Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 6 September 2019 00:00 - - {{hitsCtrl.values.hits}}

Whilst powers may be busy forging alliances and contemplating how one can stay in power, the poor housewife is squashed between meeting the needs of the family and balancing the disposable income she has in her hand. When we hear the narratives of the powers may be it clearly demonstrates that the  market vibes are not understood by the political hierarchy that governs Sri Lanka. The one question that emerges in the private sector is the poor decision that we made on 8 January 2015.

market vibes are not understood by the political hierarchy that governs Sri Lanka. The one question that emerges in the private sector is the poor decision that we made on 8 January 2015.

GDP to consumption – 4.7%

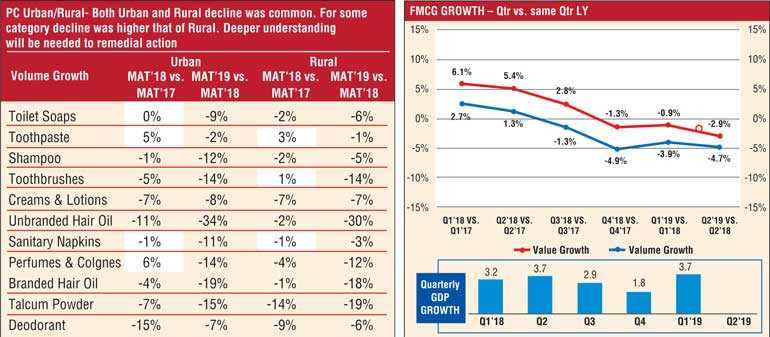

The latest data I was able to pick from the leading research agency – Kantar, reveals that from Q1-2018 the Sri Lankan household consumption of products like soap, toothpaste, milk powder, etc. has been declining even though there was an upward movement on reported GDP growth.

Way back in Q1-2018 the GDP growth was at 3.2% and consumption registered at 2.7% in volume. 2018-Q2 GDP grew by 3.7% but consumption slowed down to 1.3%. From Q3 onwards even though GDP registered a growth of 2.9% and Q4 at 1.8% the FMCG consumption at the household end has declined in volume by -1.3% and -4.9% respectively which means people are absolutely reducing consumption.

In the year 2019, the numbers are Q1 at 3.7% GDP growth but household consumption volume continued to decline by -3.9% and a staggering -4.7% in Quarter 2 of 2019. This means that things are very rough at the household end.

Given the many people being de-hired due to the crash of the tourism sector the household purchases will only further decline for the balance two quarters than an upward trend is my view.

Urban decline?

What is strange is that the consumption decline is not seen only in rural Sri Lanka but also in the urban market.

In the urban market shampoos have declined by 12% whilst in the rural market the decline is at 5% which means that the hit is coming in from affluent Sri Lanka. We also see that lifestyle categories like perfume and colognes are declining by 14% in the urban market and 12% in the rural market which is interesting as the data should be the other way round with the urban markets not wanting to change their behaviour patterns due to social pressure. But the reality is different. Strangely products like talcum powder are having a dip of 15% in the urban market whilst in rural Sri Lanka decline is greater at 19%.

The above is just a cross section; we see the same on categories like milk powder and soap which are essentially core products in a typical household of Sri Lanka. I guess when the political hierarchy talks about development and the opening up of different infrastructural projects like ‘irrigation’ and the ‘southern highway extension’, they need be more savvy with the reality of a Sri Lankan household. As at now the general vibe is that the current government has no understanding of the reality on the ground. Which is true. One does not have to think too much to project the behaviour of the Sri Lankan voter in this context is my view.

Retail data

If we want to cross the check the above data, the best set of numbers to get a pulse of the consumer is by checking on Nielsen retail audit data.

What we see is that the overall household volume consumption had dropped the whole year of 2017 and in 2018 up to Q3 (for almost two years in a row). To be specific, in the first quarter 2017 by -3.3%, the second quarter by -3.1%, the third by 3.7% and in the final quarter by -8.2%. Then in 2018 the volumes dropped by -11.7%, a staggering -14.5% in Q2, 2018 and then reversed to -8.3% in Q3 but now things are beginning to improve but a point to note is that the computation base is lower. Hence we see that a typical housewife in Sri Lanka be it urban or rural is feeling the impact of the Lowe consumption be it at the retail end or at the household entity.

Last 4 months

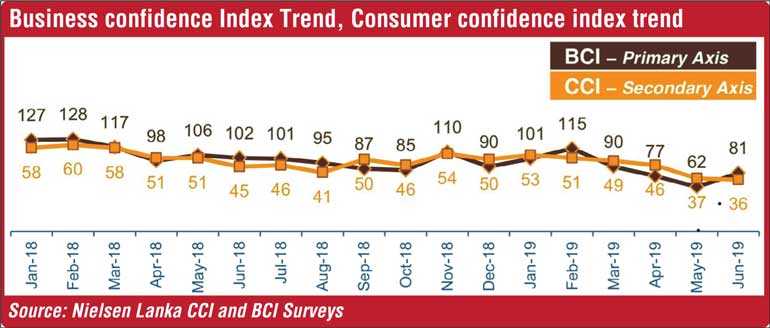

A point to highlight is that in the last three-four months things have once again become very challenging to the Sri Lankan household with even categories like ‘milk powder’ contracting which means a typical household is bound to take a drastic decision at the next elections. Sadly, the political leadership is oblivion in the ground reality which has resulted in a very poor confidence by the people. As at June 2019, the Consumer Confidence Index (CCI) has dropped to an all-time low of 36 which justifies the Kantar insight on the market place for the balance four months of the year.

259 dead and 500 injured?

It’s been four months since the murder of 259 people and around 500 injured post the Easter attacks on innocent Catholic children and parents. But to-date there has been no charge for the biggest negligence of duty that Sri Lanka has seen in recent past.

The President and Prime Minister have both denied any knowledge of the impending attacks when the Indian Intelligence report states that way back on 4 April the Government of Sri Lanka was informed. Then again on 9 and 16 April, and finally just two hours before the attack on Easter Sunday, but the warning was not heeded. It is a gross negligence of duty that stems from inadequate experience and low knowledge of the policymakers.

If it was another country both the President and Prime Minister would have stepped down. This has further agitated the typical Sri Lanka housewife that has resulted in a boycott of Muslim original products. For instance some brands of the Hemas consumer business has resulted in a 10% plus market share drop. The responsibility must be taken by the hierarchy is my view.

Conclusion

The data very clearly explains the burning issue in the market place – cost of living. This has to be addressed by the political candidates in the next three months. This reality in the backdrop of the scandals like the ‘Central Bank bond scam’ means the writing is very clear on the wall that no ‘predictive analysis’ is required on the outcome of the next election. But the key issue is how long will it take for course correction? This in turn can have an impact on the business environment of Sri Lanka.

(The author can be contacted on [email protected]. The thoughts are strictly his personal views.)