Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 29 May 2023 00:16 - - {{hitsCtrl.values.hits}}

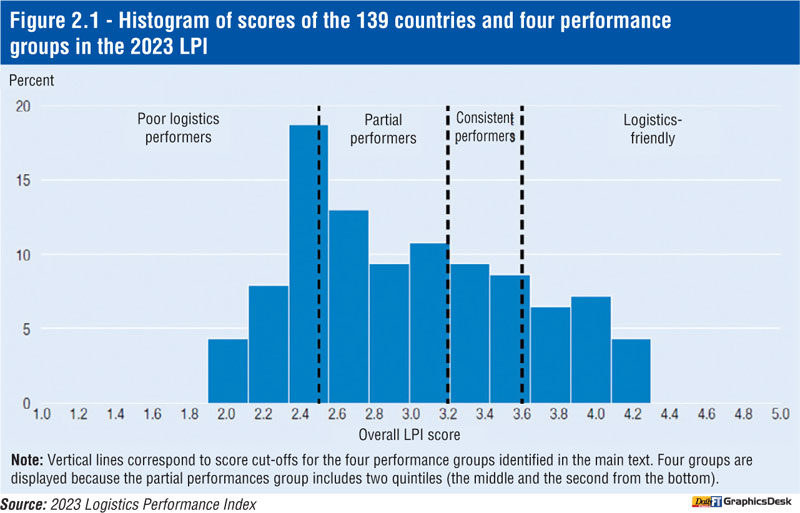

The Logistics Performance Index 2023 was published recently which has ranked the countries based on 4 categories namely; Logistics Friendly, Consistent Performers, Partial Performers and Poor Logistics Performers. Sri Lanka falls under the category of Partial Performer with a LPI score of 2.8. Singapore is ranked number 1 with a 4.3 LPI score and is categorised as a logistics friendly country whereas India is also classified as a consistent performer with a 3.4 score. When delving into Sri Lanka’s score it is clear that the infrastructure score is only 2.4 which is a poor logistics performer.

The Logistics Performance Index 2023 was published recently which has ranked the countries based on 4 categories namely; Logistics Friendly, Consistent Performers, Partial Performers and Poor Logistics Performers. Sri Lanka falls under the category of Partial Performer with a LPI score of 2.8. Singapore is ranked number 1 with a 4.3 LPI score and is categorised as a logistics friendly country whereas India is also classified as a consistent performer with a 3.4 score. When delving into Sri Lanka’s score it is clear that the infrastructure score is only 2.4 which is a poor logistics performer.

Areas to improve

The score is derived from large global tracking datasets (Big Data) covering shipping containers, air cargo, and parcels. One of the key policy highlights of the report is the importance of improving customs and infrastructure in raising the overall score of bottom performers. It was revealed that the performance of customs and border agencies, as well as the quality of trade- and transport-related infrastructure, is particularly weak in the lowest performing countries. These countries experience much longer delays than advanced and emerging economies and many middle-income countries.

Sustainable logistics options which reduce the carbon footprint of supply chains can also improve the LPI score. Environmentally friendly options include shifting to less carbon-intensive freight modes, more energy-efficient warehousing, or better capacity utilisation.

Digitalisation

As a measure of maintaining competitiveness as well as sustainable development, many countries have focused on the enhancement of trade facilitation through modernisation of existing processes and practices through the application of information and communication technology.

This has become more relevant with the evolution and increase in international trade with new solutions towards customers as well as with added complexities in the supply chain involving a number of players within as well as outside a particular country.

Case Studies and research show that countries in the Asia Pacific region who have taken steps to exploit the use of digital technologies for cross-border as well as in local day to day affairs relating to trade processes have provided great efficiency improvements for exporters, importers and other stakeholders in the logistics supply chains contributing to their economies.

Such gains as higher predictability and speeding up of business processes coupled with transactional cost savings benefit the trading communities whilst better revenue collections and compliance contribute towards the public bodies. It is stated that countries, as a whole, stand to attract investments and facilitate job creation and growth by reducing these trade related delays and costs.

It is common to note that Customs administrations become the focus when the subject of trade facilitation is discussed. Although the functions and activities of Customs administrations is an essential component towards facilitation, a view from a supply chain perspective helps to understand the various dependencies among other players, procedures and processes as well as linkages between these parties such as private sector traders, transport providers, service intermediaries and other regulatory bodies in the public sector. Efficiencies of the total process can therefore be impacted if weaknesses can be found in the chain of such activities as sourcing of raw materials, preparing for transport, requesting a license, preparing documentation for Customs clearance, process of clearance, payment, and delivery to the consumer.

This has resulted in many countries making efforts to exploit digitalisation in order to drive efficiencies through automation, paperless trade, electronic data interchange, cashless transactions, etc.

From a viewpoint of CASA, the various institutions such as customs, ports, banks and other related agencies have made efforts to make progress and advance in their respective domains aiming to improve the clearance process as well as accelerate cargo handling. Further, integration between these institutions also do exist to an extent at various stages (clearance on import/export declarations through connectivity between government agencies, electronic gate pass from Customs to SLPA, online payments for customs duty involving banks, etc.).

Regulations such as Electronic Transactions Act, Payments and Settlements Act, inter alia, have complemented such digitalisation initiatives with improvements planned to these as well as to the Customs Ordinance, which will augur well for the industry.

However, continuous improvement in this area is necessary in order to sustain and increase Sri Lanka’s competitiveness. To cite one example, today, fibre exporters require a certificate from the department of plant quarantine (which is a customer/country of destination specific requirement) to be obtained prior to submission of the declaration for clearance. This is required for each shipment involving visits to port premises. Further, obtaining the Certificate Of Origin is partially automated. These activities, among several others, have immense potential to be further improved in order to save considerable time loss and costs to exporting companies.

When analysing the individual criteria; it is evident that Customs and Border Management scoring has declined from 2018 to 2023, it is also the only criteria that hasn’t projected an improvement for the island nation, positioned strategically in the Indian Ocean.

While Sri Lanka, especially the port sector continues to add capacity, ahead of demand it’s imperative that digitisation and greater transparency in Customs processes are key focus areas. This will no doubt enable better border management and propel SL’s Logistics Performance, and enhance Customer Experience.

Infrastructure growth

To attract services which are currently not calling Colombo and to retain the share in a growing regional transhipment market, we need to have more capacity. If not, shipping lines and exporters would look for alternative ports to direct their transhipment volumes. The port of Colombo at present operates at a very competitive pricing level and to go to a price war with a competing port will make it increasingly difficult for us in the long run, leading to less investments on productivity and people. Therefore staying ahead of the demand curve is of paramount importance not just for growth but for the survival of the port of Colombo as a transhipment port.

Conclusion

It is important that the Government initiates discussion with all stakeholders and work on these main areas which are required to sustain Sri Lanka’s maritime aspirations. More importantly, an implementation body with legal mandate needs to be put in place to ensure that policy is executed without any delay. The main point to stress that a maritime Hub consists of several elements primarily capacity and physical infrastructure, quality and timely ancillary services, and ease of doing business. These levers need to be addressed simultaneously to attract more services and vessel calls, and augment USD revenue and positively impact the shipping community’s experience when transacting with Sri Lanka.