Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 25 August 2020 00:16 - - {{hitsCtrl.values.hits}}

Preamble

|

Hilmy Cader |

|

Jason Cordier (New Zealand) |

|

Malithi Herath |

|

MTI International HR Consultant |

|

Darshana Buragohain (India) |

|

Teshan Gunasekera |

On 5 August, Sri Lanka elected a New Government with a two-third majority. As the engine of growth, the private sector is expected to play a pivotal role in the much-needed economic revival of Sri Lanka – in a challenging global environment post COVID-19. To do so, the Government needs to ensure an enabling environment for the private sector to perform. Hence the need to understand what businesses expect from the new Government.

This article is based on multiple inputs sources:

Broadly, Sri Lankan business leaders have six expectations from the new Government. They are:

1. Economic Performance

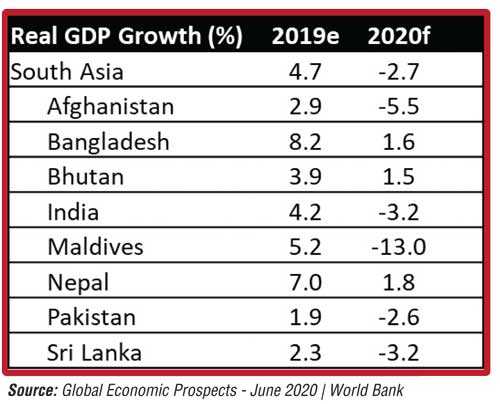

In 2019, Sri Lanka’s economy grew at a mere 2.3%, only marginally higher than Pakistan (1.9%) in the SAARC region. The World Bank’s forecast for 2020 (factoring in the Post COVID-19 impact) estimates a de-growth of 3.2% - with only Afghanistan and Maldives expected to be worse off than Sri Lanka. Sri Lanka’s debt has grown at a CAGR of 11.72% over the last five years and as at May 2020 the outstanding debt stands at LKR 13,895.9 billion. The consequential impact of the preceding aspects on inflation (which has risen to 4.2% in July of 2020 from 3.9% in the previous month, the highest since April 2020), is something that the new Government should be cognisant of.

Therefore, it’s not surprising that Sri Lankan business leaders expect the newly elected Government to give their highest priority to the management of the economy – in a sustainable manner. They expect greater focus, starting from the President and Prime Minister, whilst ensuring the ministers and civil service are aligned to this economic revival process.

In order to enable this economic transformation, the business leaders have identified two key drivers i.e. FDIs and exports.

In terms of exports, the need for much higher value-addition was highlighted and the importance of R&D and Technology to enable this. Public-Private Partnership was considered a viable model, particularly in global domains with very high entry barriers. In the words of a top conglomerate CEO “We need a game-changer if we are to make the kind of progress economies like Vietnam have done.”

Given the criticality of exports, the Government should consider having a cabinet minister for export (with clear export growth targets set) and then have the various domain specific ministers’ report to this key position. The President's decision to personally chair the Exporters Forum does send a strong message in this regard.

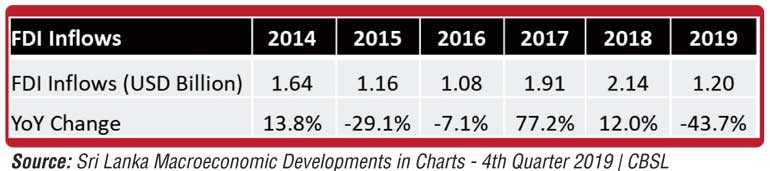

Sri Lanka’s FDIs performance between 2014 and 2019 has been lacklustre. In 2019, there has been a 43.7% decline from $ 2.14 billion in 2018 to $ 1.2 billion in 2019. The post COVID-19 global trading environment is bound to be a very challenging one for frontier markets like Sri Lanka.

