Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 27 November 2025 01:03 - - {{hitsCtrl.values.hits}}

1 Sri Lanka will only be at a 50% implementation on the 2025 capital Budget. President and Finance Minister Anura Kumara Dissanayake delivering the 2026 Budget in Parliament on 7 November

This turnaround will be a waste unless the growth reforms are done to boost Sri Lanka's foreign exchange reserves

This turnaround will be a waste unless the growth reforms are done to boost Sri Lanka's foreign exchange reserves

Whilst the dust settles down on the Budget 2026 with many points of view expressed, the key point missed out was how Sri Lanka can become a 6% plus economy in the next three years or have a forex earning of $50 billion annually. Let me explain.

Whilst the dust settles down on the Budget 2026 with many points of view expressed, the key point missed out was how Sri Lanka can become a 6% plus economy in the next three years or have a forex earning of $50 billion annually. Let me explain.

Budget must be laser sharp

I remember one of my bosses in the UN once stating that strong annual plans tend to have a few strategic initiatives to make a significant impact to the top line. What he meant was that, if the objectives to be met are clear, then we must have a few laser sharp initiatives that can achieve the set objectives.

He went on to explain how good leaders are so clear on the objectives that have to be achieved, a combination of entrepreneurial and data driven plans mixed with gold standard execution that will really make a difference. Budget 2026 sadly, did not bring out these characteristics. Let’s not forget that the current Government has a two thirds majority. Which means that a laser sharp Budget was a possibility.

Sri Lanka in the red

If we were to analyse Budget 2026, there is something for everybody. I guess when a political party has a two thirds majority and was able to garner 6.8 million votes to a single political party, there is no option but to have a multitude of initiatives to cater to the different segments of the community. Whilst this strategy has its merits, the point missed in Budget 2026 is that this strategy will not get Sri Lanka out of the red.

The fact of the matter is that even though the foreign reserves stand at $6.2 billion dollars, once the currency swaps are taken off the net reserves as per IMF stipulations Sri Lanka is at a minus on foreign reserves. If we use the Central Bank stipulations it is at a low ebb of around $ 3.4 billion. This is the naked truth. Let’s accept it.

Accept the reality

Whilst some can perceive the net foreign reserves (NFR) to be negative news, in my view it’s the best piece of data that I picked up from Budget 2026. The logic for this view is that it forces us, as a nation, to agree on what are the key 1-3 cutting edge initiatives that we have to do to make the financial health to be positive. What are the key reforms that must be brought in from cutting edge strategies in Exports, Tourism, Remittances and FDIs? Sadly, Sri Lanka did not see any clear cut strategies to build on the macroeconomic stability that the country received from the drastic reforms that the Wickramasinghe Government made.

A point that needs to be highlighted is that unless we accept this reality, we will continue to listen to the rhetoric that Sri Lanka's performance is brilliant as a country ‘for the

amazing recovery it has made from a financial crisis’. This notion can be further justified by the World Bank report that emerged around a month back, that stated that Sri Lanka is one of the best turnaround countries from a severe financial crisis. To be precise, from 123 countries the best performing nation was highlighted as Sri Lanka since the 1980’s.

Whilst this accolade was a fact, this was due to the severe macroeconomic reforms that took place in 2023-2024. We can call this macroeconomic stabilisation reforms. For instance the revenue from the increased taxes is estimated to be at 15% of GDP. All imports were curtailed so that the Foreign reserves can be buffed up to $6.5 billion by end 2025.

A point to note is that this turnaround will be a waste unless the growth reforms are done to make Sri Lanka be at $9 billion in reserves by end 2026 and $11 billion in 2027 and $ 13 billion by 2028. If we do not achieve these objectives Sri Lanka will be challenged to meet the debt payments post 2027. Sadly, the national Budget announced by the President did not have any of these numbers as objectives. We also did not see laser sharp strategies to drive up foreign exchange.

Gold backed loans have also increased to Rs. 365.5 billion in the first half of 2025 which explains the distress levels among middle and lower middle income households as well as the debt crisis that is hitting the financial structure of the country. Gold is not just an asset but the security of a typical Sri Lankan household

Gold backed loans have also increased to Rs. 365.5 billion in the first half of 2025 which explains the distress levels among middle and lower middle income households as well as the debt crisis that is hitting the financial structure of the country. Gold is not just an asset but the security of a typical Sri Lankan household

Devil in the details

Whilst Sri Lanka has registered a 15.9% revenue on GDP beating the IMF target of 15.3%. We must commend the current Government for continuing the correct policies that were infused to the economy post the financial crisis.

