further dampened an already bleak demand setting and quashed any hopes of a quick return to pre-pandemic norms.

Considering the sheer strength of the current economic headwinds, the latest forecasts — at the time of writing — by industry analysts Drewry indicate that the global container port sector is set to post a sluggish growth figure of around the 1% range for 2023.

Top 10

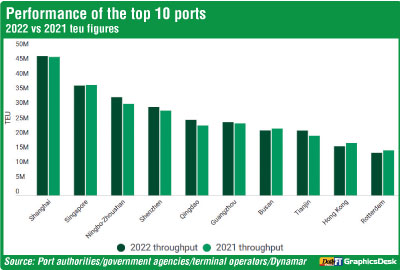

As for 2022, perhaps the least surprising result was that Shanghai, China’s container port behemoth, once again crowned the Lloyd’s List rankings, chalking up its 13th consecutive year at the top of the tree.

A sight to behold, Shanghai’s colossal complex moved 47.3m teu during 2022, edging ever closer to the quite remarkable 50m teu mark, as it continued to carve out a near unassailable position.

Despite fairly subdued volume growth of just 0.6% — having taken a significant hit by COVID-induced lockdowns in early 2022 — Shanghai managed to claw back traffic in the second half of the year to extend its lead over nearest rival Singapore. The gap between the pair now stands at more than 10m teu.

However, despite posting a drop of 0.5% in throughput, second-placed Singapore did weather the dual storm of global supply chain disruption and the macroeconomic uncertainties better than most of its regional peers and competitors — most notably Port Klang, Tanjung Pelepas, Busan and Hong Kong.

Unmoved in third place is China’s second-largest box facility, Ningbo-Zhoushan, which was again not spared the country’s draconian lockdown measures.

Yet Shanghai’s loss was the dual port of Ningbo-Zhoushan’s gain, as cargoes shifted to its terminals during the closure of the former more than made up for its respective COVID lockdowns.

A throughput jump of 7.3% at Ningbo-Zhoushan to a total of 33.3m teu made a significant dent in the gap on Singapore.

Although volumes have flattered to deceive during the initial months of 2023, port officials are still unmoved in their target of surpassing 40m teu come 2027 — an achievement that could see the Chinese port breathing heavily down Singapore’s neck before long.

Ensuring the top four remained unchanged once more came a steady performance from southeast China’s major manufacturing, tech and export hub, Shenzhen.

Ensuring the top four remained unchanged once more came a steady performance from southeast China’s major manufacturing, tech and export hub, Shenzhen.

Growth of 4.4% at Hong Kong’s northerly neighbour came in the face of recurring COVID outbreaks of its own, which continued to hamper port operations.

Further north, Qingdao’s rise to prominence continued apace, claiming the accolade as the fastest-growing top 10 port, adding no fewer than 28 new service routes in 2022 as volumes increased more than 8%.

Qingdao can now class itself as one of the world’s top five container ports, having gatecrashed the upper echelons of our listing at the expense of Chinese compatriot Guangzhou. This represented the only ranking change in the top 10.

At the tail end of the top 10, only Tianjin (eighth) bettered its 2021 total, making ground on Busan (seventh) in the process, while COVID policies did little to improve Hong Kong’s credentials as volumes dropped by more than a 1m teu.

Once the world’s largest port in the late 1980s, the danger of Hong Kong slipping out of the top 10 in the coming years is looking increasingly like a reality.

Rotterdam, propping up the top 10, was one of several European majors in the north of the continent that suffered heavily from the loss of Russian-bound cargoes following sanctions.

China

China’s dominance of the container port sector continues to show little sign of diminishing any time soon.

Despite one of the country’s entries, Zhuhai, losing its rankings status, Chinese facilities still account for as many as 24 rungs on the Lloyd’s List ladder — and, more significantly, seven remain in the top 10.

There is also a host of rapidly expanding smaller Chinese ports, including Yangpu, Zhanjiang and Weihai, which could all make their debut in the Top 100 Ports rankings before long.

With a total volume share of around 40% of the total throughput handled by the top 100, China’s contribution provided an additional 11.4m teu against its 2021 input — a 4.4% rise in total, as the main attributor to the slim growth figure achieved by the combined top 100 effort.

Whether by mistake or design, however, volumes at certain Chinese ports appeared to be inflated.

In early 2023, a report published by Linerlytica highlighted how some Chinese ports’ volumes contained an element of ‘throughput inflation’, as domestic growth did not match up with throughput numbers reported in the rest of the world.

This, according to Linerlytica, can be achieved through several mechanisms that count towards additional box liftings, often used to fabricate throughput results to mask underlying terminal performances, including barge activity and empty container movements between terminals.

Either way, a number of Chinese ports posted some serious growth figures domestically.

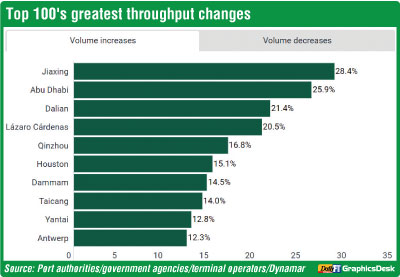

Indeed, the title for the fastest-growing elite container port in 2022 went to Yangtze River Delta facility Jiaxing, clocking up growth above 28% as its efforts to develop sea-river transport continued to provide dividends.

Jiaxing was one of five Chinese ports to hit double-digit percentile growth for 2022, alongside Dalian, Qinzhou, Taicang and Yantai. Only two — Hong Kong and Yingkou — failed to improve on the previous year’s tally.

Yet even accounting for number massaging, China’s volume growth is on course to brake sharply in 2023.