In this background, Sri Lankan business leaders have emphasised the need to clearly define our ‘Country Value Proposition’ for FDIs (in consultation with the private sector) and then ensure consistency in its policies. As highlighted in other parts of this study as well, most business leaders were very concerned about the inconsistency of national economic policies, which they strongly felt inhibits attracting FDIs. Some did emphasise the importance of foreign policy and its symbiotic link to attracting FDIs. They did caution about being over-reliant (‘addictive’ in words of a CEO) on one country, whilst being mindful of the geo-political dynamics.

In addition to driving exports and FDIs, the need to significantly improve our agriculture performance (via productivity-led modernisation) was identified by a few of the respondents, citing the need to consider food security in a post COVID-19 environment.

Caution was expressed with regards to prolonged imports restrictions, which was considered a prudent ‘emergency treatment’, but could harm overall economic growth if continued for longer.

Overall, as could be seen from some of the quotes, the need for prudent fiscal and monetary policy was highlighted, whilst emphasising that we all have to experience some ‘pain’ in the overall economic transformation process.

The MTI Perspective

Sri Lanka’s economy is in desperate need for a strong FDI pipeline. The first step would be to have a compelling and globally competitive ‘Country Value Proposition’ (CVP) – which should simply answer the question ‘Why make in Sri Lanka?’ So, what is Sri Lanka’s CVP?

Once we have got the CVP sorted, we need to look at the end-to-end process from an investor’s perspective (NOT from a BOI, EDB or GOSL perspective). The one-stop shop is one way to ensure this, but focus should be far more on its practical activation.

If a country is to get a FDI, in most cases, it means another country loses that opportunity. So, start by asking ‘Why us Vs. them? Of course, there are ‘Blue Oceans’ too that Sri Lanka can target.

Many countries tend to either heavily ‘borrow’ from the future (getting into an even bigger debt trap) and /or start creating ‘Illusionary Money’. This is a pitfall that Sri Lanka needs to consciously minimise, which requires strong reforms.

Source: Weekly Economic Indicators - 07th August 2020 | CBSL

2.Policy Consistency

A common expectation from the new Government is consistent and transparent policy making that would provide a clear medium to long term policy framework. The need for key stakeholder consultation in the development of such policy frameworks is another key expectation.

Notably, digitalisation could be expected to play a key role in stakeholder involvement and data gathering for policy development, given the Government’s focus on several digitalisation initiatives on the SOE front. Policy makers could draw upon Government led digital initiatives from around the world (Taiwan, Kenya and France) that have successfully used digital tools to facilitate public input, awareness and discussion on key policies.

Regardless of policy development however, the need for efficient and decisive policy implementation is clearly indicated by the business community of the country.

MTI Perspective

When a country is at economic crossroads, the policy makers should be deeply engaged in strategising, which in turn has to be based on strong rational analysis.

For this to happen, the ministers must develop their strategising competencies and dedicate quality time.

However, if more of their time is spent on ceremonial and administrative aspects (which should be the job of the country’s civil service), then strategic decision making may be compromised.

At the end of each day, ministers should ask the question: “What has been my strategic contribution today – that will eventually contribute to the socio-economic prosperity of the country?”