However if we dig deeper, the staggering truth is that on the budgeted expenditure that was planned for 2025, we have not even spent 40-45% of the capital expenditure. This means that the public sector administration has not brought to life the plans presented in the 2025 Budget a reality. This was highlighted very strongly by the critics of the Budget namely the Opposition.

If we take away the political colour and focus on the data, what it means is that there is a leadership challenge to fix bottlenecks which are hampering the growth agenda of the country. To be specific the capital expenditure Budget was at Rs. 1.4 trillion but the actual utilisation will be around Rs. 600 billion. This is a very serious issue and it must be addressed. Some say the corruption investigations have slowed the implementation of the last Budget. This may be true but it also means that good governance is not bringing in the results that should have kicked into the economy.

The situation is compounded as data shows that there is over Rs. 1 trillion in the Treasury from the increased taxes and vehicle export duties earned. There are also billions of rupees in the promotional accounts Sri Lanka Tourism, Sri Lanka Tea Board. End of the day money in the bank does not help drive value addition. We must identify the pillars that can add value to brand Sri Lanka and make it happen so that we attract the top dollar tourists and export revenues that can get us closer to the financial objectives that IMF has stipulated in the years 2026 and 2027.

Silver lining

Going back to the words of my UN boss, good strategic plans have a few cutting edge initiatives once again makes so much sense. In fact the silver lining of a “bad situation” is that it forces people to do the 1-3 key things that can make a serious impact on correcting the ‘bad situation’. Going back to the data shared before: if we take away the currency swaps the net foreign reserves as per IMF a stipulation Sri Lanka foreign reserve is minus. This forces us to ask ourselves what are the key initiatives that Sri Lanka can do in 2026 that can make a significant impact to the top line - foreign exchange reserves. This unfortunately did not come out of the Budget 2026 plans. Sadly I did not see the chambers of commerce address this particular issue with actionable next steps.

22.9% of the people being in poverty raised many eyebrows among policy makers. Apparently 10 % of households are on the vulnerable poverty belt and a small shock can move them to poverty. Meaning almost thirty 5% are in serious financial difficulty. This can only be corrected by increasing economic activity. We have to drive GDP growth

22.9% of the people being in poverty raised many eyebrows among policy makers. Apparently 10 % of households are on the vulnerable poverty belt and a small shock can move them to poverty. Meaning almost thirty 5% are in serious financial difficulty. This can only be corrected by increasing economic activity. We have to drive GDP growth

NPP-biggest win

Let me try to focus on the 1-3 initiatives that Budget 2026 missed out on so that even at this late stage we can support the Government. The logic for the word support the Government is because of the strong governance strategy that is being pursued with laser sharp clarity and strong leadership must be commended.

In the last six months performance on governance and corruption thrust that is in lay. Let’s accept it Sri Lanka was fast becoming the ‘Heroin capital of Asia’. The current Government must be commended for identifying this menace and has got support of governments around the world on this quest. Confiscated amounts include 1736 Kg of Heroin, 3784 Kg of Ice, 15,843 Kg of Ganja and 21,985 people taken into custody, in the year 2025 todate. This is an achievement that surely needs strong accolades.

The anti-narcotics strategies executed in the last ten months reveal that there is an ecosystem that has been at play for years on heroin smuggling and trafficking. Breaking this structure itself is the biggest contribution that the current Government has made for Sri Lanka. May be the Budget 2026 should have had a dedicated chapter on this area and allocation of resources to break this heroin ecosystem in Sri Lanka totally by the end 2026. It’s a case study for the world.

If we take away the political colour and focus on the data, what it means is that there is a leadership challenge to fix bottlenecks which are hampering the growth agenda of the country. To be specific the capital expenditure Budget was at Rs. 1.4 trillion but the actual utilisation will be around Rs. 600 billion. This is a very serious issue and it must be addressed. Some say the corruption investigations have slowed the implementation of the last Budget. This may be true but it also means that good governance is not bringing in the results that should have kicked into the economy

If we take away the political colour and focus on the data, what it means is that there is a leadership challenge to fix bottlenecks which are hampering the growth agenda of the country. To be specific the capital expenditure Budget was at Rs. 1.4 trillion but the actual utilisation will be around Rs. 600 billion. This is a very serious issue and it must be addressed. Some say the corruption investigations have slowed the implementation of the last Budget. This may be true but it also means that good governance is not bringing in the results that should have kicked into the economy