Global recession risks, sustained high inflation, and growing competition from rival manufacturing hubs in Southeast Asia, are all weighing in on the near-term prospects for the Chinese export market, say analysts.

There are also geopolitical uncertainties to contend with — most notably, China’s own souring relations with the US, threatening ties with a crucial trade partner while reigniting talk of protectionism and anti-globalisation. These are concepts that do little to promote the country’s containerised trade.

There are also geopolitical uncertainties to contend with — most notably, China’s own souring relations with the US, threatening ties with a crucial trade partner while reigniting talk of protectionism and anti-globalisation. These are concepts that do little to promote the country’s containerised trade.

Asia, excluding China

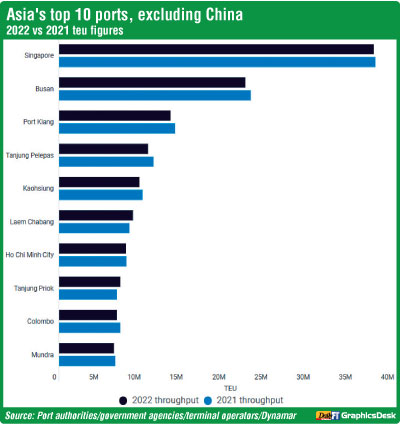

Asian ports outside of China, making up the largest share of individual ranking entries by region — 27 in total — saw combined volumes fall marginally in 2022 on their year-ago level, by 0.4%.

This was in stark contrast to the 7% growth figure posted the previous year.

With the post-COVID bounce firmly in the past, the region’s ports were feeling the bite of ensuing high inflation and its impact on consumer demand for goods, especially from the US and Europe, while the impact of Russia’s invasion on its own economies hit close to home.

All five of the region’s largest ports — Singapore, Busan, Port Klang, Tanjung Pelepas and Kaohsiung — reported a contraction in volumes for 2022.

For the latter, it was part of a wider trend across Taiwan, where the soaring price of raw materials, due to the war in Ukraine, had a significant impact on the consumer electronics supply chain and semiconductor manufacturing — both crucial elements of its box business.

All three of Taiwan’s ports saw a reversal in fortunes, but the ‘worst hit’ title was reserved for its capital, Taipei.

Having realised one of the highest growth figures in 2021, Taipei reported a deficit in 2022 of more than 14% — the biggest percentage fall in volumes of any port making the top 100 cut this time round.

Yet it was not all doom and gloom. There were pockets of growth in the region, and some standout success stories.

Manila, home to Philippines port operator International Container Terminal Services Inc.’s flagship facility, took the accolade as the fastest-growing Asian port outside China, as liftings jumped 10% to exceed pre-COVID levels.

Elsewhere of note were gains in Thailand’s Laem Chabang and the Vietnamese port of Cai Mep — two ports, like others in Southeast Asia, that aspire to become alternative manufacturing hubs to the powerhouse of China.

The shift of trade away from China to countries like Vietnam and Thailand — but also Cambodia, Bangladesh and Indonesia — in Southeast Asia is not a new concept.

However, the upshot of the pandemic — at least for these countries’ ports — is that it reinforced the need for supply chain reconfiguration and alternative production hubs.

The business case for such a shift has only been strengthened amid weakening US-Sino relations — a factor that looks set to accelerate the migration of factories to other manufacturing countries in the region.

Although these countries will not threaten China’s dominant position in the container port sector any time soon, the billions of dollars currently flooding to the region is testament to the significance of this shift in trade.

It is why Southeast Asian ports — particularly in Vietnam and Thailand — could be the ones to watch in the coming years.

Middle East

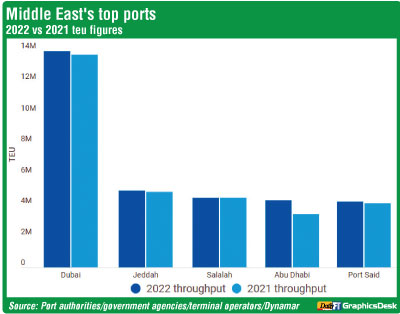

As a collective, Middle Eastern ports achieved the largest volume growth figure by region; its seven ports increased the area’s combined total in 2022 by 4.7% over 2021.

Although Middle Eastern economies shouldered global economic headwinds better than most, growth was, overall, largely subdued across its ports.

Yet one performance stole the headlines, contributing the lion’s share of additional cargoes for 2022.

In 2018, Abu Dhabi became the regional hub to two of the largest container shipping players, Cosco and Mediterranean Shipping Co, through their respective port arms, Cosco Shipping Ports and Terminal Investment Ltd.

The UAE port has since seen volumes explode, with the carrier pairing drawing in a host of affiliated deepsea services.

In 2022, total volumes amounted to 4.3m teu off the back of a more than 25% uptick in traffic, elevating Abu Dhabi as a top 50 port in the process.

Abu Dhabi’s growth trajectory in recent years has been in stark contrast to compatriot Dubai — or Jebel Ali, as it is more commonly known — which is by far and away the region’s largest port and home to DP World’s flagship operation.

Nevertheless, Dubai did manage to post growth in 2022 — albeit marginal — to continue the positive trend of 2021, following three consecutive years of volume losses.

In addition to Abu Dhabi, the other big mover in the Middle East was the Saudi port of Dammam, making a return to the rankings after a short 12-month hiatus.

Here volumes shot up nearly 15% as steady investment by the Saudi Ports Authority (Mawani) to transform the port into a major logistics hub began to bear fruit.

(Source: https://lloydslist.maritimeintelligence.informa.com/LL1145881/One-Hundred-Ports-Volume-growth-wanes-as-post-pandemic-boom-fades)