3. Good Governance

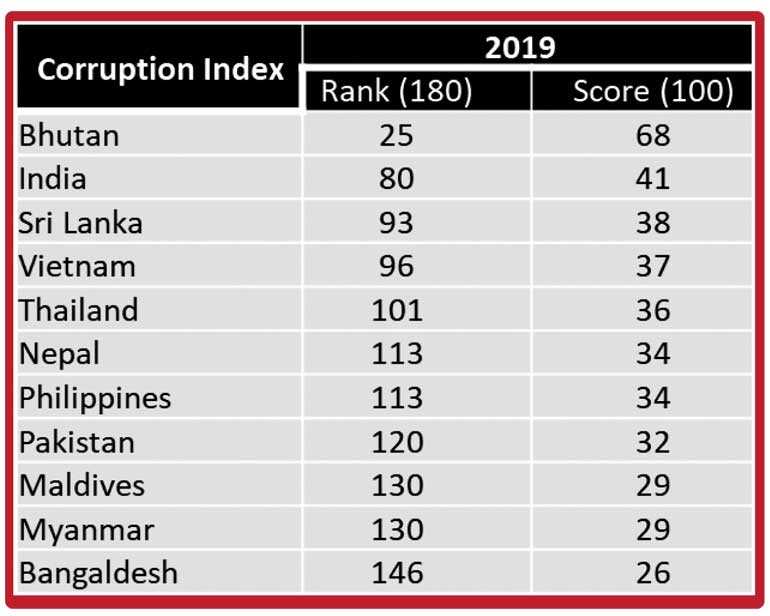

Good governance has been a key topic in Sri Lankan politics for over many decades and it was certainly brought up by many Sri Lankan business leaders with emphasis on building a corruption free country and accountable leadership.

According to Transparency International, Sri Lanka ranked 93rd out of 180 countries on the Corruption Perceptions Index (CPI) in 2019. Hence, it’s obvious that lack of good governance and potential political interference has affected the growth of the nation and deterred away much needed foreign investors.

As a solution, business leaders believe that the President and Prime Minister, holding esteemed and high power positions, should be the forerunners in eliminating corruption that will cascade down to all levels of government and society.

They expect the new Government to appoint a competent, knowledgeable and credible cabinet of ministers with ministries given to them based on their specific competencies and merit and not based on seniority within the party structures.

In addition to being suitable for their role, business leaders expect the overall Government including the President and Prime Minister to be transparent and accountable for their actions and not allowing politicians to be above the law.

As mentioned by one of the business leaders – “We need a honest administration without corruption and complying with ethics and good governance!”

MTI Perspective

In current electoral system, you need loads of money (either yours or others’!) to win an election. Isn’t this a root cause of corruption?

“For every decision a Govt. takes, ask: How many will benefit, how much, how soon?”

4. Democracy and Equality

The importance of unity, peace and inclusivity has been highlighted by the business leaders in setting out their expectations of the new Government. Racial disharmony has been on the rise in Sri Lanka (as witnessed by the communal violence incidents post Easter attacks in 2019), with no real progress made to unite the communities under one nation.

Business leaders stress the need for law and order that will guarantee equitable treatment for all citizens (not favouring some) and increase investor confidence, especially considering much needed FDIs in the current economic conditions.

MTI Perspective

The root cause of most ethnic conflicts is the lack of integration. We are all born innocent. Thereon our families, our schools and the wider society shapes our values, our thinking, that then drives our actions.

Early on in life if we learn to appreciate diversity and if we learn to respect each other’s religions and cultures, peaceful cohabitation is possible. Our schooling environment plays a major role in shaping us and builds lifelong friendships. This is where integration needs to start.

But how can this happen in a society where schooling is increasingly discriminated along religious lines? How can this happen when political parties are formed on racial divides?

5. State Sector Performance

Opinions were expressed on two fronts i.e. effectiveness of public services and the performance of SOEs (State-Owned Enterprises).

There appears to be high expectations on the promises made at both the Presidential and Parliamentary Elections on ‘cleaning up’ the inefficiencies and irregularities in the State sector. In particular, it was expected that the President will personally drive this transformation process. However, while some felt this has already started, other expressed that “there is a long way to go!”

The need to eliminate corruption in the State sector was once again the ‘loud and clear’ message in this module as well. The initial steps taken by the President-led Government was appreciated by some, with others cautioned that it needs to cascade down the entire Government system.

It was identified that in order to eliminate corruption, it is imperative to improve the competencies and operational efficiency of the civil service. Cautioning of the dangers of politicising the civil service, the need to infuse professional technocrats was also highlighted.

In terms of ministries, the need to hold ministers accountable through KPIs was emphasised – as part of the President’s endeavour to bring about a performance-based culture in the public sector.

In 2018, the total revenue generated by 54 State Owned Enterprises (SOEs) amounted to Rs. 1,916.02 billion, of which 37 SOEs recorded a net profit amounting to Rs. 130.66 billion.  Meanwhile 16 SOEs reported net losses amounting to Rs. 156.73 billion in 2018. The largest contributor to SOE losses was Ceylon Petroleum Corporation (CPC) which reported a loss of Rs. 104 billion in the same period. In this backdrop, strong views were expressed on the need for major re-structuring of these loss-making SOEs.

