Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 7 October 2025 00:01 - - {{hitsCtrl.values.hits}}

When conducting the latest analysis of real estate data (Q3 2025), one of the most positive observations that can be made is with respect to the recovery of the apartment market prices in Colombo measured in USD. Whilst average apartment prices, measured in LKR continued to witness an upward incline, even during COVID and the economic crises, much of the trend is attributed to the unprecedented currency depreciation that took place in 2022. This rendered the LKR as limited in use as a tool to gauge property market trends, especially for an international investor. However, the recovery in USD and other major currencies is more impressive because it withstood the depreciation and has since compensated for the drop in value of the LKR. Simply put, if you purchased an apartment property in Colombo in 2021 in foreign currency, you experienced some volatility in prices during 2022/23 but by 2024/25, you are in positive capital gains territory.

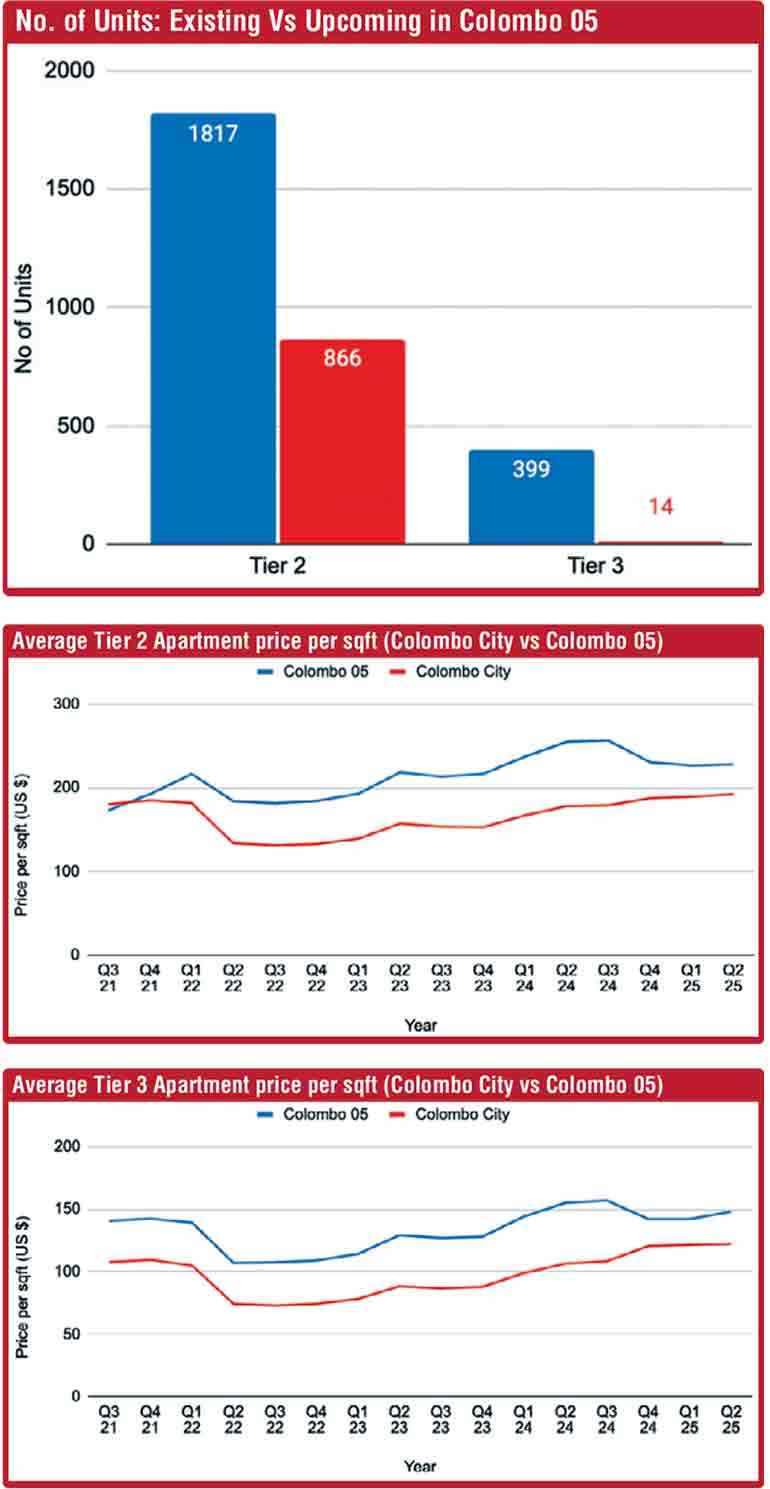

A second striking observation with reference to the rise of Colombo 5 in terms of new apartment inventory, apartment price gains as well as the increase in land prices. In our comparative analysis of Colombo, the Colombo 05 area stands out as the all-round best performer.

With reference to Tier 2 and 3 luxury apartments, Colombo 5 price trends have continued to remain above the average for Colombo as measured on a per-sq.-feet basis. Whilst the entire market dipped in 2022 (in USD terms), the pace of recovery has been strongest in the Colombo 5 area.

It is also interesting to note that this vibrant part of the Colombo city is increasing its popularity amongst developers who are catering to the top end of the apartment market. This is illustrated by the upcoming supply that is targeting the upper end of the market.

A case in point, Fairway Holdings, who have already transformed the skyline of Rajagiriya, is now set to enter the Colombo 5 market with its upcoming project, Fairway Latitude, scheduled to launch in the coming months. The development will feature 176 units and is located on High Level Road, opposite Stafford Avenue.

Commenting on the market trend, Research Intelligence Unit CEO Roshan Madawela said, “The rise in popularity of this part of Colombo can be attributed to several key factors. Firstly, Colombo 5 provides its residents with some of the best social and physical infrastructure in the capital. For instance, the hospitals and international schools in this area makes it extremely attractive for the buy-to-live market, especially parents with kids or retired couples. Secondly, the centrality offered by this location makes it particularly attractive to tourists, extended stay tourists and the diaspora who visit the country regularly. Hence, property investors have invested and are reaping the benefits of improving rental yields.”

He added, “Barring any more external shocks, we expect the apartment market in Colombo to gather momentum from several positive factors that include the growth in tourism as well as the rise in incomes that are driven by economic growth.” According to the latest data from RIUNIT, Colombo 5 is certainly leading the way in this connection.