Consumer reality

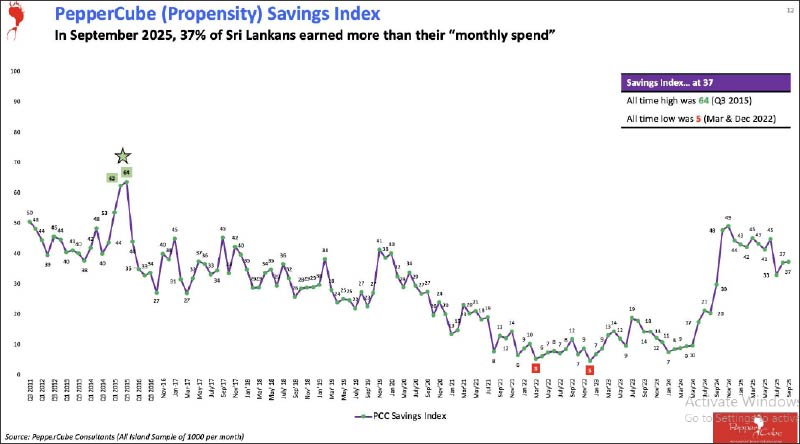

If we once again look at the ground reality. The number of Sri Lankans whose income covering the expenditure on a monthly basis is only 37%. This is a very serious issue. Which means that many families are either borrowing money or pawning their assets to keep the household fires burning.

Official data from the Ministry of Finance reveal that unredeemed jewellery jumped from Rs. 210 billion in 2019 to Rs. 571 billion in 2024. Gold backed loans have also increased to Rs. 365.5 billion in the first half of 2025 which explains the distress levels among middle and lower middle income households as well as the debt crisis that is hitting the financial structure of the country. Gold is not just an asset but the security of a typical Sri Lankan household. When this asset is mortgaged or sold to buy school books and pay for tuition fees it means that things are very fragile at the consumer end. The World Bank stating that 22.9% of the people being in poverty raised many eyebrows among policy makers. Apparently 10 % of households are on the vulnerable poverty belt and a small shock can move them to poverty. Meaning almost thirty 5% are in serious financial difficulty. This can only be corrected by increasing economic activity. We have to drive GDP growth.

1-3 key initiatives

If we focus on the key initiatives. The first task is to increase the export revenue from the current $19 billion to $30 billion. This will need a step change. We do not have to go too far in this as our immediate neighbour - the Tamil Nadu Government is growing the GDP at over 11.6% in 2025. We have no option but to sign the Comprehensive Economic Partnership Agreement with India. When an economy today is $4.1 trillion and by 2030 is targeting $7 trillion we must push this agenda strongly.

One of the clear beneficiaries will be the apparel sector that will get free trade access for 30 million pieces of garments from the current 7 million. This requires some detailed analysis but conceptually this is the one initiative that can propel Sri Lanka’s economy.

The 2nd which some say the low hanging fruit is ‘Tourism’. On this the key strategic action will be to position Sri Lanka tourism with the global communication campaign. We have moved up the bar to attract a better quality tourist that can fetch a $200 traveller.

As of now the tourism sector is registering a 4.9% growth in 2025 at $2.6 billion. But a point to note is that this performance is a -33% as against the 2018 numbers of $3.5 billion. Hence we see the quantity and quality debate surfacing that only can be addressed if we add value to Tourism Sri Lanka with a strong communication campaign.

As at now the $5 billion target is almost a near dream than a target that one can aspire to achieve.

Leave alone the strategic objective of the projected $10 billion business that the industry was targeting in 2030, now this number has been revised down to $8billion without a clear action plan.

The third initiative that requires depth is the remittances to reach $10 billion with quality service exports of Sri Lanka talent. This will require a focussed drive that is white collar driven than the red quality reality.

Strong annual plans tend to have a few strategic initiatives to make a significant impact to the top line. If the objectives to be met are clear, then we must have a few laser sharp initiatives that can achieve the set objectives. Good leaders are so clear on the objectives that have to be achieved, a combination of entrepreneurial and data driven plans mixed with gold standard execution that will really make a difference. Budget 2026 sadly, did not bring out these characteristics. Let’s not forget that the current Government has a two thirds majority. Which means that a laser sharp Budget was a possibility

Strong annual plans tend to have a few strategic initiatives to make a significant impact to the top line. If the objectives to be met are clear, then we must have a few laser sharp initiatives that can achieve the set objectives. Good leaders are so clear on the objectives that have to be achieved, a combination of entrepreneurial and data driven plans mixed with gold standard execution that will really make a difference. Budget 2026 sadly, did not bring out these characteristics. Let’s not forget that the current Government has a two thirds majority. Which means that a laser sharp Budget was a possibility

The way forward

To my mind these are the three strategies that can push the agenda for the Sri Lankan economy to be a 7% plus GDP growth. This also means that we can reach the $ 50 billion forex exchange target. But this will require razor sharp ‘ operational excellence ‘ backed by gold standard passionate implementation. I guess the next two years will tell the story.

(The author can be contacted on [email protected])