Meanwhile 16 SOEs reported net losses amounting to Rs. 156.73 billion in 2018. The largest contributor to SOE losses was Ceylon Petroleum Corporation (CPC) which reported a loss of Rs. 104 billion in the same period. In this backdrop, strong views were expressed on the need for major re-structuring of these loss-making SOEs.

The need for digitisation of public services was identified as an essential pre-requisite to significantly improve both service levels and staff productivity. In the words of a Chairman: “This is the ‘invisible’ low-hanging fruit that can spark a big change in the public’s perception of the new Government. They just need to ramp it up.” The operations of the Sri Lankan passport office (considered among the best in the world) was cited as an example where a service could be autocratically driven, however, with good intentions.

This digitisation drives needs to work in tandem with a culture change in the public sector, including the minimisation of corruption – for which some public services were quoted as notorious.

MTI Perspective

With every regime change, the entire board of most major State- Owned Enterprises (SOEs) is ‘sacked’ and replaced with an entirely new board, often with no formal transition or ‘knowledge transfer’ process. This can be detrimental to the business.

Owned Enterprises (SOEs) is ‘sacked’ and replaced with an entirely new board, often with no formal transition or ‘knowledge transfer’ process. This can be detrimental to the business.

However, two effective practices that can be considered are: Under the auspices of the Auditor General, the Government should recruit a pool of professional non-executive directors, who can be rotated among the SOEs.

They should be truly independent and cannot be politically dislodged. This can be in addition to the political appointees (if they must really resort to that!).

Make it a compulsory legal requirement for any outgoing SOE board to formally hand over a report and conduct a closing presentation for the incoming board – in the presence of an independent auditor.

6. Strengthen Local Industries

Broadly, two contrasting routes to economic development were identified by the business leaders. On the face of it, it may appear to be polar opposites, however it is possible to address concerns of both these views, with a moderately prudent approach.

Those with high reliance on local manufacturing (facing import competition which they considered unfair), felt that the Government  should protect local industries by restricting imports. Others favoured a more liberal approach (continuing the globalisation model), arguing that Sri Lanka needs to open out to the world and that it is the only way to survive in a globalised world.

should protect local industries by restricting imports. Others favoured a more liberal approach (continuing the globalisation model), arguing that Sri Lanka needs to open out to the world and that it is the only way to survive in a globalised world.

Small and Medium Scale Enterprises (SMEs) are considered to be the backbone of the Sri Lankan economy, as it accounts for more than 75% of the total number of enterprises, provides 45% of the employment and contributes to 52% of the GDP.

With the right set of tools provided by the new Government, business leaders believe that the players within the SME segment will have opportunities to expand and generate greater share of contribution to the GDP.

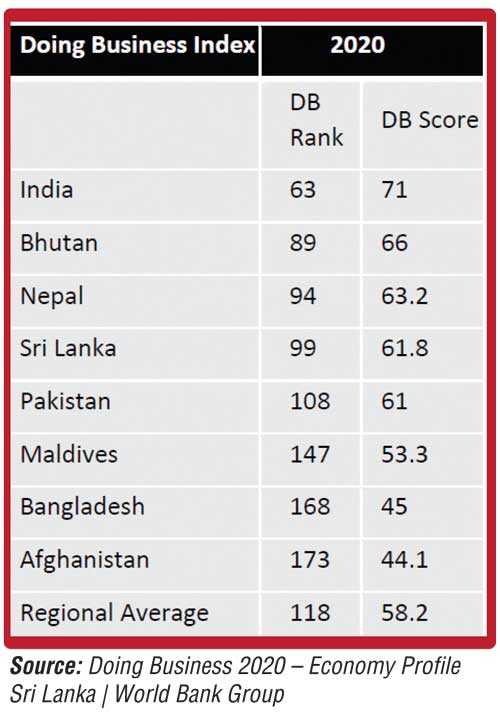

According to The World Bank’s Ease of Doing Business Index – which measures the conducive nature of the regulatory environment of a country, Sri Lanka has managed to slightly improve its ranking from 100th to 99th out of 190 countries in 2020.

