Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 14 August 2023 01:54 - - {{hitsCtrl.values.hits}}

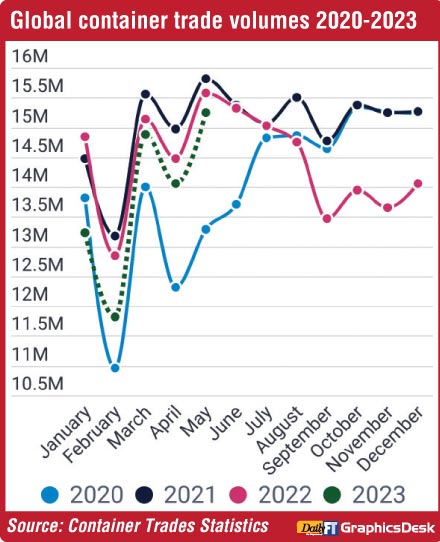

Global container volumes dipped in June compared with May, but remain up 7.4% higher than in April as the worst of the setbacks in demand appear to be over.

The total global liftings for June 2023 stood at 15.1m teu, according to the latest data from Container Trades Statistics.

On a year-to-date basis, the global volumes are down 4.3% compared with the first six months of 2022, when demand was still heavily distorted by the lockdown era.

Asia-Europe trade in June 2023 showed increases across the board, with northern Europe showing a year-on-year increase of 3.2%, CTS said.

The Mediterranean also continued its strong performance, with the west Mediterranean showing a 15.1% increase in the second quarter compared with the same period in 2022.

“The overall trade is now showing a 2.3% increase on a half-year comparison with 2022,” CTS said.

But Asia-North America volumes continue to be depressed compared with the corresponding month last year and on a year-to-date basis, where the decline is 18.3% compared with 2022.

“The decline continues to be equally on the east and the west coasts of the US,” CTS said.

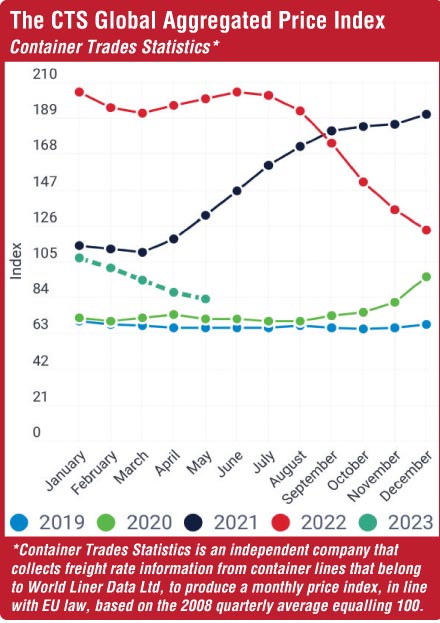

CTS’ Global Price Index fell a further four points to 79 in June 2023.

“In comparison to June 2022 — the peak rate in the past year — the index is down by 125 points,” CTS said. “The last time the index was at this level was November 2020.”

Outside the main head trades, there were some encouraging signs, however.

“The shifts between the markets is becoming quite significant, with India, Türkiye, Brazil and West Africa now covering the fall in volumes from the weaker markets of North America and northern Europe due largely to retail destocking,” CTS said.

“The large part of the cargo emanating from greater China but also seeing some strength out of Southeast Asia.”

There were also signs of freight rates rising in these areas, albeit from a low basis, reflecting the significant demand rises.

While the headline figures remain subdued, an analysis of teu/mile demand by Sea-Intelligence painted a more positive picture.

“This marks the fourth month, where the global collapse in demand growth can be said to have ended,” said Sea-Intelligence Chief Executive Alan Murphy.

“From a year-on-year perspective, global demand essentially collapsed in September 2022, and this lasted until February 2023. After this point, the collapse was halted. Demand cannot be said to have rebounded, as the growth rate is essentially hovering around zero, but the collapse ended.”

This was particularly important on the lucrative head haul trades.

“Here we see how the collapse in demand has been clearly halted, and even though it is at a low level, the year-on-year demand growth has been positive for three consecutive months now,” Murphy said.

“The demand picture is starting to clearly depict a market that went through a six-month temporary period of very weak demand on the major head hauls, but also a market where this setback has in essence been overcome already.

“But it also shows a market where, even though the setback has been overcome, we are not in a period of strong growth either.”

Nevertheless, the outlook for the remainder of the year still does not look particularly positive for carriers.

Clarksons noted that pressure on consumers, excess retail inventories and macroeconomic vulnerabilities had continued to weigh on demand throughout 2023, although a full year decline in volumes now looked avoidable as economic trends bottom out and retail inventories and consumer pressure potentially start to ease.

“The outlook for seaborne container trade in 2023 remains generally weak amid continued pressure on consumers, excess retail inventories and macroeconomic headwinds,” it said.

“Globally, box trade volumes are projected to grow by 0.3% in teu terms in 2023 and 1% in teu-miles.”