In terms of prosperity, the Legatum Institute’s Prosperity Index indicates that Sri Lanka was ranked 80th out of 167  countries in 2018 and was able to improve its ranking in 2019 reaching the 75th position. This index takes a variety of factors into account including wealth, economic growth, education, health, personal well-being, quality of life and national security.

countries in 2018 and was able to improve its ranking in 2019 reaching the 75th position. This index takes a variety of factors into account including wealth, economic growth, education, health, personal well-being, quality of life and national security.

Based on the improvements in ranking that Sri Lanka has made in both indexes, it could be deduced that Sri Lanka has the potential to reach greater heights domestically. This would also provide the new Government guidance on which macro level areas it should focus on, such as improving national security which will lead to the improvement of business confidence.

In addition, business leaders expect the current Government to create a better regulatory framework for private sector businesses that would facilitate growth, leading to increased business confidence and ability to attract much-needed FDIs.

However, business leaders also believe the regulatory framework should be a level playing field and have legislature in place to have a transparent and most importantly an ethical business environment.

MTI Perspective

The crux of the economic challenge in developing economies is the inequitable and unfair distribution of wealth. This cannot be fixed by making the rich poor, instead making the poor rich. To do that, there needs to be ‘investment’ in education/skills development and by empowerment. Technology and connectivity have a role to play in this.

7. Other views expressed by business leaders – that warrant Government consideration

Improving national security and minimising criminal activity

The Easter Sunday attacks in 2019 exposed how weak the pillars of national security and intelligence were and as a result the country suffered severe losses of human life. As a result, business leaders expect the Government to deliver on its promises of making national security a top priority and have stringent laws to tackle criminal activities ranging from underworld activities to university level ragging.

Confidence on health

Given how severe the impact and the rapid pace at which the spread of COVID-19 took place, the Government’s handling of the situation is very much commendable. However, our economy was negatively impacted by the lockdown that lasted close to four months. The economy is currently in a volatile position and is unlikely to be able to withstand a second wave of community spread of the COVID-19 virus. Therefore, the Government is expected to improve confidence on health through the tight control of COVID-19.

Education reforms

Many of the surveyed business leaders expressed the need for reforming and upgrading the education system in the country to match international standards through the integration of modern technology.

Another reform suggested was the re-organising of existing technical training institutes and the setting up of special technical training institutes for every district in the country which would produce the required and skilled labour needed for the growth of the economy.

Public transport reforms and road development

Expediting road infrastructure projects, especially the highway roads which would enable convenient island wide logistics of goods and people. Public transport in Sri Lanka hasn’t changed much over the past few decades when compared with other nations. Hence, business leaders are expecting the newly-appointed Government which is strong in numbers to reform and modernise the public transport system.

Environmental conservation

As an island nation, Sri Lanka will certainly feel the negative externalities of rapidly-increasing global warming and pollution. Therefore, the economic development the country should strive for should consider sustainability and environmental conservation to ensure the country is in hospitable conditions for future generations to live in. Environmental conservation should also be in place to protect the country’s unique wildlife which is currently in danger due to poaching and other human-wildlife conflicts.

Inviting multinational companies to set up shop

Allowing for the commencement of industries by inviting major MNCs to setup and operate their plants in Sri Lanka will help generate jobs for the country’s work force and build skills and competencies.

About MTI Consulting

MTI Consulting, Sri Lanka’s leading strategy consultancy, has worked on over 650 assignments in over 47 countries, covering a diverse range of clients, brands, industries and challenges.

MTI is powered by a pool of internationally experienced strategy consultants and analysts, augmented by a panel of specialists – by industry, function and geo-domains and like-minded boutique consultancy relationships in over 30 countries.

MTI has been at the cutting-edge of thought leadership on strategy, having presented at over 150 conferences around the world.